How to Set Up a Crypto Stop-Loss Order

If you’ve entered a crypto trade and can’t watch it closely, you should set up a stop-loss order to avoid losing all of your money. But what is a stop-loss order, and how can you set it up?

What Is a Stop-Loss Order?

A stop-loss order is a risk management technique that investors use to limit the losses on investments. Basically, it represents an advance order to sell an asset (or a percentage of an asset) when it reaches a particular price point.

As a trader, you decide on the minimum price you want to sell your crypto for. Once the asset reaches that price, the exchange or trading service will trigger a sale to limit your loss on that trade.

You could say a stop-loss order is a way to protect against price volatility, which is one of the biggest risks for crypto investors.

Steps in Setting Up Your Stop-Loss Order

To help traders better control their trades without constantly checking the charts, most cryptocurrency exchanges allow users to set up stop-loss orders. The following steps show you how to set up a stop-loss order on Binance, but it’s a similar process on most crypto trading platforms.

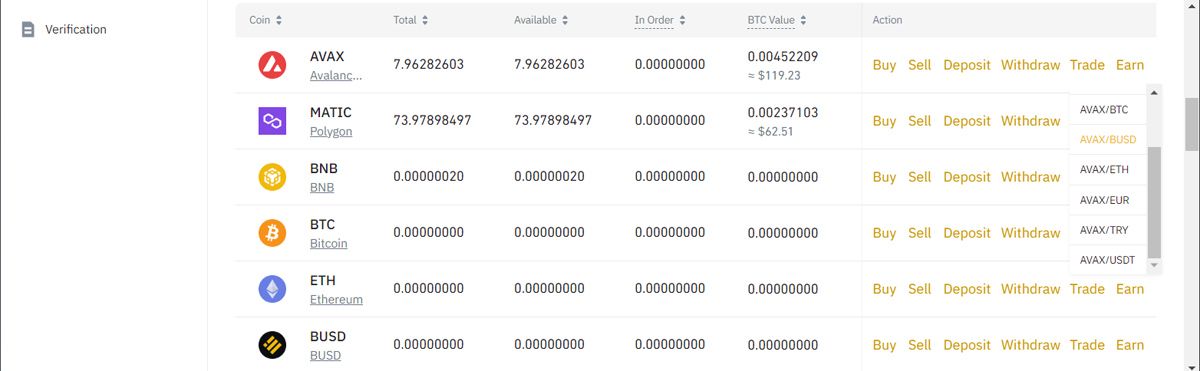

First, let’s select the token that you want to trade. To check the list of available assets, go to Wallet > Fiat & Spot.

Now, select Trade next to the token you want to set a stop-loss order for and select one of the pairs.

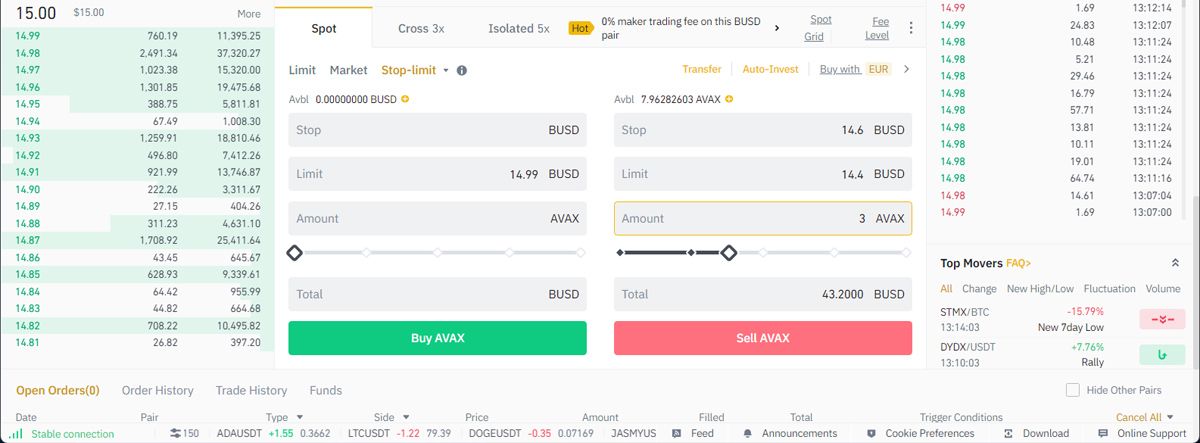

Then, select the Stop-limit option below the chart. On a simple stop-loss order, there are three components:

- Stop price. The stop price should be a bit higher than the price you want to actually sell for. This way, the sell order will appear on the order book and you don’t end up selling for less than you wanted. Remember that the trigger price should be below the current mark price.

- Limit price. The limit price is the price that you actually want to sell your asset for.

- Amount. Here you can specify how much of your asset you want to sell. You can use the slider to put in a percentage if you don’t want to sell it all.

Once you’ve set everything up, click the Sell button.

Binance will now create the sell order. You can check it in the Open Orders section. Look at the Price, Amount, and Trrigger conditions values to ensure the trade will take place as planned.

If there’s something wrong with the stop-loss order, or you’ve changed your mind and want to remove it from your account, click the Cancel icon on the right part.

However, don’t think that by setting up a stop-loss order, your profits are now safe. You still need to implement crypto risk management practices to protect your investment.

Can You Make Money With a Stop-Loss Order?

While it doesn’t have the most optimistic name, you can still make money by setting up a stop-loss order. As long as the minimum price is bigger than the purchase price, you’ll make a profit. On the other hand, if the price recovers after the stop-loss order is executed, you’ll miss the chance of selling at a higher price.

It’s quite a challenge to figure out the right time to sell, but it will help if you learn more about resistance and support for effective crypto trading.

Protect Your Trades With a Stop-Loss Order

Using a stop-loss order might give you confidence while trading, as your assets are better protected against price volatility. However, it shouldn’t be the only trading strategy you apply to your trades.

If you’re interested in learning more trading strategies, you should give scalping a try. Despite its focus on small profits, it can be profitable once you figure out its secrets.

.jpg)