These Are Most Important Dates to Watch

Numerous financial institutions are lining up to offer ETFs pegged to the value of Bitcoin, the world’s largest cryptocurrency by market capitalization

Bitcoin, the world’s largest cryptocurrency by market capitalization, has a host of financial institutions lining up to offer exchange-traded funds (ETFs) pegged to its value.

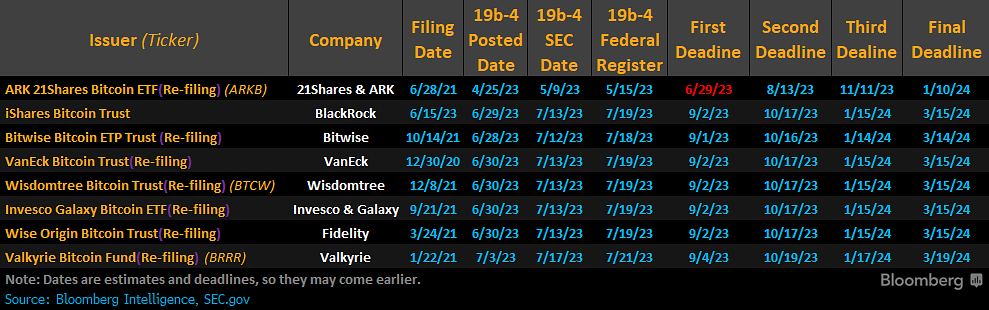

According to a tweet by prominent ETF analyst James Seyffart, key dates in the race for approval include deadlines for ARK 21Shares Bitcoin ETF, BlackRock’s iShares coin Trust, Bitwise’s Bitcoin ETF, Van Eck Bitcoin Trust, Wisdomtree BitcoinTrust, and several others.

For ARK 21Shares, the second deadline is slated for Aug. 13. This early date may offer ARK 21Shares an advantage in the race.

Bitwise has its first deadline on Sept. 1. A large group of issuers, including the iShares Coin Trust by BlackRock and several others, share the first deadline of Sept. 2. Being grouped together could mean these issuers will face a collective judgment day, which may potentially influence the SEC’s decision-making process.

Finally, the Valkyrie Bitcoin Fund has its first deadline on Sept. 4. This places Valkyrie slightly behind the majority of the pack, allowing them to potentially learn from the outcomes of the earlier deadlines.

Investors have been clamoring for an ETF tied to Bitcoin as it would provide a more accessible and regulated means of investing in the cryptocurrency without having to deal with the intricacies of crypto wallets and exchanges.

Interestingly, BlackRock, one of the biggest names in the list, was the last to file but is set to get its response in line with others who submitted their applications much earlier.

Seyffart clarified that BlackRock’s timing may not be as late as it appears; though their prospectus filing dates might be later, all others had already been denied by the SEC in the 19b-4 process once or even multiple times. This wave puts BlackRock arguably at the front line, stirring the ETF race anew.

Grayscale’s GBTC, a popular Bitcoin investment product, is also vying for ETF status through a different channel: a lawsuit against the U.S. Securities and Exchange Commission (SEC). A decision from judges is expected within the next month or two. Some crypto enthusiasts believe that GBTC could become the first Bitcoin ETF if it wins the lawsuit against the SEC.

However, Seyffart has warned that even if Grayscale wins its lawsuit, it could still be denied the ability to convert to an ETF.