FTX Stakes Millions of SOL, Amid Liquidation Fears

The estate of the now-defunct crypto exchange FTX has reportedly staked 5.5 million Solana (SOL) tokens, worth approximately $121 million USD.

This follows a court filing that highlights the substantial SOL holdings owned by the FTX estate.

FTX Stakes Solana Following Approval of Liquidation Process

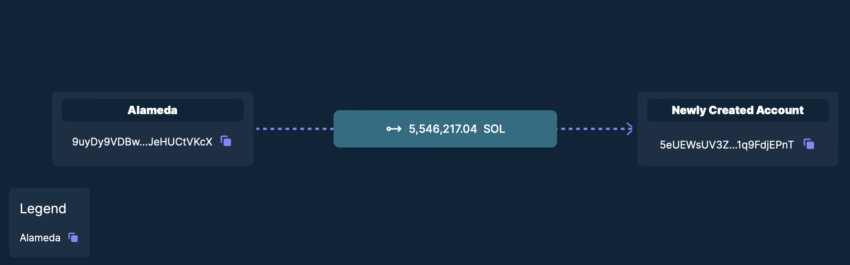

A user on X (formerly Twitter) initially discovered the transaction, which is visible on Solana.fm under the wallet name ‘Alameda’.

The staked amount comprises 5.55 million SOL tokens, worth approximately $121.17 million.

Staking means that the tokens are locked up for a certain amount of time, in return for passive income, similar to a bank term deposit. The locked tokens actively contribute to sustaining the blockchain’s operation.

At the time of publication, SOL’s price stands at $22.03.

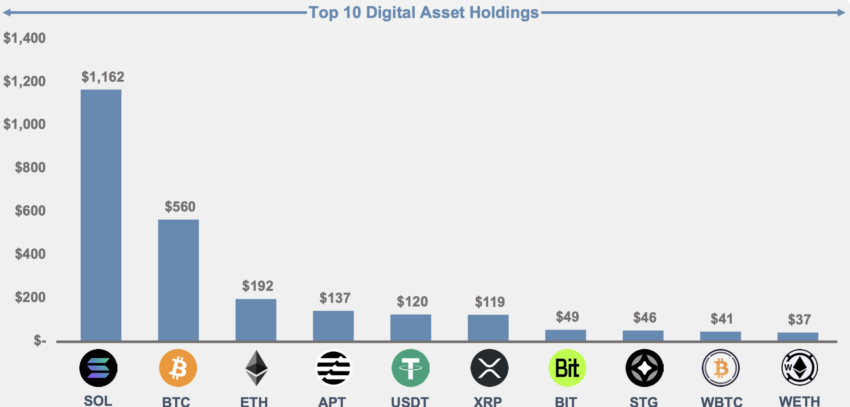

However, a recent court filing revealed that the estate of the now-defunct crypto exchange FTX holds a staggering amount of SOL, as its largest portion of digital assets. According to the court filing, it holds approximately $1.16 billion.

SOL holders found themselves in a state of uncertainty when the bankruptcy court approved FTX’s liquidation plan, including the $1.16 billion in SOL and roughly $2.5 billion in other crypto assets.

Meanwhile, the liquidation process adheres to stringent regulations. This is to prevent any adverse repercussions on the crypto market from a sudden, massive sell-off.

Instead, it was implemented in increments of $50 million per week, gradually ramping up to $100 million.

Meanwhile, SOL has hit record-breaking amounts in its total value locked (TVL) recently. On October 2, as BeInCrypto reported, it reached its highest levels in 2023, boasting a TVL of $338.2 million.

This marked significant excitement amongst avid members of the SOL crypto community, especially considering the apprehension stemming from a steep decline in SOL’s TVL just a year ago.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.