Bitcoin price threatens drop as sell signals multiply amid lack of ETF news

- Bitcoin price shows signs of exhaustion as it trades around the $34,000 region.

- Two sell signals on the daily time frame suggest a potential pullback.

- On-chain metrics show declining investor sentiment and a potential sell-off.

Bitcoin (BTC) price has recently printed not one but multiple sell signals both from a technical and on-chain perspective. Hence, investors need to exercise caution and control their bullish outlook, at least until the scenario changes.

Bitcoin ETF is key for the ongoing rally

The approval of a Bitcoin spot Exchange-Traded Fund (ETF) has been a speculative event for a few years now. But lately, the ETF-related developments have been heating up. The US Securities and Exchange Commission (SEC), which approves or disapproves the ETF products, has been on the backfoot after losing a string of crypto lawsuits.

The initial run-up in Bitcoin price kick-started in mid-October and was caused by the SEC losing Grayscale’s lawsuit for converting the GBTC product into spot ETF offering and other ETF-related developments. But now that there are no updates, BTC has been moving sideways.

Regardless, the speculative Bitcoin trading frenzy will mutate to a new level in January 2024, which is the next key deadline for the ETF decision. This event will make or break the crypto space. Until then, however, investors should be prepared for a retracement, especially considering that Bitcoin price has been sprouting multiple sell signals.

Bitcoin price could slide soon

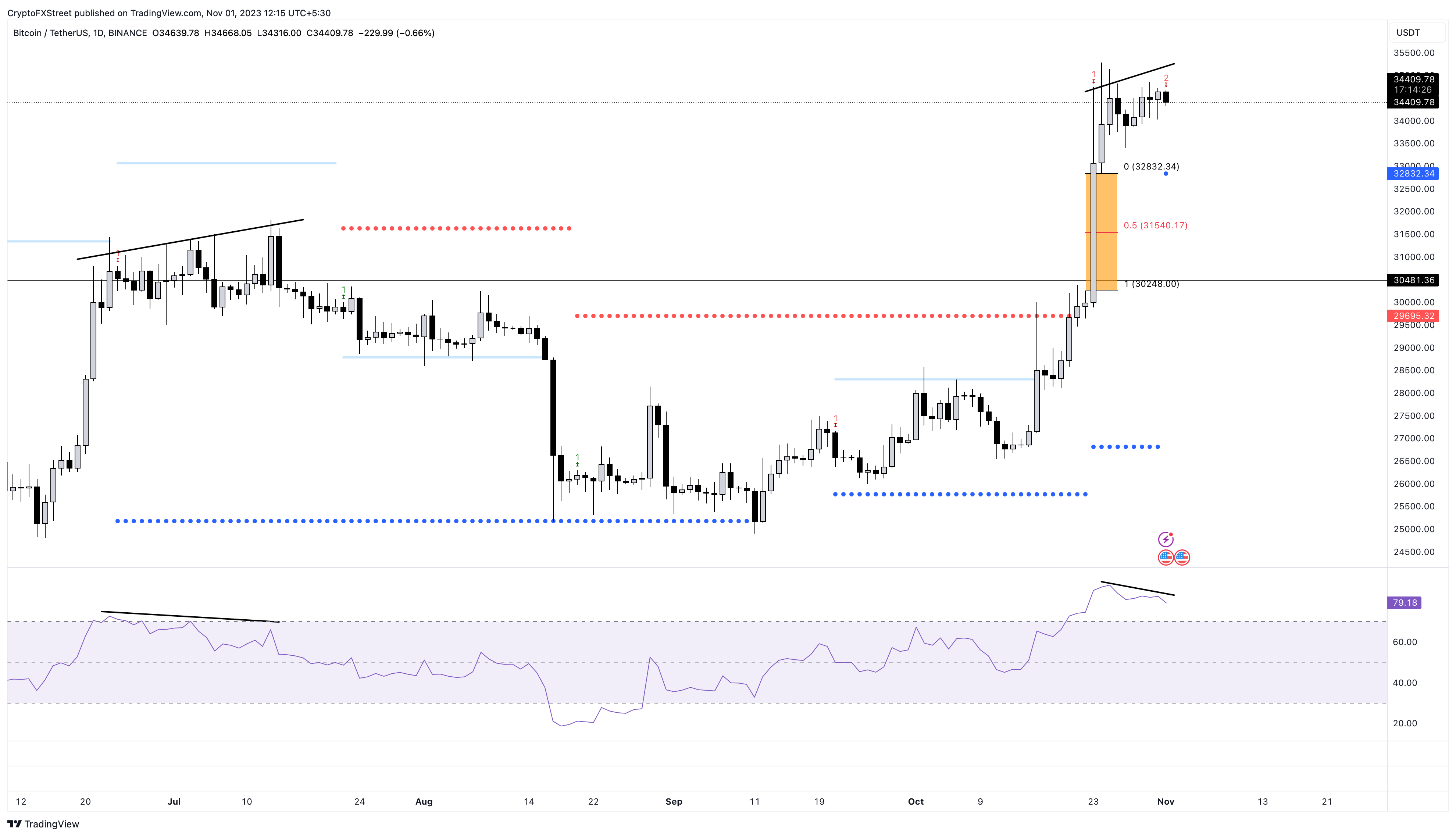

Bitcoin (BTC) price rallied 30% between October 16 and 24 and set up a local top at $35,280. This move was impressive due to the massive bullish momentum. But after this swing high was formed, BTC has been moving sideways. Since October 25, the daily candlestick closes have produced an upward slope, which might seem bullish to the naked eye. A closer look at the Relative Strength Index (RSI) shows it is sloping downwards. This non-conformity is called bearish divergence and often leads to a pullback or correction.

This it the first major sell signal that investors need to notice.

Apart from the bearish divergence, the Momentum Reversal Indicator (MRI) has flashed not one but two sell signals. The first sell sign was printed after the daily candlestick close on October 23 in the form a red down arrow. Nine days later, the MRI has flashed another red down arrow. This sign forecasts a one-to-four down candlesticks.

Hence, investors could see Bitcoin price slide lower. The Fair Value Gap (FVG) area, extending from $30,248 to $32,832 and its midpoint of $31,540 are key support levels to watch.

BTC/USDT 1-day chart

On-chain metrics add credence to bearish outlook

The Network Realized Profit/Loss (NPL) indicator from Santiment shows two major spikes on October 24 and 28 of $524 million and $542 million, which indicates that investors are booking profits. When similar profit-taking events occurred in July coupled with bearish divergence, Bitcoin price crashed from roughly $31,400 to $25,800.

BTC NPL

The same bearish outlook can be seen in Whale Transaction metric, which has been skyrocketing since October 23. A spike in this index, which tracks the transfers worth $100,000 or more, suggests whales are likely moving their holdings to book profits.

BTC whale transaction

The 30-day Market Value to Realized Value (MVRV) indictor is used to measure the average profit/loss of investors that purchased BTC in the past month. Currently, the MVRV is hovering around 10% after dropping from 16% on October 23. This level suggests that the average profit of investors that purchased BTC in the past month is 10%. These holders could sell to realize their profits, triggering a sell-off.

Typically, the 30-day MVRV has formed local top around 16% to 22% in the past year. Hence, this area can be termed as “Danger Zone” since it is followed by a correction in Bitcoin price.

BTC 30-day MVRV

Concluding thoughts

All in all, the outlook for Bitcoin price looks rather bearish, not just from a technical standpoint but also from an on-chain perspective. The only way these sell signals can be sidestepped is if there is an ETF-related development.

In such a case, Bitcoin price could tackle the $35,000 hurdle and make its way toward the $40,000 psychological level. This move would invalidate the bearish thesis.

%20[10.20.30,%2001%20Nov,%202023]-638344253240271669.png)

%20[10.21.49,%2001%20Nov,%202023]-638344253486331747.png)

%20[10.20.58,%2001%20Nov,%202023]-638344253715958840.png)