Who’s who in the Sam Bankman-Fried trial?

Sam Bankman-Fried, the co-founder and former chief executive officer of collapsed cryptocurrency exchange FTX, is facing seven charges in a case brought by the Department of Justice (DOJ) in relation to his operation of the exchange. Charges include wire fraud, securities fraud and conspiracy to commit money laundering. As his first trial draws closer, here are some of the key players in the case.

Sam Bankman-Fried

Bankman-Fried rose to fame as a crypto whiz kid who at 29-years-old amassed a net worth of US$26.5 billion in a matter of years. He studied physics at Massachusetts Institute of Technology (MIT) but often joked about being “absolute trash” in college. He then got his start in the industry at Jane Street, a leading trading firm, where he executed arbitrage trades on exchange-traded funds (ETFs). Parlaying those trading skills into the crypto world, he launched Alameda Research, a crypto hedge fund, which capitalized on a Bitcoin arbitrage trade between the U.S. and Japan.

Then came FTX, a crypto exchange built by Bankman-Fried alongside Nishad Singh and Gary Wang that aimed to rival the “s-–show exchanges” Alameda traded on. By late 2021, FTX ranked as the second leading exchange in crypto derivatives after its competitor Binance and had secured a valuation of US$32 billion. The exchange had the backing of some of the venture industry’s most venerable players including Sequoia, Lightspeed and BlackRock.

As the crypto bear market took hold, a report from Coindesk revealed that Alameda Research’s balance sheet contained a significant proportion of illiquid assets, predominantly in FTX’s native token FTT. In response Binance said it would liquidate its FTT holdings, sparking a bank run that revealed a shortfall in over US$8 billion in customer funds on FTX and ultimately led to the exchange filing for bankruptcy.

Reports from FTX’s liquidators, regulators and the DOJ allege the exchange significantly lacked corporate controls and oversight. Bankman-Fried has pleaded not guilty to all charges.

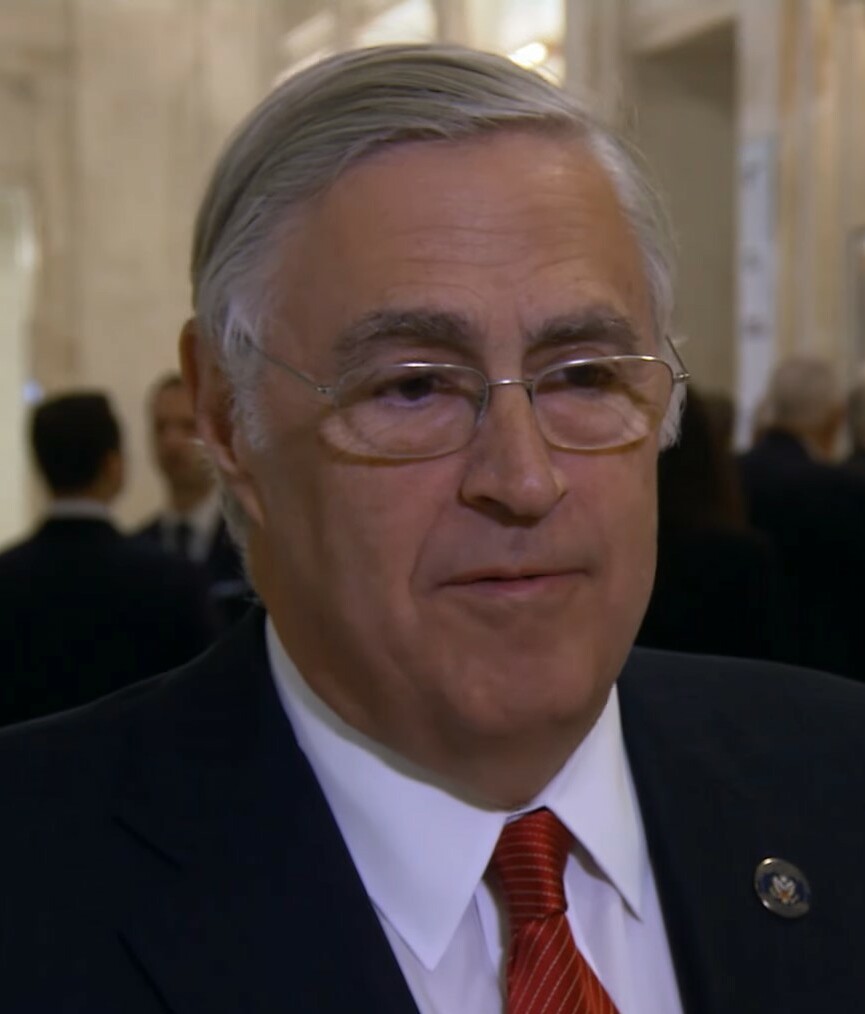

Judge Lewis A. Kaplan

Overseeing the criminal case against Bankman-Fried is U.S. District Judge Lewis Kaplan. The 78-year-old judge previously worked as a partner at law firm Paul Weiss in New York before being nominated to a Federal judicial position in New York by U.S. President Bill Clinton in 1994. He then secured senior status on the bench in 2011.

Kaplan has preceded over many high-profile cases in the U.S. District Court for the Southern District of New York including a civil lawsuit filed by Virginia Giuffrie against the U.K.’s Prince Andrew claiming he sexually assaulted her on three separate occasions. Andrew tried to dismiss the case, having previously reached a settlement with Giuffrie in 2009, however Kaplan denied the request. The case was settled outside of court with Andrew paying an undisclosed sum to Giuffrie.

He also presided over the recent civil case brought by writer E. Jean Carroll against former U.S. President Donald Trump, which accused Trump of raping her in a dressing room in a department store in the early 90s. Jurors awarded Carroll US$5 million, finding that she was sexually abused, but rejecting the allegation she was raped. He is also presiding over a second trial that will determine how much Carroll is owed in relation to defamatory claims made by Trump.

- The prosecution

Prosecuting Bankman-Fried on behalf of the United States is the U.S. Attorney’s Office for the Southern District of New York. The office represents the interests of the U.S. government in criminal and civil matters.

U.S. Attorney Damian Williams is the lead attorney for the office and was nominated by U.S. President Biden in August 2021. In his previous role as assistant U.S. attorney, Williams primarily investigated and prosecuted cases involving corruption in financial markets and politics, according to the agency’s website.

Co-leading the prosecution against Bankman-Fried for the agency is Assistant U.S. Attorneys Nicolas Roos and Danielle Sassoon. Roos has worked at the U.S. attorney’s office for over seven years, according to LinkedIn. Sassoon previously worked as a litigation attorney at Kirkland and Ellis and was an adjunct professor at New York University’s law school before joining the office.

The defense

Bankman-Fried is represented by lawyers from the law firm Cohen and Gresser. Partners Mark Cohen and Christian Everdell are co-leading the defense. Cohen co-founded Cohen and Gresser and headed up the firm’s litigation and arbitration group as well as the white collar defense and regulation group. Before co-founding the firm he served as an assistant U.S. attorney for the Eastern District of New York.

Everdell also worked in the U.S. Attorney’s office but for the Southern District of New York before joining Cohen and Gresser. He now leads Cohen and Gresser’s U.S. Privacy & Data Security group and is also a member of the firm’s litigation and arbitration group and white collar defense and regulation group.

The pair recently represented Ghislaine Maxwell in a high-profile criminal case where she was convicted of sex trafficking offenses related to recruiting underage girls for the billionaire financier and sex offender Jeffrey Epstein. She was sentenced to 20 years and fined $750,000.

Court filings show that for the Bankman-Fried case, the defense is looking to, at least partially, use an “advice of counsel” strategy. Under this defense, Bankman-Fried will claim he was “acting in good faith” when it came to alleged conduct such as loaning funds to executives and setting messages to auto-delete because he was following the advice of in-house lawyers as well as outside law firm Fenwick and West.

The witnesses

The prosecution intends to draw on testimonies from Bankman-Fried’s closest advisers, expert witnesses and former FTX employees, lenders and investors, according to a court filing. FTX co-founders Gary Wang and Nishad Singh as well as former Alameda Research CEO Caroline Ellison have all pleaded guilty to criminal charges and are cooperating with investigators. They are expected to testify at trial.

FTX Digital Markets Co-CEO Ryan Salame recently pleaded guilty to criminal charges linked to campaign financing and conspiracy to operate an unlicensed money transmitting business. According to the New York Times, federal prosecutors have stated that Salame is not cooperating with them in the case against Bankman-Fried. He had a close relationship with Bankman-Fried and Business Insider described him as a person he was “instantly very impressed with.”

Bankman-Fried’s father Joseph Bankman could make an appearance at the trial. He previously worked in a part-time role at FTX and reportedly helped set up meetings for his son in Washington D.C. The exchange is currently trying to claw back an illegal US$10 million loan made to Bankman-Fried’s father, which liquidators believe has been used to bankroll his son’s legal defense. Bankman also retained his own lawyers, according to a report from Reuters.

Both Bankman-Fried’s father and mother, who are professors at Stanford University, have stood by him as the case has unfolded. They co-signed Bankman-Fried’s US$250 million bond in a bail package and up until recently he was under house arrest at his parent’s home.

The jury

Bankman-Fried’s legal team had until Sept. 1 to request a trial extension in relation to complaints over unsuitable conditions in jail for the preparation of his defense. The judge set this time frame because a jury for the trial needed to be requested by Sep.7.

In the jury selection process, a group of prospective jurors will receive an online questionnaire to fill out and then, in a process known as voir dire, those who are summoned will face more questions from the judge and the lawyers to determine their suitability for jury duty.

On Sept. 11 both the defense and the prosecution filed their questions for prospective jurors including questions regarding knowledge of Sam Bankman-Fried, FTX, cryptocurrencies, political donations, effective altruism — which is a charitable philosophy Bankman-Fried followed — and ADHD, a medical condition that Bankman-Fried takes medication for.

One of the challenges of this case is its high-profile nature. The prosecution and defense could face challenges finding jurors who are unfamiliar with Bankman-Fried, similar to the government’s case against startup founder Elizabeth Holmes.