Bitcoin’s leap above $28k triggers $130 million in crypto liquidations

Bitcoin’s (BTC) brief climb above $28,000 during the early trading hours of today led to liquidations of roughly $130 million in positions held on the crypto market.

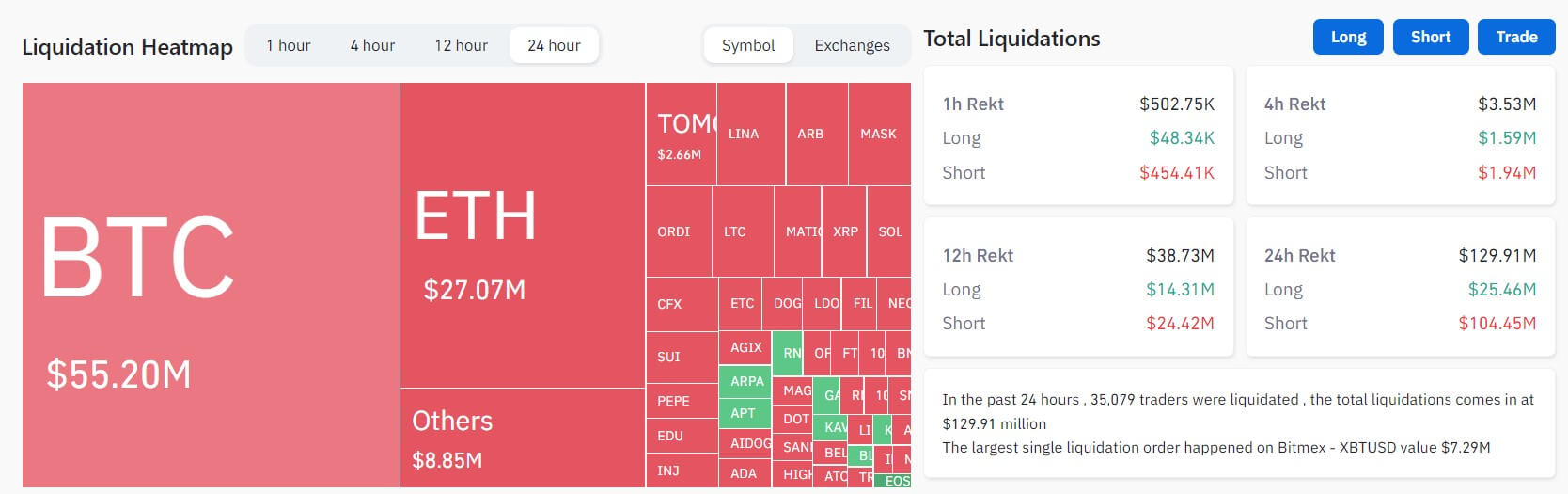

According to Coinglass data, the flagship digital asset saw $55 million in liquidations for traders who held positions in it in the last 24 hours.

Roughly $130 million liquidated

The crypto market saw $129.91 million liquidated in the past 24 hours, with more than 35,000 traders being liquidated.

Data from Coinglass showed that short traders lost $104.45 million, with Bitcoin and Ethereum accounting for over $68 million of these losses.

Meanwhile, long traders experienced $25.46 million in liquidations. The top two digital assets were responsible for more than 50% of these losses.

Other assets such as Dogecoin, BNB, Chainlink, XRP, Litecoin, and Solana experienced less than $2 million in liquidations, respectively.

Across exchanges, most of the liquidations occurred on OKX, Binance, and ByBit. These three exchanges accounted for over 70% of the overall liquidations, with 99% being short positions. Other exchanges like Huobi, Deribit, and Bitmex also recorded a sizeable amount of the total liquidations.

The most significant liquidation occurred on Bitmex – XBTUSD, valued at $7.29 million.

Bitcoin briefly climbs above $28k

During the last 24 hours, BTC broke the $28,000 level barrier, peaking at $28,432, according to CryptoSlate’s data.

However, it has retraced to $27,960 as of press time.

Ethereum (ETH) rose 3%, while BNB is up 2%. XRP, Cardano (ADA), Dogecoin (DOGE), and others also saw respectable gains during the reporting period.

The rally was fueled by news that the U.S. government reached an agreement on its debt ceiling. On May 28, President Joe Biden described the agreement as a “compromise” and an “important step forward that reduces spending while protecting critical programs for working people and growing the economy for everyone.”

In a note shared with CryptoSlate, Matrixport’s chief researcher Markus Thielen stated that the debt ceiling agreement means market skeptics will need new reasons to maintain a bearish outlook. He added:

“Many investors were scared about the debt ceiling and the potential default by the U.S. government, although the likelihood of such an event is extremely low. Now, they will need to find something else to be bearish about, as the market likely rallies.”