Polygon (MATIC) Investors Cash Out, Adding Downward Pressure

Polygon (MATIC) price entered a free fall after the United States Securities and Exchange Commission (SEC) listed it among the ten cryptos identified as securities. Where will prices find support with investors now in panic mode?

MATIC price dropped 15% as the recent SEC court filing against Binance spread negative sentiment across the markets. After an initial sell-off on Monday, panicking investors are now withdrawing their tokens from various DeFi smart contracts. Will the newly unstaked tokens flood the market and trigger more sell-offs in the coming days?

Investors Are Withdrawing Tokens from Smart Contracts

After testing the $0.90 milestone last week, Polygon’s (MATIC) price has been in free fall since Monday. Yet, the selling pressure could increase over the coming days.

An in-depth analysis of the underlying Polygon on-chain data shows that concerned investors have been unstaking their MATIC tokens at an unprecedented rate.

Between May 29 and June 8, MATIC Supply in Smart Contracts dropped from 64.9% to 63.7%. This means that 111.5 million MATIC tokens (1.2% of the total circulating supply) have been unstaked over the past week.

The Supply in Smart Contracts metric tracks the percentage of a cryptocurrencies’ total circulating supply that holders have locked up across various DeFi protocols. When investors unstake a large number of tokens within a short period, it could cause a sudden increase in the volume of tokens available to be traded on exchanges.

At current prices of $0.78, the recently unstaked tokens are worth approximately $87 million. If a significant percentage of these tokens are pumped into the market, MATIC holders can expect further price downswings in the coming days.

Long-term Holders are Losing Confidence

Furthermore, the sharp rise in Age Consumed suggests low confidence among long-term investors in the Polygon ecosystem. According to on-chain data, long-term investors have been increasingly selling off their coins over the past week.

Age Consumed evaluates the trading activity of Long-term investors by tracking the number of recently sold coins multiplied by the number of days since they were last moved. MATIC Age Consumed spiked 2,400% from 38.2 million to 950.9 million between June 2 and June 8.

When Age Consumed spikes considerably, as seen above, it signals that long-term holders are selling off large amounts of coins. This could spook potential new investors to become bearish about MATIC’s future price prospects.

In conclusion, the newly unstaked tokens potentially flooding the market and the low confidence among Polygon’s long-term investors are critical bearish factors. This suggests that MATIC’s price will likely drop further in the coming days.

MATIC Price Prediction: Bears Can Push for a $0.65 Retest

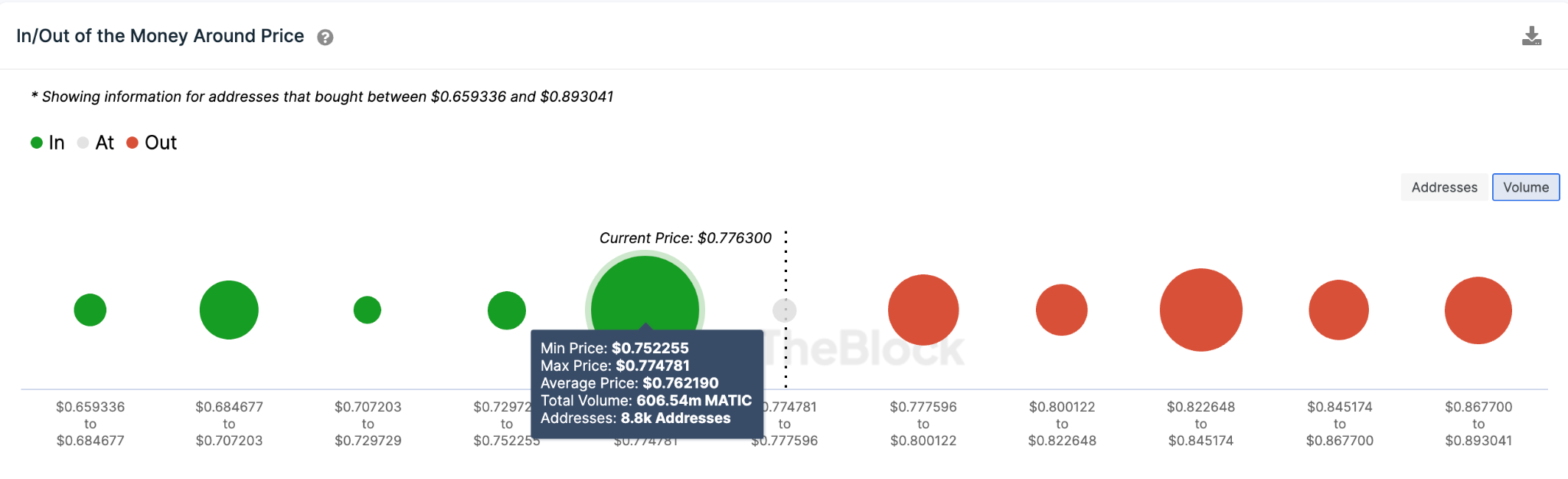

The bearish mood among the long-term investors suggests that MATIC’s price will likely drop toward $0.65. But, according to IntoTheBlock’s In/Out of the Money Price (IOMAP), Polygon will likely experience initial support around $0.76.

At that zone, there’s a demand wall mounted by 8,800 addresses that bought 606.5 million MATIC at an average price of $0.76.

But if that support caves as expected, then MATIC price could drop as low as $0.65.

Still, the bulls can negate this pessimistic narrative if MATIC’s price manages to break above $0.80. But as seen above, some of the 18,160 investors that purchased 183.4 million coins around $0.80 could resist.

Only if that resistance level fails to hold, MATIC can push the rally as far as $0.89.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.