China Wants Yuan to De-Dollarize Global Trade

China want the yuan to displace dollar-based trade, as five other countries explore alternatives.

The communist state has embarked on strategic initiatives to promote renminbi use in international trade through initiatives with the economies of Brazil, Russia, India, China, and South Africa, the Shanghai Cooperation Organization, and the Organization of the Petroleum Producing Countries.

China Wants Yuan Popularity to Be Driven by Russia

The world’s second-largest economy wants its strategic yuan initiatives to offset the dollar’s global hegemony.

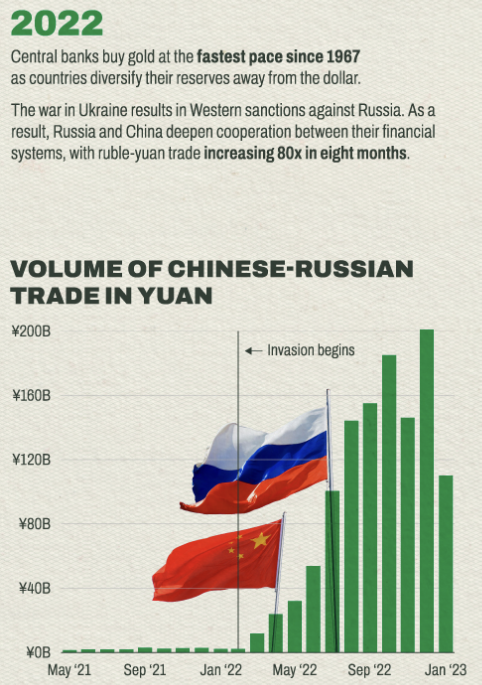

Recent economic sanctions against Russia have allowed China to promote the renminbi’s potential to replace dollar-based trade.

Following a recent agreement, Brazil and China now trade with the Chinese yuan instead of the US dollar. Direct exchange eliminates the need for currency conversion.

The Brazilian Trade and Investment Promotion Agency says this switch will reduce costs and drive bilateral trade and investment.

And China is Brazil’s largest trading partner, with Chinese goods accounting for 20% of Brazil’s imports. And Chinese exports make up more than a third of all Brazilian exports.

Saudi Arabia and Iran Prepare for Dollar Independence

Saudi finance minister Mohammed Al-Jadaan suggested in January the country’s readiness to participate in non-US dollar US trading in January. The move would mark a departure from long-standing economic relations with the US.

However, until that happens, the country will explore alternatives without abandoning the petrodollars it earns from oil exports

Staying in the Middle-East, Iran’s President Ebrahim Raisi asked the Central Bank to progressively minimize the US dollar’s role in bilateral trade in favor of the Iranian rial. The central bank has progressed towards this goal.

In a recent meeting with Oman’s Commerce Minister, he lauded the rial’s bilateral trade merits. Iran is currently under US sanctions.

India Strengthens Rupee Influence With 19 Countries

India and Bangladesh recently agreed to use the Indian and Bangladeshi rupees for bilateral trade. Bangladesh will pay roughly $2 billion from a possible $13.7 billion in Indian exports using rupees. It will pay the balance in US dollars.

In line with 18 other regions, India will pay rupees for Bangladesh exports worth $2 billion in 2022. Russia, Germany, Great Britain, Singapore, Sri Lanka, Malaysia, Oman, and New Zealand already settle Indian trade transactions in rupees.

Kremlin Wants to De-Dollarize With Yuan and BRICS Alternative

In the war with Ukraine, Moscow favors the Chinese yuan over the US dollar for international trade. Moreover, the Kremlin is also exploring a unified currency with BRICS allies.

Goldman Sachs economist Jim O’Neill coined the BRICS acronym in 2001 to describe regional economies that will dominate the global economy by 2050.

The BRICS regions also belong to the G20 and were originally intended to represent investment opportunities.

Recently, Coinbase CEO Brian Armstrong argued that China’s adoption of the digital yuan and Hong Kong’s crypto ambitions threaten US supremacy in the digital currency space.

By adopting the Chinese yuan, the Russian economy secured an alternative to Western financial networks and the US dollar.

Now, BRICS leaders must make important decisions about a common currency and confirm their de-dollarization when they meet in August.

But energy exporters increasingly favor the yuan for payments, with the Russian state wealth fund securing its oil reserves in yuan.

The increasing importance of the Chinese currency further establishes the countries’ relationship. A shared discontent with the West turned their competition for global influence into a truce.

For a run-down of the best Bitcoin exchanges, click here.

But, the change is consistent with China’s mostly unsuccessful ambitions to entrench the renminbi’s importance in international finance and trade.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.