Insider Trading on New Token Listings Still a Crypto Industry Issue

Recent research from Solidus Labs has revealed that insider trading in crypto is far more prevalent than previously reported. The study examined crypto assets listed on major platforms and exchanges, showing how serial insider traders systematically took advantage of token listings and announcements.

A study by crypto and DeFi market surveillance and risk monitoring firm Solidus Labs has unveiled the extent of insider trading related to new token listings.

Insider Trading Scourge Persists

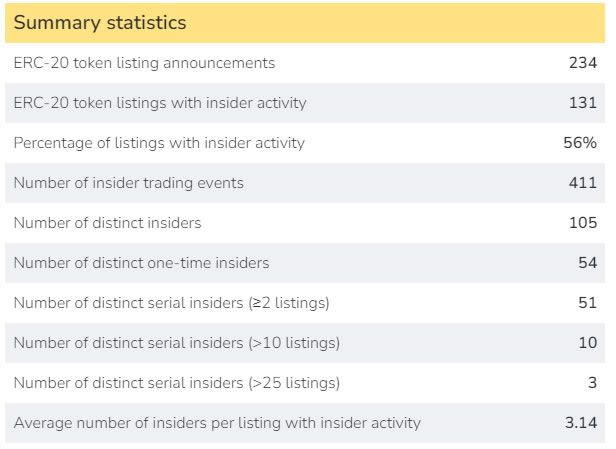

The study revealed that 56% of crypto token listings on centralized exchanges since 2021 showed signs of insider trading.

The results were derived from data from Solidus HALO’s DEX-based detection tool.

Solidus identified over 100 entities, individual cryptocurrency wallets, or groups of connected wallets that have executed over 400 suspected insider trades since January 2021.

It reports that “serial insider trading” makes up most of this suspicious activity. Solidus flagged 51 entities that have used decentralized exchanges (DEX) to swap Ethereum, Tether, or USDC to buy soon-to-be-listed crypto tokens on two or more occasions.

It noted that ten of these entities have traded just before and after more than ten token listing announcements. Furthermore, the three most prolific insiders have traded ahead of more than 25 listing announcements apiece.

Solidus Labs co-founder Chen Arad said the study confirms that DEX-based insider trading is a major market integrity problem, adding:

“The permanent, public, and traceable nature of blockchains means that we can detect and deter this phenomenon with unprecedented transparency. With this technology, we can help regulators and exchanges enable safe crypto trading.”

The HALO platform monitors more than a trillion events per day across more than 150 markets.

In May, a former product manager at NFT marketplace OpenSea was found guilty of fraud in the first crypto insider trading case.

Crypto Market Outlook

Crypto markets have begun their inevitable retreat from heavy resistance zones. As a result, total market capitalization has lost 1.3% in a fall to $1.20 trillion.

Bitcoin could not overcome resistance at $30,000, and a double-top formation appears to be forming. BTC dropped just under 1% on the day. It has fallen to $30,211 at the time of writing, and further losses look likely.

Ethereum has taken a bigger 1.5% hit to $1,839. Meanwhile, the rest of the altcoins are deeper in the red during the Thursday morning Asian trading session.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.