What Next for Bitcoin Price After $30,000 Rally

Bitcoin’s (BTC) price reclaimed $30,000 on October 20, erasing losses from massive liquidations that followed Cointelegraph’s erroneous news report on Monday. On-chain analysis outlines factors that could propel BTC toward the $40,000 milestone.

Bitcoin price hit $30,000 on Friday as markets responded to several bullish macro events, including Grayscale’s fresh application for Spot Bitcoin ETF with the US Securities and Exchange Commission. Will the bullish investors hold out to reclaim $40,000?

Rising Bitcoin Dominance Could Push Prices Toward $40,000

Bitcoin price crossed $30,000 on Friday, bringing its weekly gains into double-digits. However, vital indicators show that BTC prices will likely rise higher in the coming days.

First, Bitcoin Dominance (BTC.D) has risen for 10 consecutive days since October 10. This is quite unusual because, historically, once BTC scores sizable gains and crosses a milestone price level, investors begin to diversify and channel funds into altcoins to amplify their gains strategically.

However, the skittish macroeconomic landscape and events surrounding the Middle East crisis could make investors unwilling to diversify into altcoins this time around.

This recent trend in BTC.D affirms the thesis that Bitcoin’s “safe haven” status could further accelerate the ongoing price rally.

The chart below shows that Bitcoin’s crypto market share stood at 51% when the crisis broke out on October 7. Following two weeks of escalating tensions, Bitcoin has gained more ground, with BTC.D rising toward 52.71% on October 20.

Bitcoin Dominance (BTC.D) captures the percentage of the total cryptocurrency market valuation that Bitcoin currently holds. When Bitcoin’s market rises during bearish macro conditions, it signals that investors are exhibiting lower risk appetite and piling into BTC as a safe haven bet.

This phenomenon was also observed after the Russian vs. Ukraine war broke out around February 24, 2022. Bitcoin’s Dominance in the crypto market jumped from 44% to 48% within two weeks.

After the initial price dip from the war FUD, BTC price skyrocketed 51% from $20,200 to $30,400 between March 10 and April 10, 2022, as crypto investors keyed into Bitcoin’s safe haven status.

The chart above shows that the circumstances surrounding the current Bitcoin price rally and BTC.D trends are similar to events that followed the Russia vs. Ukraine war.

If history repeats, another 50% bounce could send Bitcoin price well above the $40,000 mark in the weeks ahead.

Long-term Holders Have Made Large Acquisitions Since Previous All-Time High.

Large BTC transfers from weak hands to long-term holders are another vital on-chain indicator that could further accelerate the ongoing Bitcoin price rally.

According to key data points obtained from Glassnode, Long-term holders had 11 million BTC, while Short-term holders’ supply stood at 5 million BTC when Bitcoin price peaked at $69,000 in November 2021.

Since then, Long-term investors (blue line) acquired over 3 million more BTC as their balances reached 14.89 million BTC as of October 19. Meanwhile, Short-term traders’ supply (red line) has dropped by more than half, sitting at 2.4 million BTC.

This vividly illustrates a massive transfer of wealth from the weak hands to more resilient investors over the last 2-years.

Wallets that have held their crypto assets unmoved for over a year are regarded as long-term hodlers. This persistent increase in the amount of BTC held long-term further affirms global confidence in Bitcoin as a safe haven asset.

With lesser BTC now in control of short-term traders, it creates an artificial market scarcity. Hence, a further increase in Bitcoin dominance and overall market demand could accelerate the price rally toward $40,000.

BTC Price Prediction: The $40,000 Target is Viable

From an on-chain perspective, the rising market dominance and long-term holder acquisitions could push BTC’s price further toward $40,000.

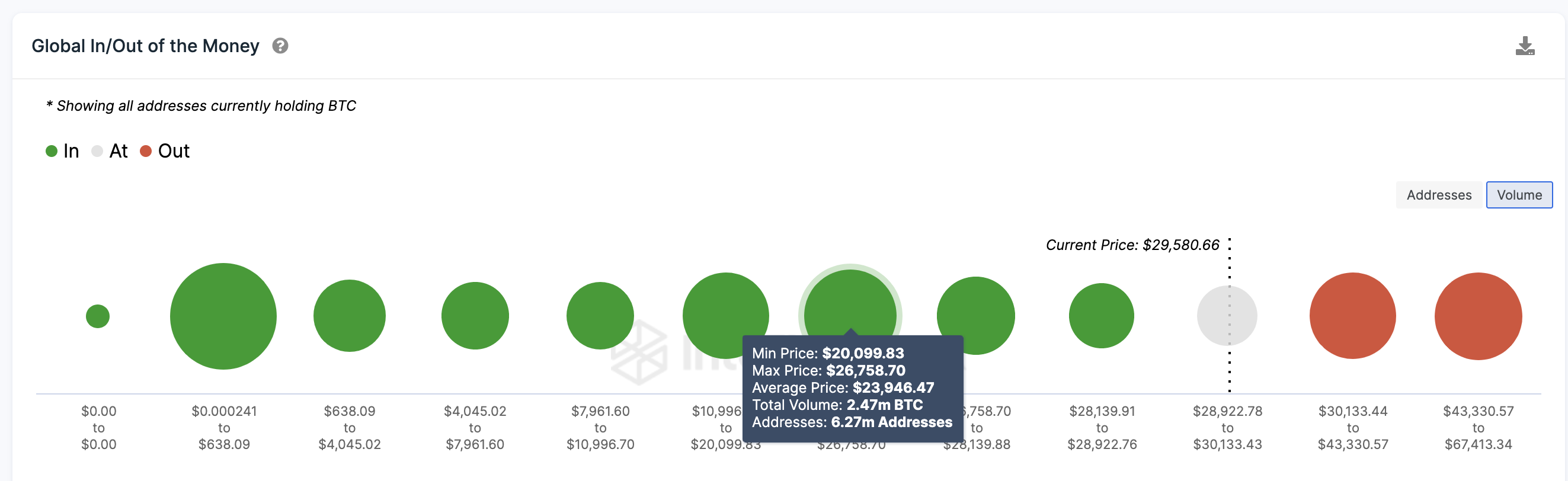

However, the Global In/Out of Money data depicting current Bitcoin holders’ entry price distribution highlights key resistance levels.

It shows that BTC’s initial resistance around the $30,130 territory is quite significant. As illustrated below, the 2.08 million addresses bought 842,330 BTC at an average price of $30,133.

But a decisive breakout from that $30,200 could open the door to a larger upswing well above $35,000

Still, the bears could invalidate this bullish prediction if Bitcoin price reverses below $25,000. However, the chart depicts that 6.27 million addresses purchased 2.47 million coins at the maximum price of $26,750.

If those wallets continue to HODL, BTC price will likely enter an instant price rebound.

But if the bears get around that support buy-wall, it could catalyze a prolonged Bitcoin price downswing toward $25,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.