Are Bitcoin Halving Events Still Relevant to Crypto Market Cycles?

It has long been assumed that Bitcoin’s four-year cycles are intrinsically linked to the halving events when the block rewards are cut. However, an alternative theory has emerged that suggests this may not be the case.

The past three major market cycles for Bitcoin and crypto have come pretty regularly every four years or so, with the peak in the year following the halving event.

Bitcoin Cycle Coincidence?

However, this may be coincidental according to the latest theories floating around on crypto social media.

On September 5, Bitcoiner ‘Pledditor’ said,

“Bitcoin’s four-year cycles are just coincidences and have little to do with the halvenings.”

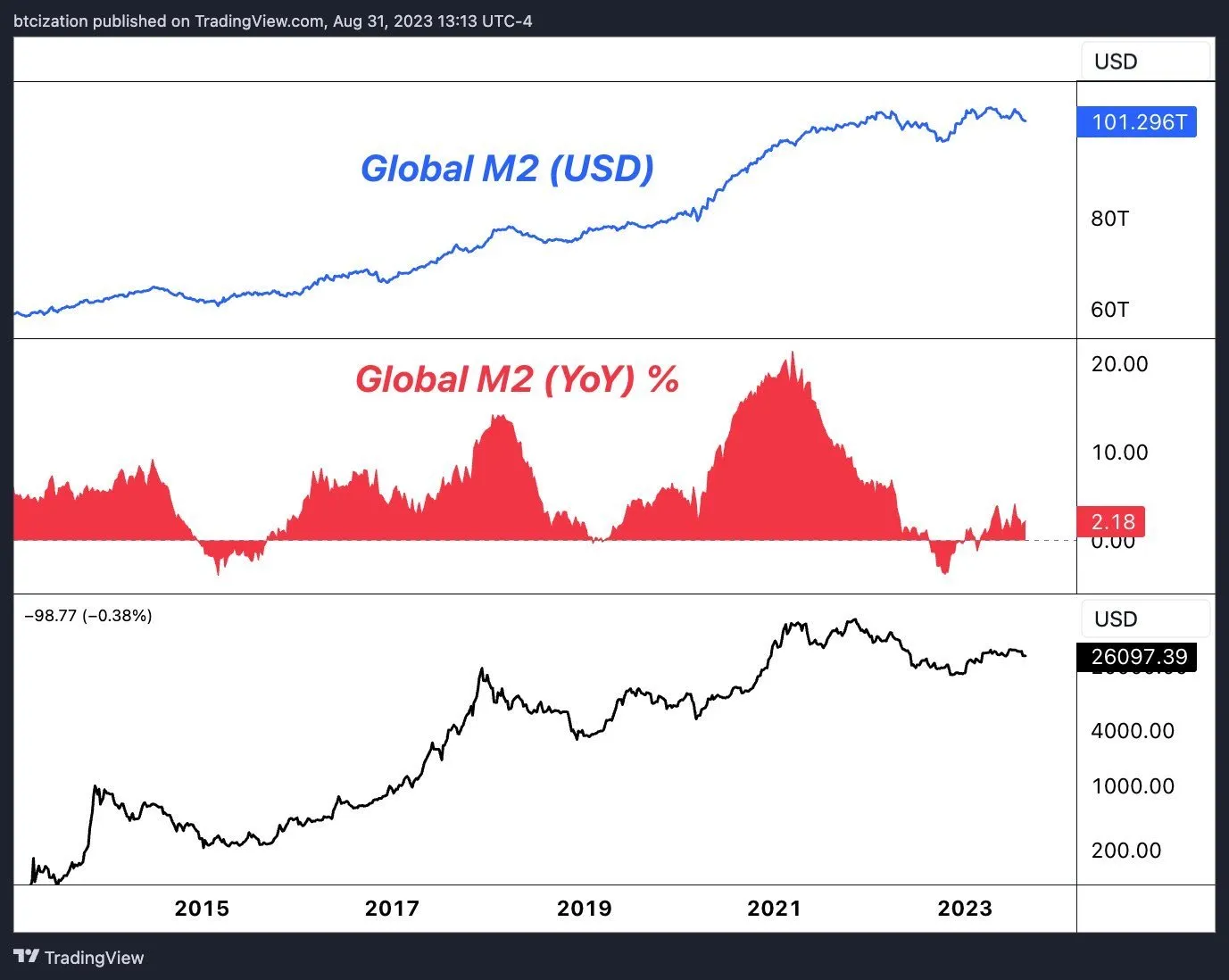

They said that the cycles are closely correlated with those for the global M2 money supply.

“Global M2 money supply has actually been having its own “4-year cycles” as of late, and those cycles have been reflected in most risk assets, including Bitcoin.”

M2 is a broad measure of the money supply. It includes currency and various sorts of bank and money market mutual fund deposits that are relatively liquid.

According to the chart, the last three Bitcoin cycle peaks have also coincided with the largest changes in the global M2 money supply.

The last cycle, for example, occurred in 2021 and 2022, when M2 grew at record rates during the pandemic. This was when central bank money printers were churning out new cash for stimulus measures.

Last year, GMI CEO Raoul Pal suggested something similar in that BTC cycles were connected to macro patterns and M2 growth.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Now that global money supply is in decline, Bitcoin and crypto markets also remain deep within bear territory. Is this a coincidence or just another novel theory?

Earlier this week, BeInCrypto reported that US household savings were falling and about to be totally depleted. This would impact the amount of excess money available for high-risk investments such as Bitcoin.

Halvings Still Relevant

Author Vijay Boyapati, who wrote The Bullish Case for Bitcoin, also questioned whether the four-year cycles were still relevant in a recent podcast with Stephan Livera.

He noted that the amount of money that has to come into the Bitcoin market daily to maintain the current price level is much higher.

However, after the halving, the “financial energy needed to maintain prices is not as much,” which will push prices up, he added.

“Bitcoin finds a new price level … where the halving still has an impact just by the fact that the total market cap has increased significantly.”

The next Bitcoin halving event is due around mid-to-late April, depending on which counter you use. Analysts are still confident that a rally and a new bull cycle will follow in late 2024.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.