Dogecoin (DOGE) Address Trends: Majority at Loss

The cryptocurrency market is experiencing significant losses. The Dogecoin price has also witnessed a sharp decline, leading to a situation where the majority of Dogecoin addresses are currently in a loss.

Over the past four days, the Dogecoin price has plummeted by approximately 28%, breaching the crucial golden ratio support at around USD 0.064.

Dogecoin Price Plummets 30% in 4 Days

This decline indicates a strong bearish sentiment, with the previous upward momentum no longer sustained, pushing Dogecoin back into a bearish trend.

Furthermore, the daily MACD signals a clear bearish trend, while the RSI is rebounding from oversold levels. Additionally, the daily chart displays a death cross of the EMAs, solidifying the bearish trend in the short to medium term.

However, Dogecoin is presently showing signs of a rebound from the horizontal support at $0.0615, indicating a possible upward movement in the short term.

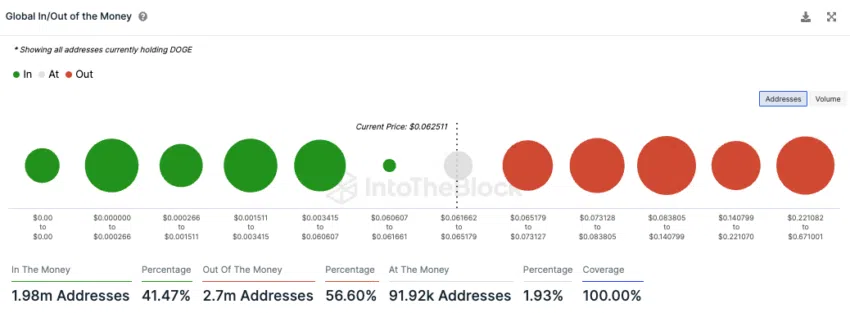

Over 50% of Dogecoin Addresses Now Show Losses

This indicates that over half of the Dogecoin addresses are currently facing losses. Approximately 56.6% of Dogecoin addresses would experience a loss if they were to sell their DOGE tokens at the current market price.

On the other hand, around 41.5% could potentially gain profit, with about 1.93% being at the breakeven point.

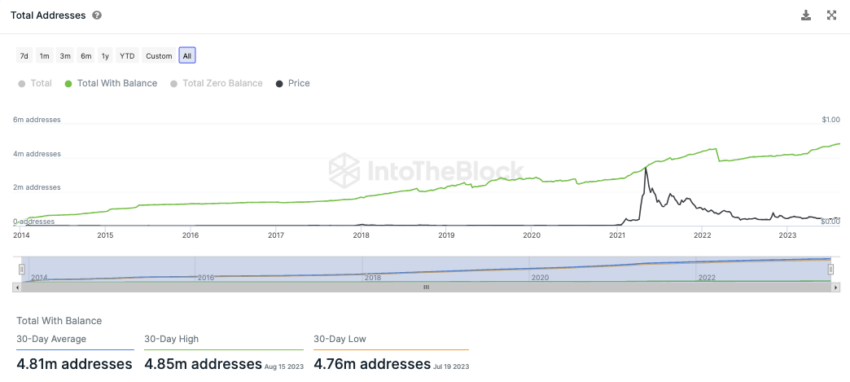

DOGE Addresses Continue to Grow: Upward Trend Persists

The count of Dogecoin addresses continues to exhibit steady growth. Over the past 30 days, there has been an average of approximately 4.81 million addresses holding DOGE.

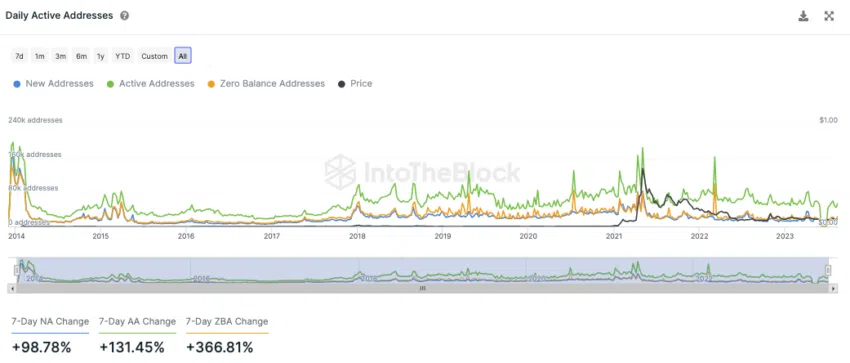

Dogecoin’s Active Addresses Double

Within the past seven days, the count of active addresses within the Dogecoin network has surged by more than 131%.

Additionally, new Dogecoin addresses have risen by nearly 100%. The number of DOGE addresses without any credited coins has seen a remarkable increase of around 367%.

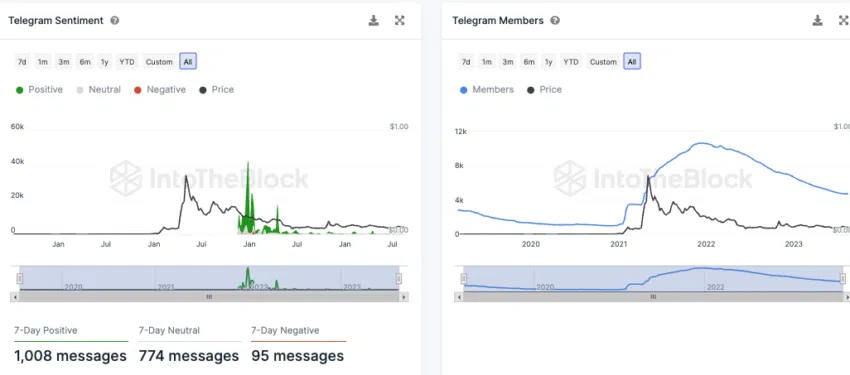

Dogecoin Sentiment on Telegram: Mostly Positive

The sentiment regarding Dogecoin on Telegram is significantly positive. Over ten times the number of positive messages compared to negative ones.

However, the membership count of the Dogecoin Telegram group has experienced a notable decline since late 2021.

Dogecoin Addresses: Over a Third Represent Retail Investors

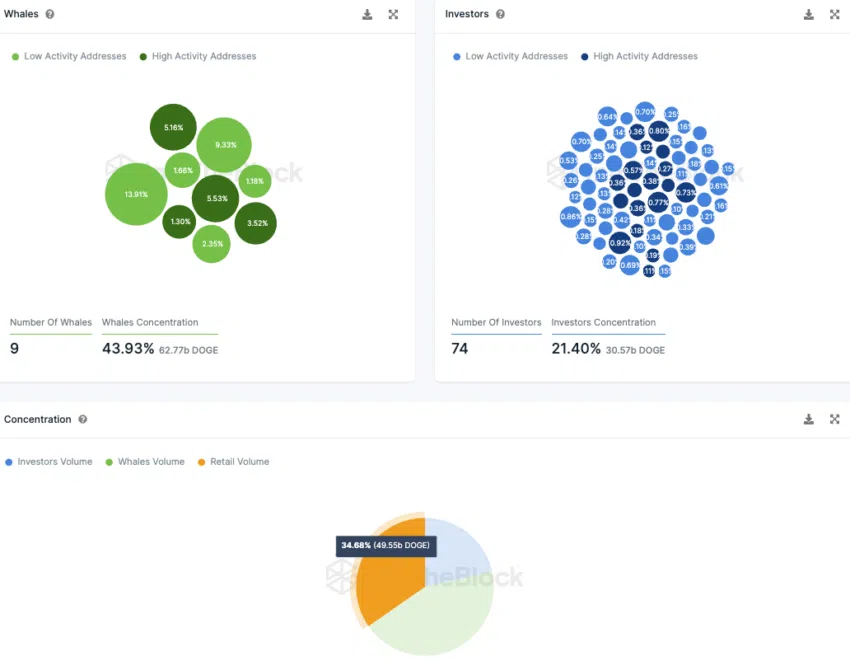

Dogecoin’s ownership distribution indicates encouraging patterns. Retail investors posses over a third of the total tokens. While a group of 74 significant investors, holding between 0.1% and 1% of the tokens each, collectively own around 21.4% of the token supply.

Notably, there are nine addresses classified as “whales” that own more than 1% of the total token supply. Collectively controlling approximately 43.93% of the Dogecoin supply.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.