Centralized exchange trading volumes hit yearly low, though South Korean exchanges resist trend

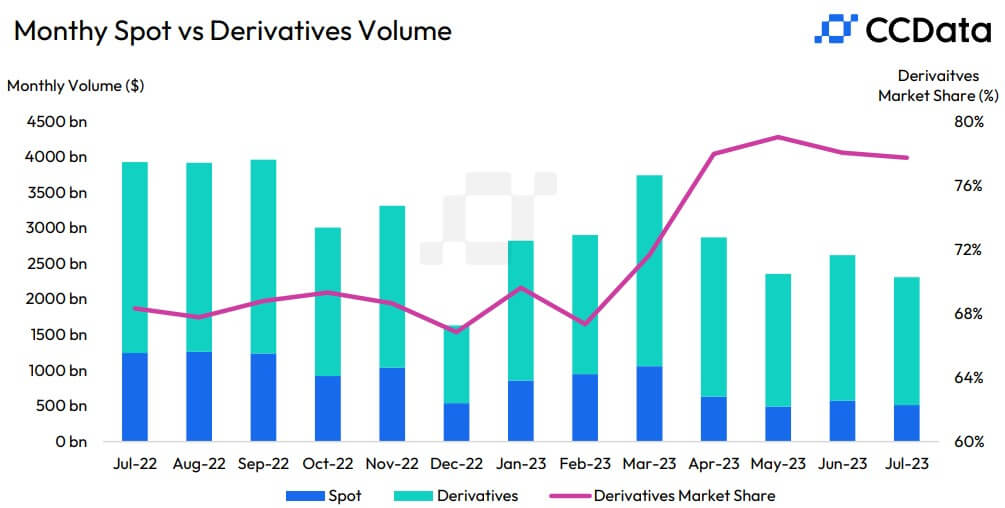

Crypto trading on centralized exchanges declined by 12% to $2.36 trillion. This is the lowest volume recorded since the beginning of the year, indicating a significant downturn in trading activity, according to CCData.

A breakdown of these trading activities showed that spot trading volume fell 10.5% to $515 billion —the second-lowest since March 2019. On the other hand, derivatives volume fell 12.7% to $1.85 trillion, which is the second-lowest volume since December 2020.

The crypto research firm attributed the diminished volume to the lack of price action volatility in significant crypto assets, including Bitcoin (BTC) and Ethereum (ETH), which traditionally drive trading volumes. CryptoSlate Insight reported that BTC’s price movement in July was “closely confined” as the flagship digital asset had “virtually no change in its price” on some days.

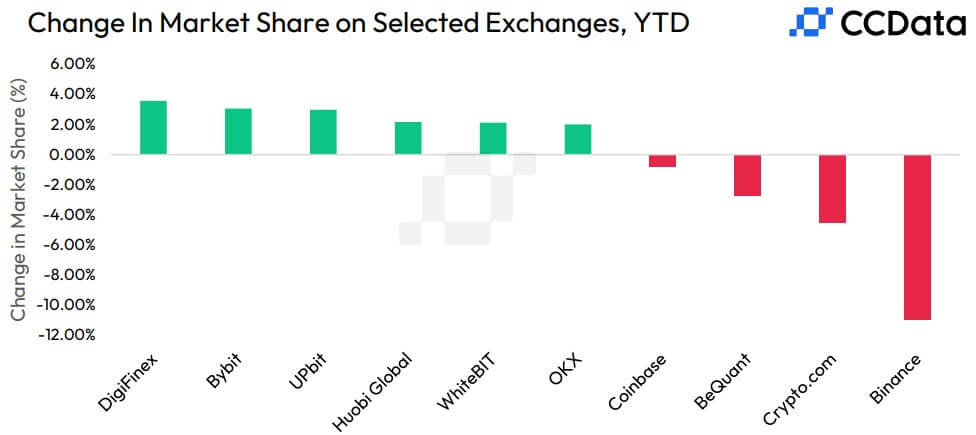

Binance’s market share continues to fall

CCData reported that Binance’s market share has fallen for the fifth consecutive month despite being the largest crypto exchange by trading volume.

According to the report, Binance recorded $208 billion in spot trading activities in July, far ahead of other rivals like Coinbase, Kraken, UpBit, etc. However, its market share fell to 40.4% in July, its lowest since last August.

In July, Binance’s regulatory struggles became more pronounced as it exited several European markets, including the Netherlands, Cyprus, Germany, and the U.K., over its inability to get appropriate licensing within these jurisdictions.

While the exchange also scored minor victories with recent regulatory approvals in Dubai and Japan, confidence in the platform remains shaken as the U.S. Department of Justice reportedly weighs fraud charges against the platform.

South Korean exchanges come to fore

CCData noted that South Korean exchanges, including UpBit, Bithumb, and CoinOne, bucked the general decline trend to see an uptick in their volumes during the previous month.

Per the report, UpBit t is now the second-largest exchange by trading volume after it outtraded more storied rivals like Coinbase and OKX during the period. The exchange’s volume rose 42.3% to $29.8 billion, while its rivals’ volume declined. The increased volume also means the platform accounts for roughly 6% of the total trading volumes across centralized exchanges.

Additionally, Bithumb and CoinOne saw their volumes rise 27.9% and 4.72% to $6.09 billion and $1.39 billion, respectively.