Institutional Investors Want TradFi Backing To Invest In Crypto

A new survey by Laser Digital suggests that institutional investors are ready to invest in cryptocurrencies as part of their portfolio strategy. The survey shows an overwhelming openness to the technology. However, it also reveals hurdles to crypto adoption. Some investors are not willing to make the leap without the support of big backers in traditional finance.

According to the survey, 96% of respondents view digital assets as an opportunity to diversify their investments, alongside traditional asset classes like fixed income, cash, equities, and commodities. And 45% said their holdings of digital assets will be between 5% and 10% over the next three years. Only 0.5% say they will not figure at all.

Institutional Investors Confident in Crypto

However, around 90% said that it is important to have the backing of a large traditional financial (TradFi) institution for any digital asset fund or investment vehicle before they would consider handing over their money.

The findings demonstrate how reliant crypto investment is on big financial behemoths like banks, pension funds, and insurance. As well as a reluctance on the part of institutional investors to acquire similar products in decentralized finance (DeFi).

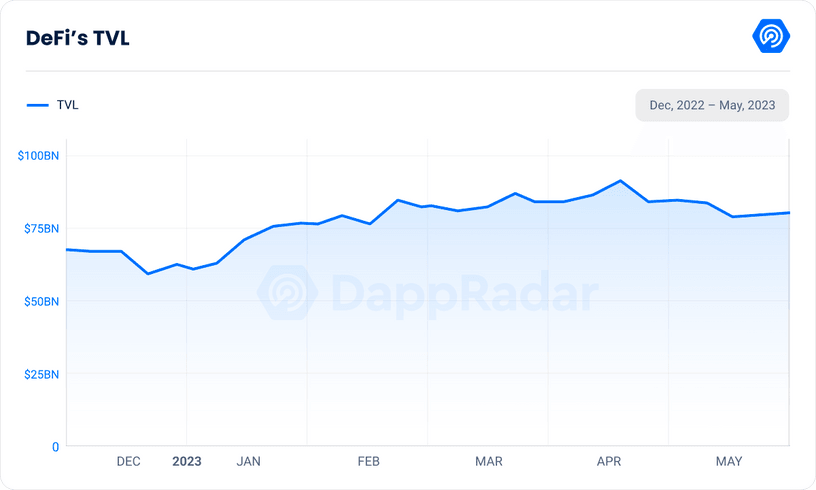

Of course, the liquidity in DeFi remains much smaller than in traditional finance. As of May 2023, the Total Value Locked (TVL)—the total amount of assets locked in decentralized finance protocols—was $79.16 billion. A 4.3% decrease from the previous month, according to DappRadar. Whereas offerers of traditional investment products have many trillions under management.

Legal Barriers Remain

The survey also found that over 76% of respondents believe legal or regulatory constraints may deter any investment in digital asset-related products. An unsurprising conclusion, considering the regulatory tussles in many jurisdictions.

However, globally, 2023 overall has so far been a year of greater legal clarity for investors. Despite market turmoil since spring 2022, and the collapse of several banks and exchanges, many banks still feel bullish on digital assets, including crypto.

“The fallout of the past year has clearly rocked investors’ confidence in the crypto industry, so it’s not surprising that so many are looking for reassurance from more established institutions before sinking their money into these funds,” Brian D. Evans, the CEO and founder of BDE Ventures, a web3 venture studio, told BeInCrypto.

“People see institutional backing as validation, and they are less likely to lose their jobs if things go wrong by placing bets on institutional-backed investments,” he continued.

“But that shouldn’t be automatically equated with a drop-off in investments in the industry. Outside of the United States, institutional interest is alive and well, as are retail investments.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.