Altcoins’ bullish surge comes to an end, analyst explains market decline

- “Alts just finished their squeezes,” notes crypto analyst Cold Blooded Shiller.

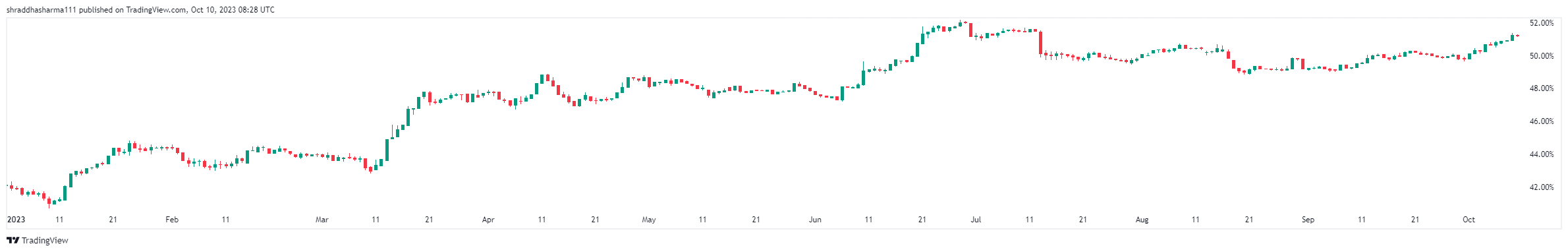

- Bitcoin dominance has risen from 42% at the beginning of 2023 to over 50%.

- The global cryptocurrency market cap is experiencing range-bound stagnation with an altcoin buying opportunity.

The altcoin market, which was riding a wave of bullish momentum months after the FTX collapse, is now facing a downward shift. The rise in the sector has come to a halt in October, crypto analyst Cold Blooded Shiller noted on X.

Altcoin market experiences a dip

Crypto analyst Cold Blooded Shiller suggests that altcoins have completed phases of price increases, testing higher resistance levels, and concluding their last surges.

He noted, “Alts just finished their squeezes, their retests of HTF resistance, their final exit pumps.” As a result, the crypto market is witnessing a period of low volatility and tight trading ranges, with altcoin prices on a decline.

This is the up only crypto chart of 2023.

Alts just finished their squeezes, their retests of HTF resistance, their final exit pumps.

There are no retests to buy.

All gains have been erased.

They are pathetically weak. pic.twitter.com/RAF3LNpwbM

— Cold Blooded Shiller (@ColdBloodShill) October 9, 2023

For part of 2023, the cryptocurrency market recovery was characterized by a bullish altcoin trend. However, Q4 is shifting the market dynamics to present a buying opportunity by bottom fishing.

At the time of this writing, the global cryptocurrency market cap stands at $1.1 trillion, indicating a slight decline of over 1% within the last 24 hours, according to CoinGecko figures. The total trading volume for cryptocurrencies in the past day amounts to $42.5 billion.

To gauge the state of the altcoin market, investors often turn to the Bitcoin dominance ratio. It measures Bitcoin’s market cap against the cumulative market cap of all cryptocurrencies. On Tuesday, this ratio stood at 51%, signaling a shift from January 2023 when it was at 42%. The ratio rose to 47% in March and peaked at 52% in June. In October, Bitcoin dominance hovers around the 50% mark, suggesting a continued downward trend for altcoins.

BTC dominance ratio YTD

Altcoin Buying Opportunity in November

While the current state of altcoins may appear bearish, some analysts remain optimistic about the buying opportunity. Crypto analyst Altcoin Sherpa recently shared insights on X, stating, “$ETH: ETHBTC getting slaughtered, I don’t see a bounce until we get to lower areas. Thinking low 0.05s.”

This means that the Ethereum-to-Bitcoin trading pair is experiencing a negative relation, and any price recovery is not expected this month. He hinted that November could be a great time to buy altcoins. “The time for a short altcoin rally is just right around the corner, in my opinion,” the analyst added.

Traditionally, the last quarter of the year leading up to a Bitcoin halving event has been considered a bullish period for cryptocurrencies. Altcoin Sherpa believes that with the current market trend, November could present a valuable buying opportunity in altcoins.