Unpacking trends in Bitcoin trading volatility

Quick Take

Bitcoin’s trading patterns have been unusually consistent, primarily fluctuating around the $30k mark. However, a recent dip saw the cryptocurrency briefly fall below $29,000. This volatility has been linked to Bitcoin’s sharp decline in 2022, coupled with significant macroeconomic uncertainties. Consequently, many investors have adopted a more cautious stance, predicting lower price targets for Bitcoin.

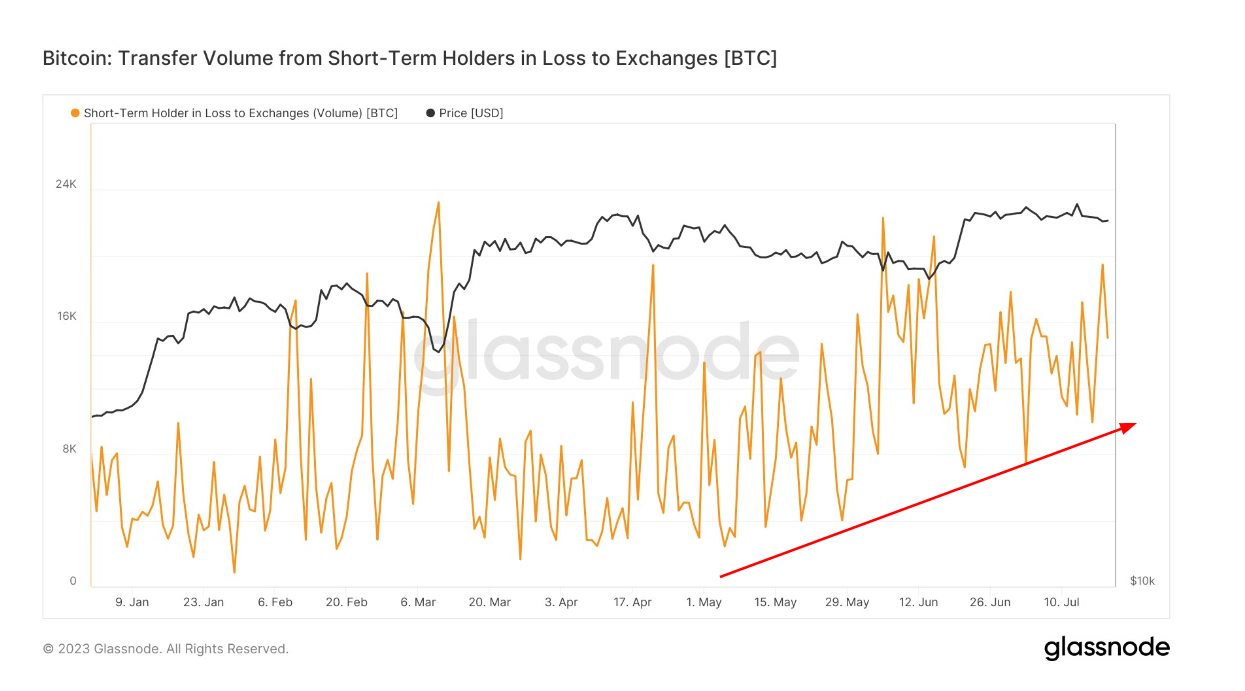

An interesting trend emerged when Bitcoin’s price dropped to $29,000: a significant number of short-term holders opted to sell. This decision resulted in over 20,000 Bitcoins being sold at a loss, constituting the fourth-largest volume of such transactions this year.

Moreover, a marked rise in anxiety among these investors is evident from a red arrow indicator, denoting an increase in selling activity over recent months.

The post Unpacking trends in Bitcoin trading volatility appeared first on CryptoSlate.