Why is Tether Selling Off? Your USDT is Now Worth $0.10 in Huobi, Top Analyst Reports

The famous Twitter analyst and technical analysis expert, Adam Cochran (@adamscochran), recently shared a detailed thread on the potential reasons behind Tether’s sell-off. He suggests that the likely cause is the insolvency of Huobi, a prominent cryptocurrency exchange.

Cochran points out that Binance, another major cryptocurrency exchange, began selling off USDT in bulk, which coincided with the questioning of Huobi executives and Tron personnel by the police. This event followed the launch of stUSDT by Justin Sun, the founder of Tron, and unusual balance shifts at Huobi over the past month.

According to Cochran, Binance, due to its scale and connections, is often the first to know about risky assets or issues within the industry. He notes that the rapid sell-off of USDT on Friday happened after Huobi employees would have been questioned and after weeks of steady USDT decline in Huobi.

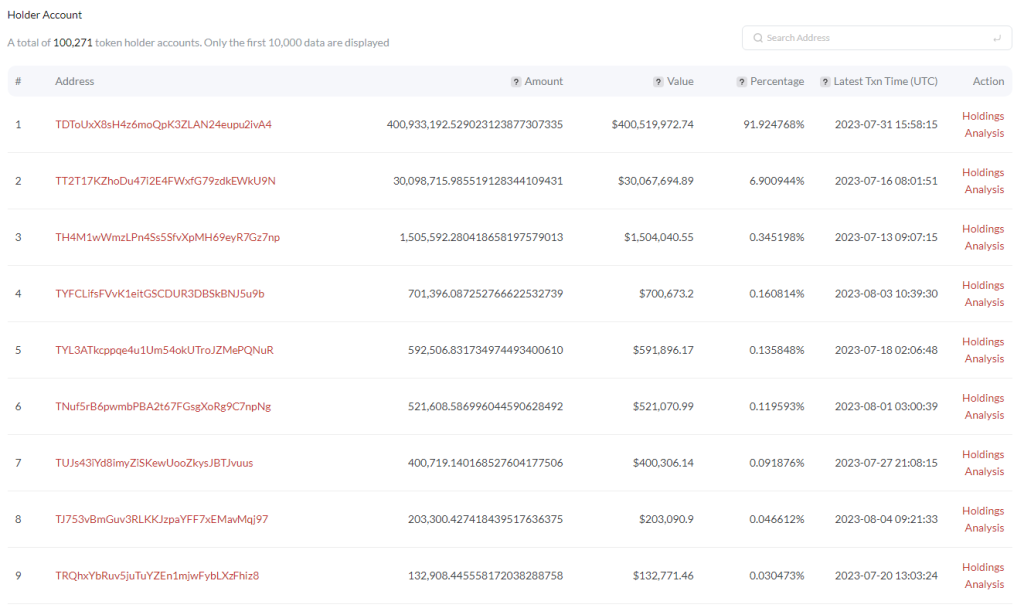

Cochran also scrutinizes Sun’s stUSDT, which Sun claims is USDT sitting in government bonds gaining a 4.29% yield. However, Cochran points out that 98% of the token is held by Sun or Huobi directly, and when USDT is staked into stUSDT, it gets swept into a Huobi deposit address.

In his analysis, Cochran casts doubt on the legitimacy of stUSDT. He argues that if stUSDT were genuine, we would expect to see about $500M in redemptions from Huobi addresses on Tron, converting into redeemed Tether to purchase bonds for yield.

However, Cochran asserts that no such redemptions exist. Instead, the mint proxy sends it to the main address, which then distributes it to other addresses. These addresses, according to Cochran, belong to either Justin Sun, Huobi, or Sun’s Binance address. Most notably, a significant portion of these funds appears to be funneled into Sun’s own DeFi positions, such as JustLend.

Cochran further reveals that Huobi only holds $63M of assets across USDT and USDC combined, while Huobi’s own “Merkle Tree Audit” still lists that Huobi users have $630M of USDT held and a wallet balance of $631M USDT. He suggests that the rest of the funds are being used by Justin Sun to prop up his other DeFi apps, and paying a yield on it to get users to deposit more into Huobi. Another $21M USDT left Huobi today, leaving only $63M against the supposed $630M in obligations. This implies that the USDT in Huobi users’ balances is worth about $0.10 and dropping, a stark contrast to the value users believe they hold.

Cochran also suggests that all the user ETH is missing as well, as Sun has turned it into stETH. Users think they hold 141,000 ETH on Huobi, but instead, Sun holds about half that total balance, and it’s all in stETH.

Cochran concludes by suggesting that Binance is selling their Tether for two reasons: they want to topple USDT to push stables they can control and gain from, and they realize Sun doesn’t have the USDT he claims to, which could lead to a mass dump to escape his exchange if users find out.

🔥 Unibot: Trading Intelligence that Makes You 7x More Successful!

💥 Discover the edge in crypto trading with Unibot – a user-friendly Telegram bot that boasts a 35% profitability rate amongst users, seven times higher than the average trader (only 5% of traders are profitable)!

Experience top-notch features like decentralized copytrading, DEX-based limit orders, and protection against MEV bots. 🔥 Click to connect with Unibot 🔥!

Show more +

In summary, Cochran suggests that just like he did with Poloniex, Sun has been using Huobi as a personal piggy bank to earn from user deposits, and he can’t honor the balances there on ETH or USDT if users try and withdraw or sell in bulk. He also suggests that Binance started selling USDT to mitigate their risk when they heard that Huobi/Tron employees were being investigated in relation to actions at Huobi, as Huobi is deeply insolvent.

We recently covered a story: Is Tether on The Brink of Collapse?

CaptainAltcoin’s writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com

Source link