Bitcoin: Government Shutdown Rally (BTC-USD)

Richard Stephen/iStock via Getty Images

Some analysts and experts are predicting a Bitcoin (BTC-USD) rally in case a US government shutdown happens on the 1st of October. In this article, I will try to analyze if this would be a logical thing happening, based on past reactions of the Bitcoin price to other shutdowns and to the 2023 banking crisis.

Government shutdown approaching

Unless US Congress reaches an agreement soon, the government is headed toward a shutdown from the 1st of October, which is already this Sunday. I will not talk politics in this article, since this is a financial analysis about cryptocurrency. I will only look at the effects this shutdown might have.

Usually, financial markets do not like government shutdowns. It must first be said that on the long term, government shutdowns have no measurable effect on the performance of stock markets (and likely also of cryptocurrency). But on the short term, uncertainty leads to volatility.

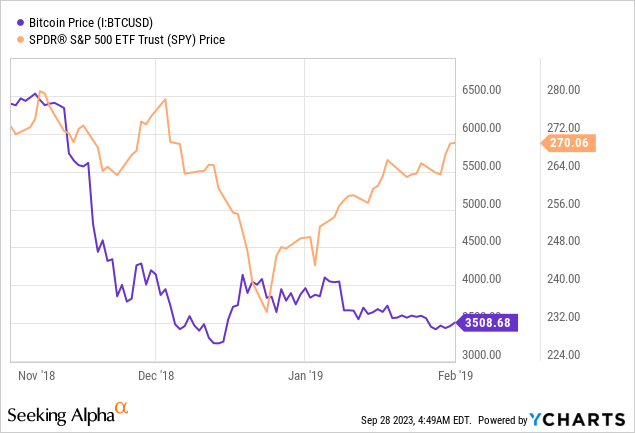

The government shutdown that started in December 2018 was even accompanied by drops in the stock market of almost 20%. Let us take a look at the price development of Bitcoin during the previous government shutdowns. There are only three government shutdowns during which Bitcoin already existed, so there’s not a whole lot of data here.

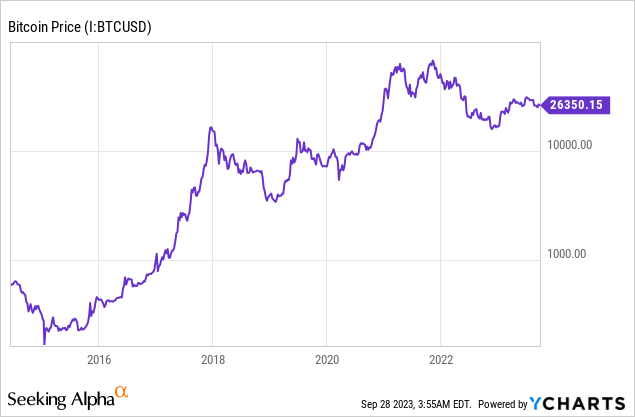

Graph 1: Bitcoin price (logarithmic) over the last 10 years (2013 is not listed since the data do not go back this far).

| Dates of shutdown | Price change of Bitcoin during the shutdown |

| 1 – 16 October 2013 | +7.8% |

| 20 – 23 January 2018 | -15.7% |

| 22 December 2018 – 25 January 2019 | -9.8% |

Table 1: Performance of Bitcoin during government shutdowns (source: calculated by author)

For the 2013 shutdown, during which Bitcoin gained almost 8%, it should be noted that Bitcoin was still relatively unknown during this time, and people especially did not view it as a safe harbor in case of financial turmoil. Also, after this shutdown, at the end of 2013, Bitcoin skyrocketed from levels around $200 to high of more than $1,200, so compared to this, the price change during the shutdown was quite insignificant.

In the beginning of 2018, Bitcoin just came off from then all-time highs of more than $12,000 (see graph 1), which likely explains the bulk of the more than 15% drop.

For the longest shutdown on our list, from December 2018 to January 2019, Bitcoin price dropped by almost 10%. As we can see on graph 2, the response of the S&P 500 (SPY) to the government shutdown is clearly visible, while Bitcoin’s main drop happened before this (when the stock markets obviously did not yet view a potential government shutdown as a danger). The almost 10% drop of Bitcoin during the shutdown seems insignificant compared to the almost 50% crash in November 2018, which makes it more likely that the behavior of Bitcoin during this shutdown was just ‘regular’ volatility.

Graph 2: Bitcoin and S&P 500 prices between November 2018 and February 2019.

So for previous government shutdowns, it seems unlikely that Bitcoin’s price dropped or gained because of these events.

Parallels between the 2023 banking crisis

The 2023 US banking crisis is mentioned by some as a better comparison, since it happened more recently. Also, during the last couple of years, Bitcoin has increasingly been viewed as a safe haven by some investors. Let us take a look and see if the banking crisis which happened in the beginning of this year is a better comparison.

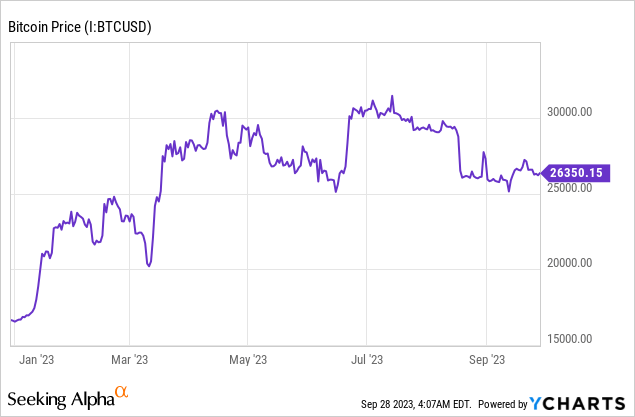

Graph 3: Bitcoin price during 2023.

The banking crisis started at the 8th of March and ended around the end of April this year. After rising quickly in the first months of 2023, Bitcoin price reached a value of just above $20,000 on the 10th of March, after which it rose to more than $30,000 about a month later. This was a strong rise of 50%, but did it happen because the market saw cryptocurrency as a safe destination of capital?

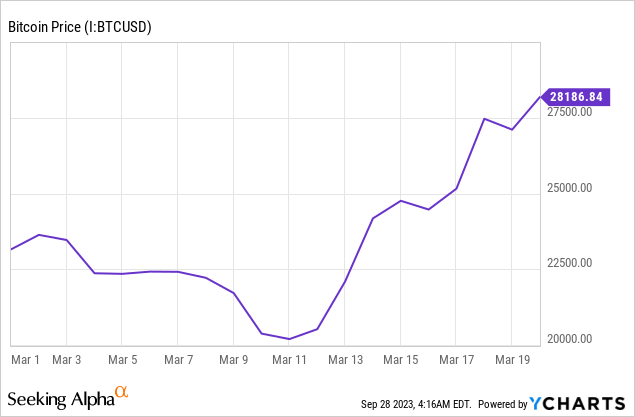

Graph 4: Bitcoin price during March 2023.

If we look closer and zoom in using graph 4, we can see that between March 8-10, when the Silicon Valley Bank run happened, Bitcoin price dropped. After the bank was seized on March 10, prices stabilized. Only after broad measures including a backstop from the Federal Reserve and the US Treasury Department on March 12, Bitcoin price started to rise again.

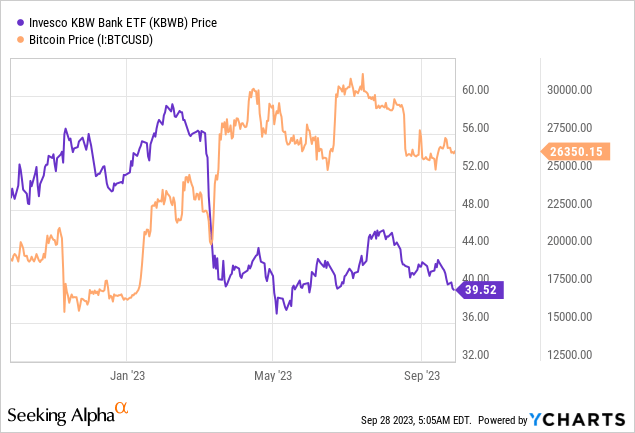

Graph 5: Bitcoin price during the last year compared with Invesco KBW Bank ETF (KBWB).

Also, as we can see in graph 5, while the banking sector was hit hard and did not recover yet, Bitcoin price experienced some strong performance since then.

I can draw a couple of conclusions from these graphs and events:

- Like most other financial assets, Bitcoin price dropped when uncertainty was at its highest, during the bank run

- Bitcoin has recovered quickly and sharply after the 2023 banking crisis

- Banks were hit hard while Bitcoin, being seen as an alternative to traditional banking, performed well

- Still, given Bitcoin’s price volatility, it remains difficult to estimate how large the real effect of the banking crisis on the price of Bitcoin was

What to expect from Bitcoin during a shutdown?

As we tried to analyze earlier in this article, during previous government shutdowns, Bitcoin seemed to be influenced more by other sources of volatility than by volatility stemming from these shutdowns. Therefore, the 2023 banking crisis might be a better comparison. However, when we zoomed in on the events leading up to the banking crisis of earlier this year, we discovered that during times of uncertainty, Bitcoin price dropped. It was only after the largest uncertainties were covered that Bitcoin’s price rallied.

For this reason, I believe a government shutdown will not lead to a rally in Bitcoin price. Also, in the case of the banking crisis, it is likely that some investors regarded Bitcoin as an alternative to the traditional banking system. This might explain its strong rally between March and April this year. I think a government shutdown will not have the same effect on Bitcoin as the banking crisis. While Bitcoin and the contemporary banking system can be viewed as alternatives, this is not the case for a government shutdown.

Long-term perspective

On the short term, Bitcoin will remain a relatively volatile asset. Since its nascence, Bitcoin seems to have acted more as a trading instrument than as a store of value. On the longer term, though, I believe Bitcoin and other cryptocurrencies are likely to become another store of value, next to gold (GLD). Compared to gold, cryptocurrency has the advantage that it can also be used as a liquid means of payment at the same time.

We can already see in graph 1 at the beginning of this article that Bitcoin’s volatility has come down during the last 10 years, and I believe this development is likely to continue. Bitcoin might or might not act as an inflation hedge (the jury is still out on that one), but I am convinced that cryptocurrency will play a large role in the future of payment and store of value.

Though volatility seems to be decreasing, please keep in mind that investing in cryptocurrency is a very risky business. Only ever invest money you can afford to lose.