Bitcoin is on track to hit $50,000 target, says prominent crypto analyst

- Bitcoin spot ETF applications could be approved by the US SEC by November 17, fueling a BTC price rally.

- A leading crypto analyst has set a $50,000 target for Bitcoin price, predicting an acceleration phase in BTC.

- Bitcoin price sustained above $36,400, after wiping out weekend gains.

Bitcoin price wiped out its weekend gains, correcting to the $36,400 level, early on Tuesday. BTC traders are awaiting the release of US CPI data for October, as macroeconomic catalysts influence the risk asset’s price trend.

BTC holders are awaiting the US Securities and Exchange Commission’s (SEC) decision on 12 spot Bitcoin ETF applications. The SEC’s window to approve all BTC ETF applications opened on November 9 to November 17.

Also read: Bitcoin price drops below $37,000 ahead of US CPI

Daily Digest Market Movers: Bitcoin spot ETF approval window closing soon, BTC traders tread cautiously ahead of US CPI

- Bitcoin price traded sideways, below the $37,000 level, ahead of the US CPI data release for October 2023. The macroeconomic catalyst is likely to determine the direction of BTC price on Tuesday. Read more about it here.

- BTC yielded 4.35% weekly gains for holders, before its recent pullback to the $36,400 level.

- Bitcoin price trend is currently influenced by the possibility of spot BTC ETFs by the US financial regulator. An approval is set to usher in widespread institutional interest in Bitcoin, fueling demand for the asset and possibly driving prices higher. Typically, demand and utility for regulated instruments like ETFs grows alongside its price.

- The approval window for the 12 Bitcoin ETF applications is closing on November 17.

- Opposed to mainstream sentiment on approval of spot Bitcoin ETFs, a JPMorgan report says that the excitement about potential approval has fueled a strong rally in cryptocurrencies, but the move seems overdone.

- The bullish sentiment among crypto traders has been buoyed by the possibility that the SEC’s stance on crypto may soften, post the ETF’s approval.

- JPMorgan analysts’ argument is that instead of new capital entering crypto, existing demand for Grayscale Bitcoin Trust and listed mining companies will move to newly approved spot ETFs and generate little to no interest from investors, as seen in the case of similar ETFs in Canada and Europe.

Technical analysis: Bitcoin price gears up for rally to $50,000

Crypto analyst Faibik, behind the handle @CaptainFaibik on X, evaluated the Bitcoin price trend and set a $50,000 target for the risk asset. According to the analyst, if Bitcoin price remains within the $34,000 to $38,000 range for two months, it could begin the halving rally by mid-February and hit $50,000 by late March 2024.

BTC/USD 3-day chart

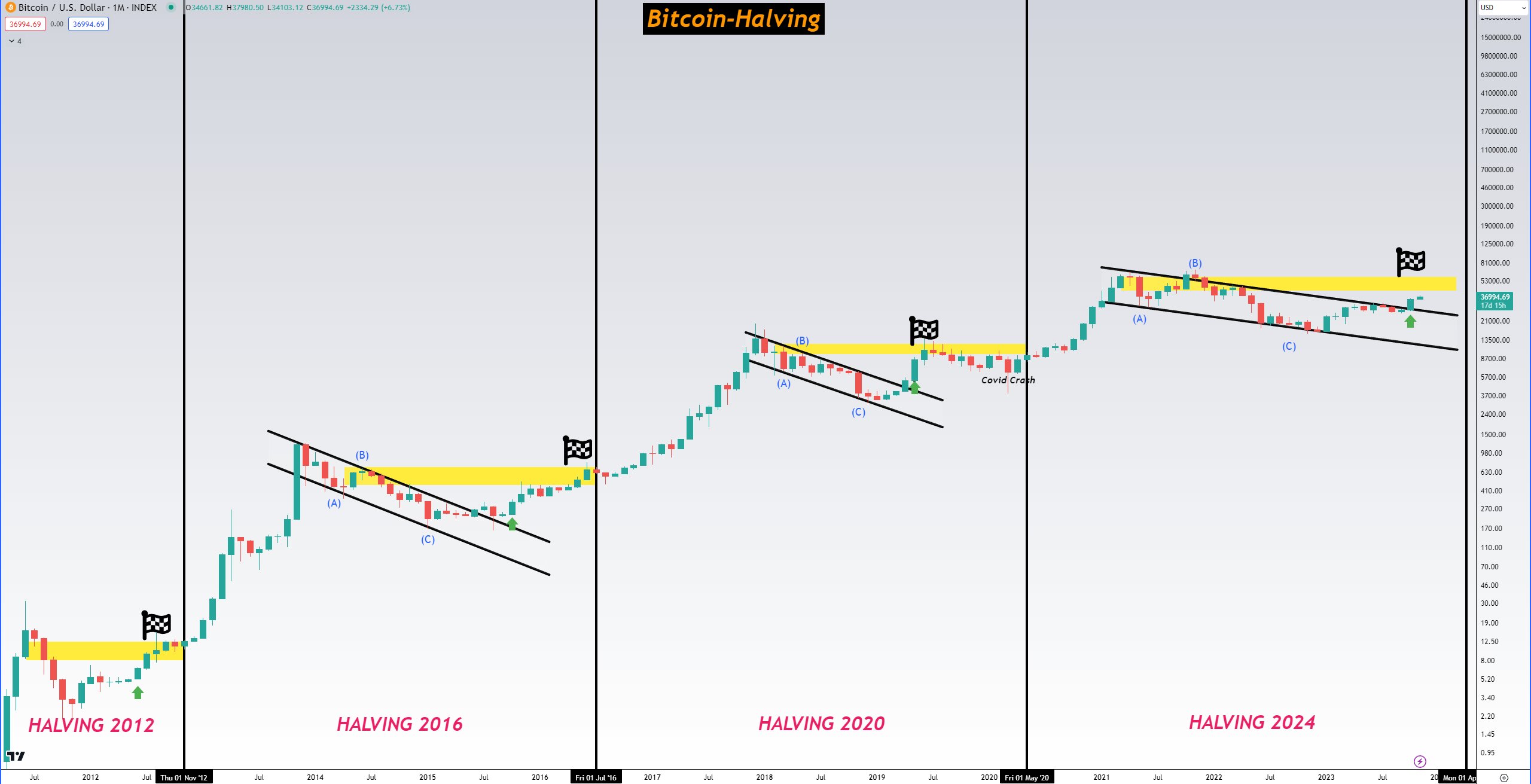

The analyst behind the X handle @el_crypto_prof’s thesis supports Faibik’s $50,000 target for Bitcoin. The expert argues that Bitcoin has returned to Elliott wave B of an A-B-C correction, just as it does every time since 2012, ahead of a halving event. The analyst expects a new all-time high in 2024, however identifies the $48,000 to $50,000 area as the next big target for Bitcoin price.

BTC/USD 1-month chart

At the time of writing, Bitcoin price is $36,555 on Binance. The asset’s price is muted over the past 24 hours.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.