BNB Hacker Loses 10% of Stolen Funds in Venus Liquidation

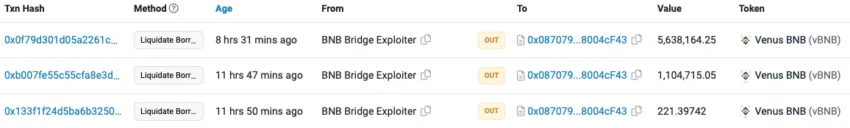

A hacker who stole almost $600 million in BNB last year had over $60 million in collateral liquidated on the decentralized borrowing and lending service Venus Protocol. Security firm PeckShield first reported the liquidation.

They pledged the stolen funds as collateral for a $30 million USDC loan. But a leap in bond yields in the last 24 hours sent digital assets into a nosedive causing the loan to become undercollateralized.

BNB Hacker Couldn’t Outsmart Smart Contracts

After BNB dropped below $220, the Venus smart contract liquidated three loans worth $148 million. The hacker deposited 900,000 BNB ($198 million) as collateral to borrow USDC, USDT, and BUSD stablecoins.

Unlike traditional margin trading, where brokers advise investors to increase the initial margin they pledged to avoid liquidation, smart contracts liquidate positions with no warning. As a result, investors must closely monitor any leveraged or collateralized positions they suspect may fall below a protocol’s minimum threshold.

DeFi Bridges Suffer From Poor Cyber Hygiene

The person or persons stole $568 million worth of BNB after hacking the BSC Token Hub bridge in October. While the perpetrator is unknown, several similar attacks in 2022 have been attributed to Lazarus, a North Korean cybercrime group suspected of funding a government nuclear program.

Bridges help traders move tokens from one blockchain to another. They are smart contracts that lock tokens from a source blockchain and then mint their equivalent on the destination blockchain.

Not sure what a smart contract is? Read our comprehensive guide here.

While convenient, laws do not yet compel bridge creators to undergo smart contract audits that could reveal security flaws. As a result, hackers can exploit their code to reveal locked funds.

On the flip side, the centralized nature of bridges often means fallout from hacks can be contained. Last year, after the hack, Binance stopped its Smart Chain and froze $7 million of the stolen funds.

Got something to say about the BNB hacker’s liquidation on the Venus Protocol or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.