32% of Russians View Digital Ruble as Scam

As Russia prepares to launch its central bank digital currency (CBDC), a recent survey reveals skepticism among its citizens. A survey by Bankinform reveals that a significant portion of respondents see the digital ruble as potentially fraudulent.

President Vladimir Putin signed the digital ruble bill last month, marking Russia’s progression toward launching its CBDC.

Survey Reveals Mixed Reactions

The survey conducted by Bankinform reveals that 13% of participants are eager to use the digital ruble. But 34% of respondents expressed interest in the new ruble with no intention of using it.

Meanwhile, 21% of the respondents were not interested in the CBDC.

Notably, 32% of those surveyed believe the digital ruble may be a scam. Their chosen option said, “This is some kind of fraud, you have to be careful.”

The platform said that the results cannot be attributed to ignorance or correlated with the level of awareness. Instead, they call for a more in-depth and larger study.

Russia’s Move Towards CBDC

President Vladimir Putin’s signing of the digital ruble bill last month marked Russia’s official move towards a CBDC. Following this, the Bank of Russia (BoR) released the official logo for the digital ruble in August – a ruble symbol enclosed in a circle.

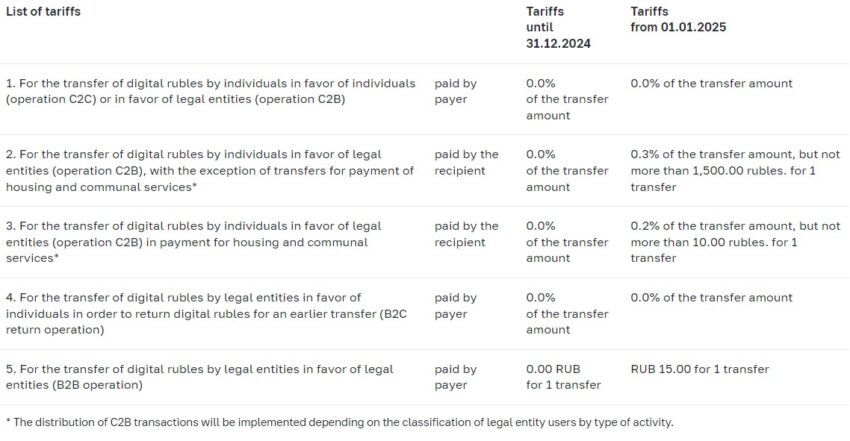

The CBDC aims to serve as an additional payment instrument and will be free between individuals and their payments to businesses. However, from 2025, it will cost 0.3% of the transfer amount, capped at 1,500 rubles per transfer, for certain C2B transfers.

Transfers between certain legal businesses will cost 15 rubles per transfer after 2024.

Despite the momentum, the digital ruble has yet to gain full clarity in its definition and execution.

Bankers Ask for Clarity

Local reports reveal that Russian bankers have requested clarification from the regulator regarding the digital ruble’s status. According to information obtained by Kommersant, the Association of Russian Banks (ARB) asks whether it’s a third form of money, or non-cash currency.

Questions have also been raised about whether credit institutions will be compensated for providing access to the digital ruble platform.

Interestingly, Russian law has occasionally associated cryptocurrencies with payment and property. Recently, the Russian Supreme Court also overturned an earlier ruling that dubbed converting crypto to rubles as money laundering.

Therefore, addressing the digital ruble’s top concerns will become crucial for the central bank.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.