Real-World Asset Market Provides Distressed Debt Opportunity

The tokenization of real-world assets (RWA) has been one of the hottest crypto narratives in 2023. However, the emerging sector is not immune to distressed debt situations, which appears to be what has happened with Goldfinch.

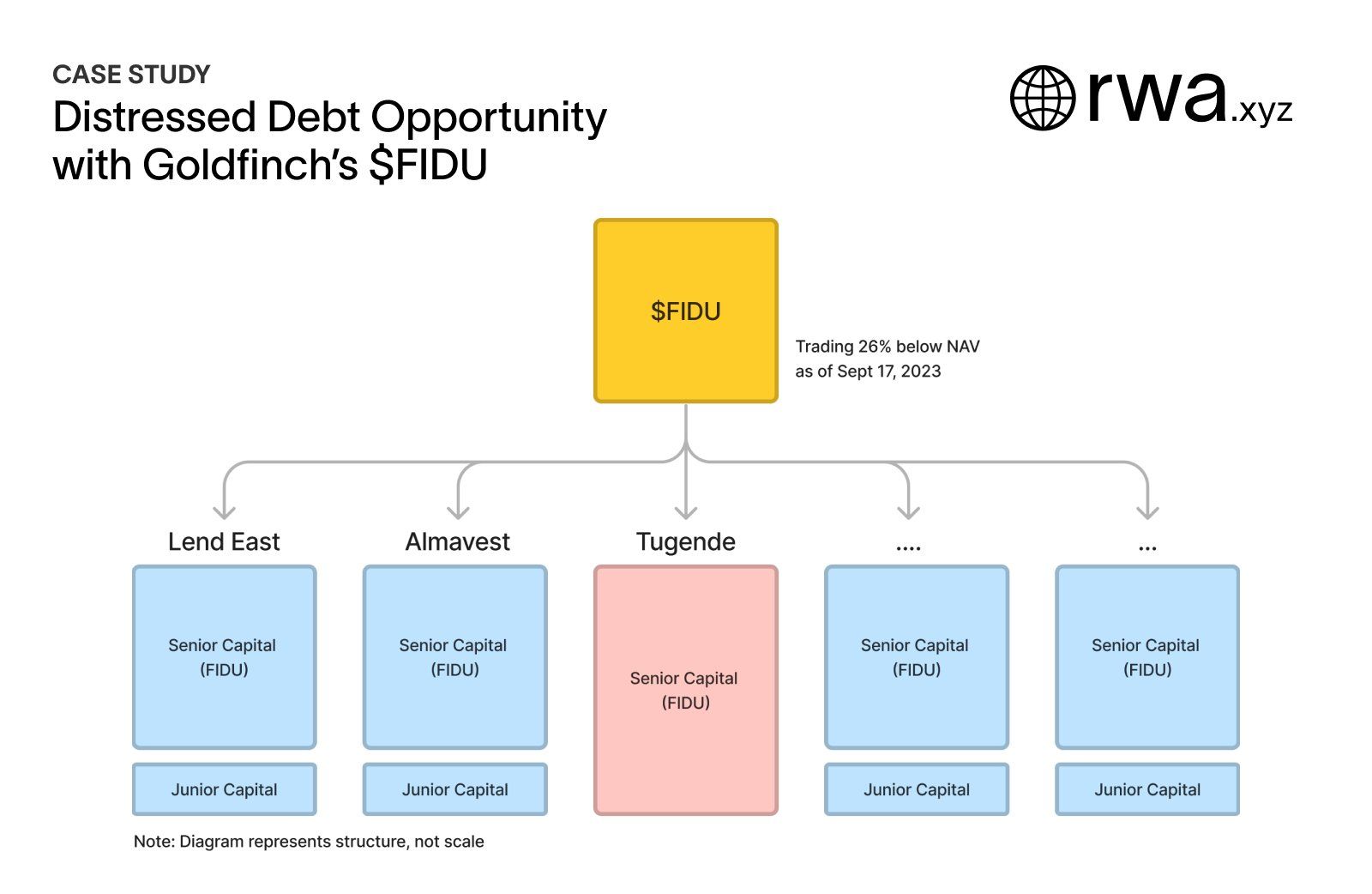

Decentralized credit protocol Goldfinch’s FIDU token has been trading at a discount to net asset value (NAV). This has created a “distressed debt opportunity,” according to RWA analysts.

Real-World Asset Opportunities

FIDU is a “digital receipt” that represents a liquidity provider’s supply into the Senior Pool of the Goldfinch Protocol.

On September 27, analysts at industry outlet RWA.xyz reported that FIDU was trading at a discount of -26%.

Goldfinch, which is pioneering private credit in the RWA space, recently experienced a default in one of its loan deals. Moreover, the Goldfinch governance forum suggested there may be a total loss of the $5 million loan, the outlet noted.

However, they added that,

“Investors should not suffer total loss from the default, since the distressed loan represents only one of eleven different deals in Goldfinch’s Senior Pool.”

Investors allocate capital to Goldfinch’s Senior Pool via the FIDU token, which has fully collateralized exposure across eleven different loans.

After accounting for the loan default, the NAV of FIDU can be calculated to be $1.08, the outlet noted. However, earlier this month, it traded on secondary markets as low as $0.80, where it is still priced at a discount.

Furthermore, there is an entire industry in traditional finance seeking opportunities to buy credit at a discount to NAV, they said before asking:

“Could FIDU’s discount to NAV represent the first analogous opportunity in the RWA markets?”

Nevertheless, this situation presents growing pains for bringing real-world assets on-chain.

RWA Ecosystem Latest

According to RWA.xyz, there is currently $557.6 million in active loans for private credit in DeFi.

Ethereum-based Goldfinch has $103.7 million in active loans with an average base yield of 11%. Other big real-world asset tokenization protocols include Centrifuge, Maple Finance, Clearpool, and TrueFi.

Moreover, there is $666.7 million in total value of tokenized US Treasuries, yielding an average of 5.25%. T-bills are currently more lucrative than holding USD, DeFi stablecoins, or bank deposit accounts.

As reported by BeInCrypto, real-world asset tokenization reached an all-time high of over $3 billion in August.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.