Japan’s blockchain group lobbies for tax change

In this issue

- Japan’s crypto tax law: An industry group urges tax change

- Don’t write off Bitcoin NFTs

- Litecoin’s halving: Prices fall

From the Editor’s Desk

Dear Reader,

The only two certainties in life may be death and taxes – at least according to U.S. founding father Benjamin Franklin – but for the digital asset industry in Japan, those two ugly twins morph into one: death by taxes.

The Japan Blockchain Association’s recent request for a rethink of Japan’s high taxation of cryptocurrency activity can thus be seen as a cry for help, of sorts, from an industry lobby that may not have much industry left to lobby for if crypto and other digital asset businesses continue to depart Japan due to those taxes.

Yet a look around the region should also serve as a reminder that favorable tax rates are not everything. Other East Asian jurisdictions seeking to develop as digital asset hubs offer crypto taxes much kinder than Japan’s, but other ingredients of the not-so-secret sauce that can bring digital asset companies to the table aren’t always on the menu.

South Korea’s forthcoming rules framework, which is set to find expression in the country’s Digital Asset Basic Act next year, promises to go a long way toward providing regulatory certainty for digital asset businesses, yet we’re not witnessing a rush on Seoul.

Hong Kong has done much touting of its own supposedly crypto-friendly regulatory arrangements, even though in reality they’re quite restrictive.

And Singapore, true to form, has made it clear that digital assets are welcome if they’re run by TradFi and off limits to the “little people”.

If governments want to mix the sauce right, they need to take a holistic approach to supporting the digital asset ecosystem and not simply hope that lower taxes might do the trick. In short, they need to step up and do just what they would for any other promising new industry.

It seems almost too easy. So what are policymakers waiting for?

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Call for change

Japan Blockchain Association (JBA), a non-government lobbying group of the blockchain industry, last Friday petitioned the Japanese government to revise tax on crypto assets — Japan’s biggest barrier for foreign Web3 companies — as Tokyo positions itself to become a global crypto hub and center of digital innovation.

- A crypto asset tax is the biggest barrier that Web3 companies face when setting up shop in Japan, followed by obstruction to crypto adoption among citizens, JBA said in its petition that called for three major changes to Japan’s tax system for crypto assets.

- The first change would be to abolish the year-end unrealized gains tax on corporations holding crypto assets, which refers to profits that occur on paper but have not been realized through transactions.

- In June, the Japanese government exempted cryptocurrency issuers from a 30% corporate tax on unrealized gains on tokens, and the petition seeks to expand the exemption to corporations holding crypto assets issued by third parties.

- The second requested change is a revision of the taxation method for personal crypto asset trading profits, which would switch the current aggregate taxation method to a separate self-assessment method that features a uniform tax of 20%.

- The petition also hopes to eradicate the income tax on profits generated by individual crypto asset transactions.

- “In the borderless Web3 era, there is a high possibility that the exchange of crypto-assets will become the mainstream of the economic zone, and due to the wide variety of transactions that occur and the types of crypto-assets that are exchanged, tax calculation will be extremely difficult,” said JBA.

- JBA’s suggested changes come as Japan seeks to become a global leader in the Web3 industry. At the WebX conference in Tokyo last week, Japanese policymakers reiterated their vision that Web3 would be a force in transforming the global social economy, and pledged more support for the industry.

Forkast.Insights | What does it mean?

Japan appears so far to have learned the hard way that if it wants to foster a digital asset industry, it needs to create a sufficiently attractive environment in which digital asset businesses can thrive and – even if only when they become growth enterprises – turn a profit.

Offering low taxes, is, of course, a relatively straightforward means of creating such an environment for crypto companies and other businesses in the digital asset space. It’s not the only one, but its importance shouldn’t be underestimated, as the JBA clearly understands.

Indeed, its importance is such that the Japanese government is understood to have been looking at potential revisions to the way in which it taxes crypto for almost a year, seemingly prompted by the departure of a number of crypto companies from its shores.

In this light, the JBA’s proposals are eminently reasonable. After all, crypto investors in Japan face a potential tax burden of more than 50% on capital gains, and some of the taxes imposed on them are controversial — in particular, the taxation of unrealized capital gains, the very constitutionality of which the U.S. Supreme Court is set to rule in its 2023-24 session.

Neighboring South Korea levies a 20% tax on capital gains pocketed by crypto investors. Hong Kong, a city renowned for its low taxes that aspires to be a crypto hub, collects no crypto capital gains tax from individuals or companies, only tax on overall income. And Dubai, arguably the brightest spot on the crypto map, famously collects no taxes at all.

Japan’s current crypto tax arrangements, by contrast, somewhat resemble those in place in India. Japanese policymakers would therefore do well to recall the result of New Delhi’s imposition of a 30% tax on digital asset holdings and transfers last year: an outpouring of digital asset enterprise and talent from the country.

If the Japanese government wants to make good on its oft-repeated desire to be a magnet for crypto and digital asset businesses, and the development of the industry that their presence brings, listening to the industry’s plea for reduced taxes would be a good place to start.

2. Bitcoin NFTs, a sleeping juggernaut?

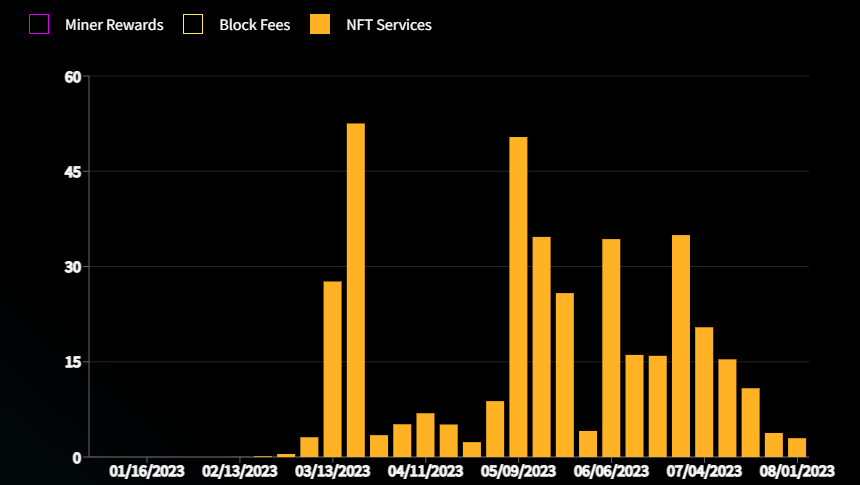

- NFT services on Bitcoin, a measure of marketplace fees and creator royalties, fell to a three-month low this week with just 2.96 BTC or US$86,760.

- Bitcoin Ordinals and BRC-20’s seven-day volume fell 14.09% to US$4 million.

- Unique sellers on Bitcoin declined 62.53%, with 5,276 sellers over the past seven days.

- Total transactions decreased by 16.5%, with just 21,637 transactions in the past seven days.

- Average sales prices on Bitcoin fell to US$494.79 in July, the lowest monthly average in Ordinals since the first few Ordinals sales on Jan. 31.

- Noteworthy BRC-20 collections making moves are $SATS which rose 14.94%, $FRAM, which declined 72.05%, and $TRAC, which decreased 43.24%. The general Ordinals collection, representing most of Bitcoin’s Ordinals, lost 30.55%.

Forkast.Insights | What does it mean?

Many consider Bitcoin’s NFT ecosystem to be a sleeping juggernaut that will one day flip the sales volume of Ethereum NFTs. Whether that’s five years out, or 10, it seems (or seemed) a realistic possibility given the significance of collectibles on the historic blockchain. That outcome seems much less certain, following weak NFT sales that highlight a growing problem with Bitcoin’s blockchain collectibles.

Just a few months ago, Bitcoin Ordinals and BRC-20s transacted millions of dollars worth of NFTs per day, even reaching highs of over US$18 million in daily sales volume in May. Now, Bitcoin collectibles trade under US$500,000 in sales daily, failing to enter the top five blockchains by sales volume and revealing a glaring problem for the blockchain that many knew was always there.

A lack of utility is causing this drastic fall in the value of NFTs on the grandfather of blockchains. Simply put, while blockchains like Ethereum, Cardano, Polygon and Solana have smart contracts that foster endless innovation and ultimately drive value to their ecosystems’ NFTs, Bitcoin simply has Bitcoin. There’s no real utility, and thus no real opportunity to drive value to an NFT, outside of any intrinsic value the image or data may hold. By all metrics, traders are showing that the intrinsic value of Ordinals and BRC-20s isn’t worth much to them.

An ever-increasing supply of Ordinals and BRC-20s is another immediate challenge that traders face today. While the massive supply of inscriptions shows that the community still believes strongly in Bitcoin, it is also a signal that prices may fall even further. July 30 was the single highest day of inscriptions minted on Bitcoin, with over 422,000 new inscriptions, bringing the total supply of inscriptions to over 21 million. Ordinals and Inscriptions now have a major issue with supply and demand.

Writing off Bitcoin’s ecosystem now would be a mistake, and developers may be here to offer up some utility sooner than we had thought. Just this week, the Ordinals team launched a non-profit to help fund developers in the Bitcoin ecosystem, clearly seeing the need to bring utility to this Ordinals ecosystem. Ordinals were just born in February, and it took Ethereum’s NFTs years before they ever saw the type of sales that Bitcoin traded this year. Given time to cook, developers may find the recipe for success again on Bitcoin and maybe deliver that Ethereum flipping experience that almost arrived this year.

3. Litecoin completes halving

Litecoin prices fell after its third halving occurred Wednesday evening in Asia. The event cut the token’s mining rewards by half, reducing it from 12.5 LTC per new block mined to 6.25 LTC, slowing the issuance of new Litecoins.

- Following the halving, Litecoin prices slid 5.46% in the past 24 hours to US$87.36 as of 12:20 p.m. in Hong Kong on Thursday, according to data from CoinMarketCap.

- “Although the halving would normally be a positive event for the price of Litecoin, the current bearish market and recent negative industry news has had a larger impact on trader sentiment,” said Nick Ruck, chief operations officer at Singapore-based blockchain infrastructure platform ContentFi Labs. “Additionally, the halving as an event may already be priced in since traders have known about it for quite some time.”

- Traders with Litecoin holdings of US$9,500-950,000 have aggressively accumulated the token since the middle of July, as investors had expected the halving event to fuel a bull run in Litecoin, according to crypto analytics firm Santiment on July 30.

- Launched in 2011, Litecoin works on a proof-of-work mechanism similar to Bitcoin, where “miners” invest computing power to verify on-chain transactions and receive cryptocurrency rewards in the process known as mining. A Litecoin halving event takes place every 840,000 blocks mined, which takes about four years.

Forkast.Insights | What does it mean?

Demand has been rising among investors and miners with the halving of Litecoin rewards. This event, which reduced rewards to 6.25 LTC, has driven a surge in the demand for the digital currency ahead of the once-every-four-year occurrence.

Data gathered by blockchain aggregator IntoTheBlock revealed a growing number of Litecoin’s long-term holders. The number of wallets that have held Litecoin for more than a year rose from 3.78 million on May 1 to 4.8 million by Aug. 1. Over the same period, wallets holding the cryptocurrency for at least a month grew by 540,000 to 3.67 million.

However, a word of caution to Litecoin investors came from the network’s creator, Charlie Lee. In a recent podcast interview, Lee said that while Litecoin’s quadrennial cycles have historically ignited price rallies, investors may need to hold onto their assets longer to profit from the new, lower supply inflow. Litecoin, like the majority of other altcoins, has its price action tied close to that of Bitcoin. The next historic price rally may not occur until Bitcoin’s projected halving in April 2024, an event many analysts, including Geoff Kendrick of Standard Chartered Bank, believe will trigger a major price uptick.

An indication of rising demand among miners is reflected in the network’s increasing hashrate, a measure of total computational power engaged in mining activities. This figure hit a record high of 802.04 terahashes per second on July 31, pointing to an intensifying level of competition in Litecoin mining, IntoTheBlock data show.

Throughout 2023 to date, data from IntoTheBlock revealed a shift in Litecoin miners’ behaviors. To maintain viability, miners have considerably reduced their holdings. Total miner reserves, defined as Litecoin balances held by miners, have dropped from a yearly high of 4.86 million LTC in April to around 2.28 million at the start of August, a decrease of more than 50%.

For the first few months following the halving, Litecoin miners may continue their rough year due to the drop in revenue. However, the anticipated rise in price may result in long-term economic benefits for miners.