Nouriel Roubini’s crypto secretly wishes it was bitcoin

Oversized crypto critic Nouriel Roubini’s fix for crumbling US dollar hegemony is a cryptocurrency: Atlas, a portfolio safe haven from persistent inflation and fiery global conflict. One that will outperform the US dollar in perpetuity.

But for all of Atlas’ pomp, Roubini’s pitch can be boiled down to the following: We’ve devised an AI-powered trading bot that will outperform the US dollar and accelerate green investments.

What Atlas proposes is nothing new — similar projects were popular around the 2017-2018 ICO boom with none seeing long-term success. It’s likely Atlas will be no different.

Funnily enough, on the surface Atlas (full name the Atlas Capital Team Index, or ACT) actually sounds just like bitcoin (BTC), of which Roubini is a staunch skeptic. But in execution, ACT more resembles stablecoin Tether (USDT), which Roubini has previously labeled a massive fraud illicitly pumping crypto prices.

Roubini’s constant crypto negging makes his token project a soft target. But his conversion should hardly surprise: Tether says it’s earning $700 million in profits every quarter due to ballooning yields on its $50-billion-plus stash of Treasurys backing USDT.

What’s more frustrating is the way in which Roubini, via Atlas, has adopted the worst habits of crypto marketing so readily.

In presentation, ACT reminds me of the worst initial coin offerings of cycles past: Inane techno-finance jibber-jabber addled with meaningless buzzwords.

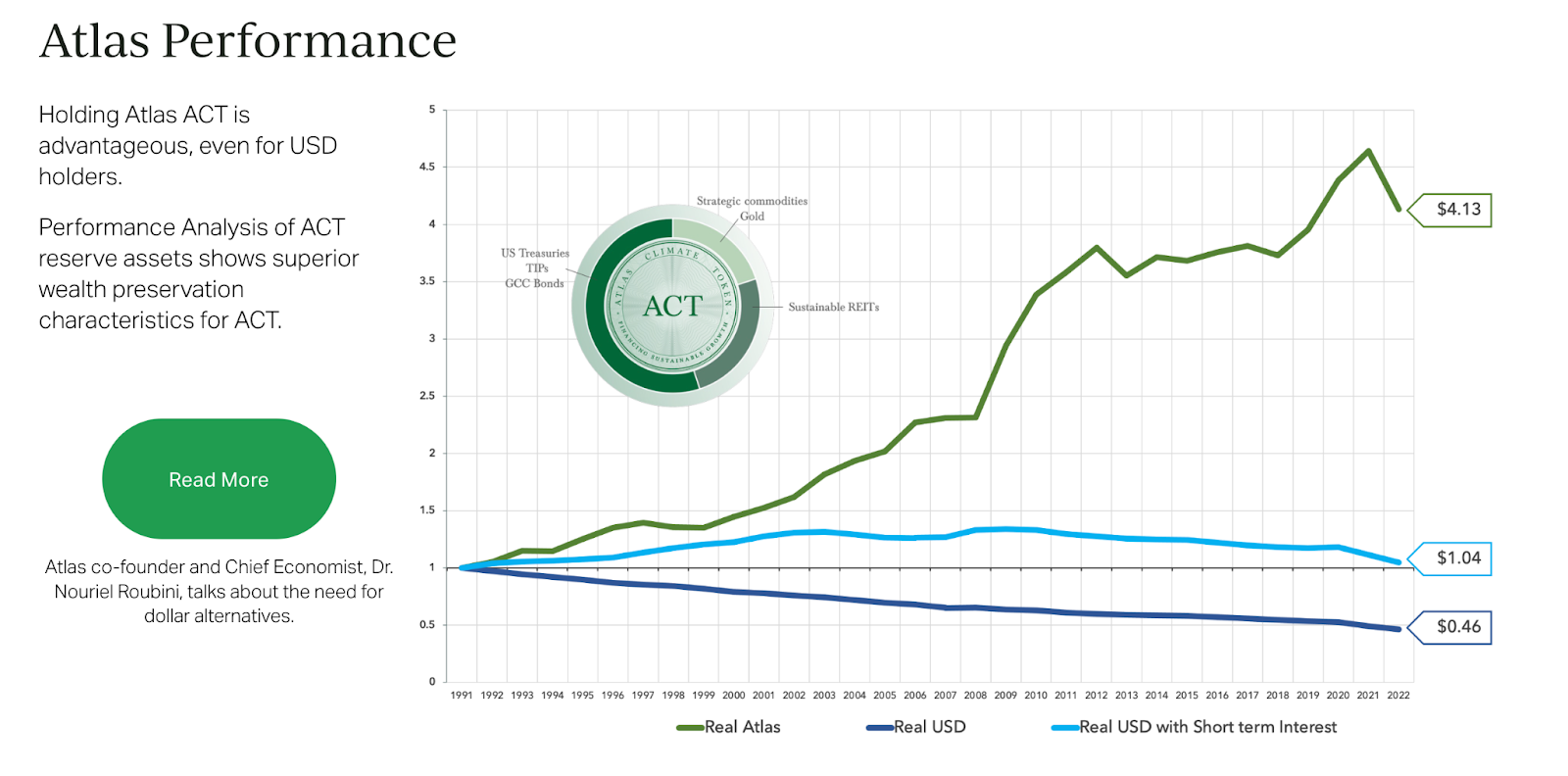

The project’s website lacks a formal whitepaper, or any real technical details (which blockchain will be used is still a mystery). Its “executive summary” is more a collection of lofty promises slotted between bullish charts all pointing to one thing: ACT tokens going up.

Roubini, a grumpy economist who found mainstream fame when his incessant doomposting finally correlated with widespread market meltdown (the 2008 global financial crisis), became notorious in crypto for celebrating price corrections as if they were cataclysmic Black Swan events.

Critics like Roubini often say BTC can never be “digital gold” — a precious metal alternative for terminally online millennials — as it’s not backed by anything physical. Gold can at least be smelted into jewelry, coins or toilets; something intrinsically valuable. Good luck doing that with BTC.

Rather, bitcoin is only valuable due to supply and demand — whether as an investment or a censorship-resistant cash network. Roubini seems certain that demand will dry up any day now, sending the whole industry to zero.

“Bitcoin falls more than 40% from its peak in less than one month,” Roubini posted in 2021, as BTC was retreating from record highs. “Which institutional investors are reckless enough to invest in such a risky and volatile pseudo-asset with no intrinsic value? They should be fired on the spot if undertaking such a reckless speculative gamble!”

Roubini now marketing his own special blend of tokenized speculation is surely ironic, but he probably wouldn’t agree. Atlas, of which he is a co-founder and chief economist, would sell a token at least backed by a basket of real-world assets — mostly gold, US Treasurys, bonds from Gulf countries and exposure to real estate in regions marginally affected by the climate change Black Swan.

Inflation-hedging aside, Atlas’ overall structure really does mirror USDT. Tether fractionalizes exposure to a carefully managed portfolio of real-world assets (like Treasurys and bonds), and sells that exposure to crypto users, one dollar token at a time.

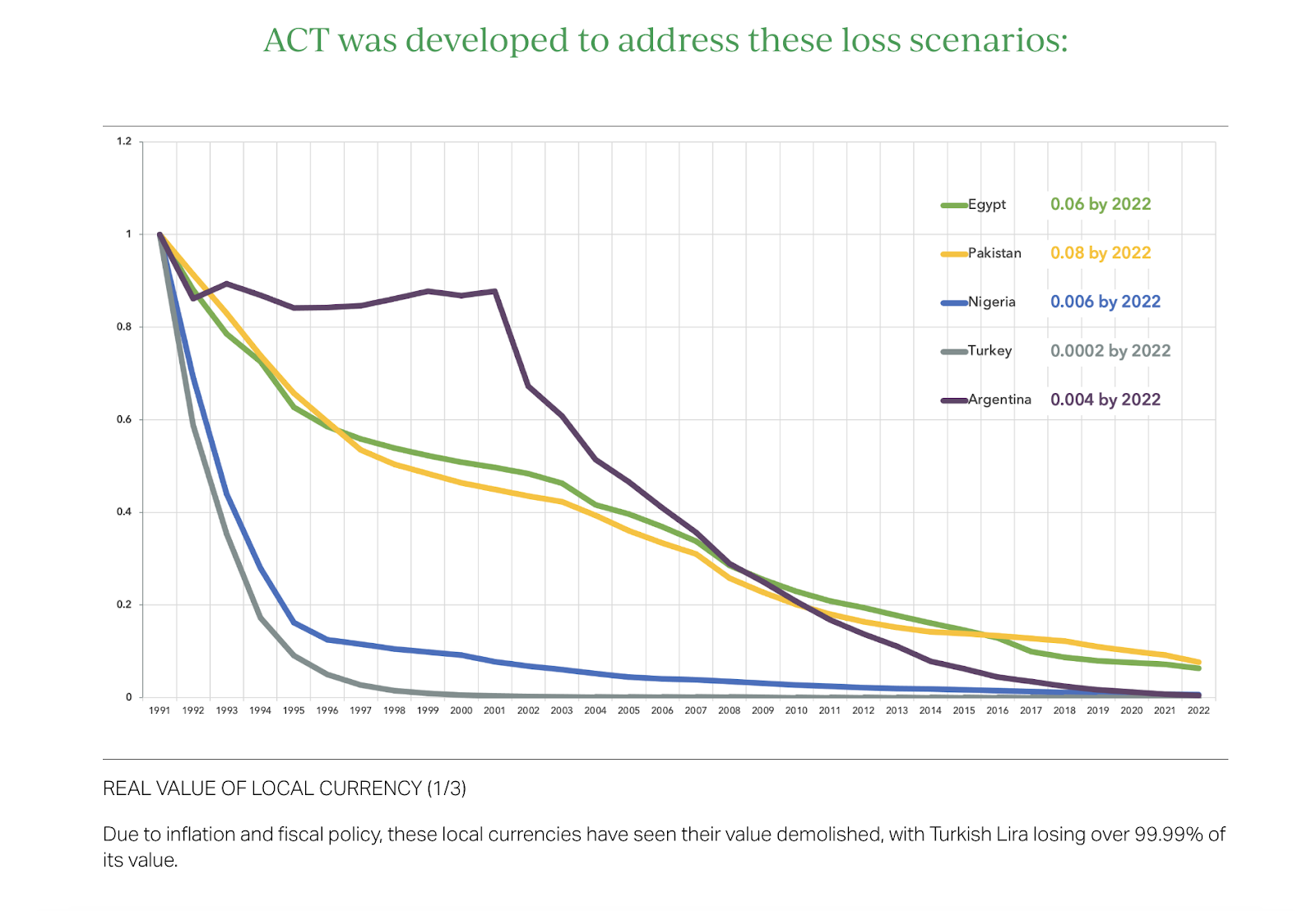

Atlas will also sell tokenized fractional exposure to its own basket of assets, But rather than the US dollar, ACT tokens track an ETF tied to an index of Atlas assets. And Atlas purportedly tweaks its index so masterfully (with the help of machine learning and AI) that it easily outruns inflation and “preserves the purchasing power of financially vulnerable members of Emerging Market economies.”

Atlas says it “uses machine learning and artificial intelligence to track and measure price performance and volatility of the underlying assets used in Atlas investment products.”

“Using this underlying technology, Atlas can select and allocate assets to offer optimal inflation-protected returns. The proprietary asset management algorithm analyzes market signals and macro data in a systematic and impartial manner to construct resilient portfolios of sovereign bonds, commodities, and REITs that maximize risk-weighted returns.”

So, where Tether helps those in economies wrought by currency devaluation preserve their wealth by jumping into a dollar-pegged token, Roubini’s Atlas wants to go one step further by breaking them free from the greenback once and for all.

(For what it’s worth, crypto thought leaders including Coinbase’s Brian Armstrong and Balaji Srinivasan have previously opined about the potential for so-called “flatcoins” — stablecoins pegged to inflation rather than the US dollar — to one day disrupt USD-linked tokens in much the same way.)

Hang around crypto fans long enough and Gandhi will appear. “First they ignore you, then they laugh at you, then they fight you, then you win.” If crypto mass adoption were scaled to that quote, Roubini’s participation in Atlas surely signals victory.

Although at this rate, it’s sadly just another opportunity for them to laugh.

Don’t miss the next big story – join our free daily newsletter.