U.S. Bitcoin Mining Consumed 50 Billion kWh of Energy in 2022

There’ve been rivers of ink written on all aspects of cryptocurrency ever since that fateful day of the Bitcoin whitepaper publishing. Still, one question that’s repeatedly brought to the limelight (and understandably so) surrounds energetic and environmental sustainability. Now, the White House itself is adding fuel to the fire through its DAME Tax proposal, whose aim is, and we quote: “making cryptominers pay for costs they impose on others.”

How, you ask? By phasing in an additional 30% tax penalty for cryptocurrency mining firms on any energy they consume in that process. According to the White House, this is “an example of the President’s commitment to addressing both long-standing national challenges as well as emerging risks – in this case, the economic and environmental costs of current practices for mining crypto assets.” The idea is simple: Bitcoin mining consumes a lot of power; this consumption drives electricity prices up; which is bad for everyone unfortunate enough to share a grid with a cryptocurrency mining firm.

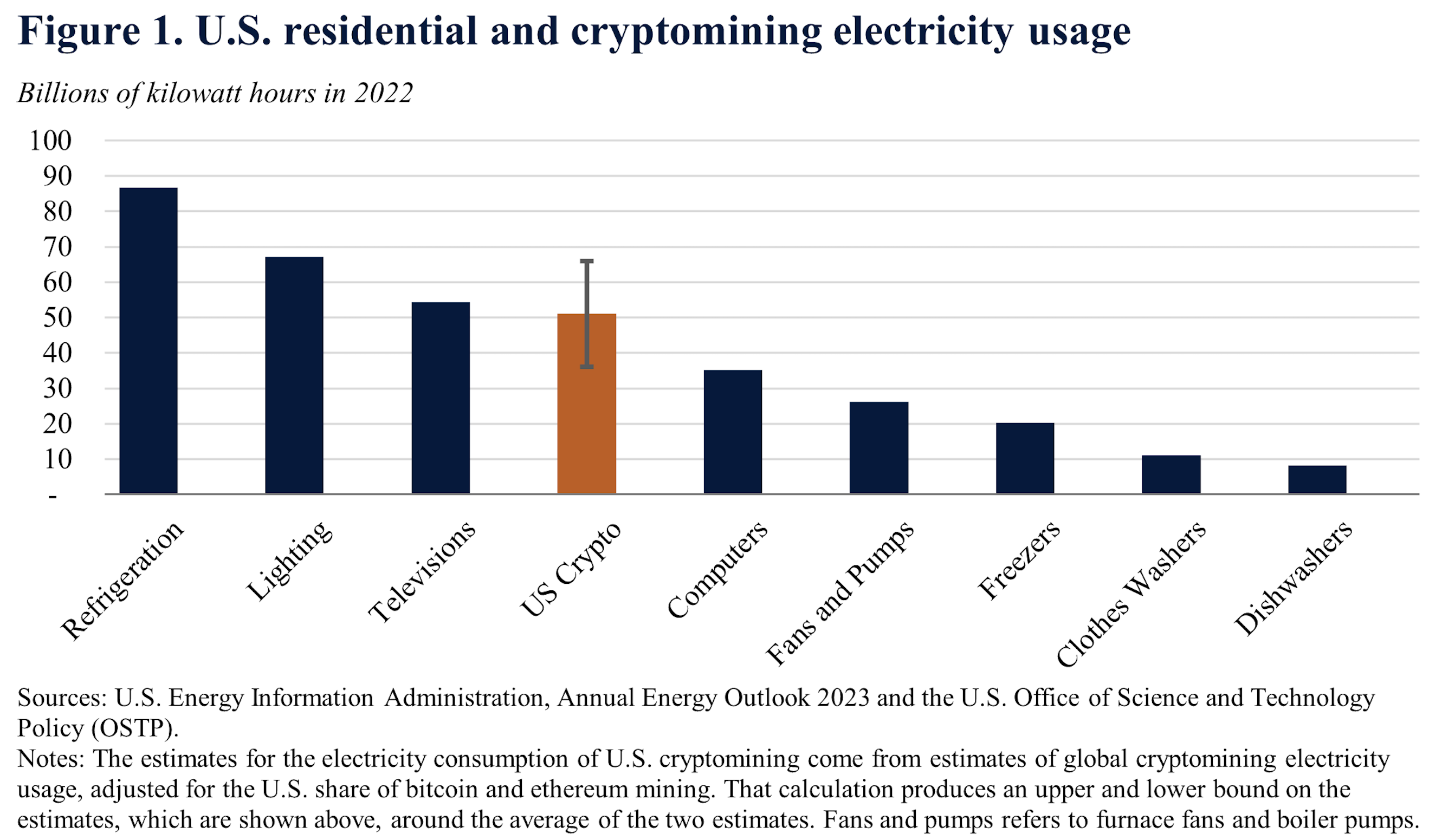

It seems that the White House’s hand has been forced by their very own report, which estimates total Bitcoin mining energy consumption in 2022 at an eye-watering 50 billion kilowatt-hours (in fact, the estimate places consumption anywhere between the low of 30 billion kWh and a high of 60 billion kWh). That’s greater power consumption than all operating computers in the United States put together – and within the margin of error of the countrywide electrical consumption for as basic a necessity as lighting.

It’s also more energy than Americans consume through their TV sets, and it’s right here, in a nice graph:

Let’s get this straight right off the bat: public and private lighting is definitely (and inarguably) more important than Bitcoin mining.

However, some arguments favoring the proposal seem to be mired in inconsistencies. Back when Intel announced its “Bonanza Mine” cryptocurrency mining chips, we took a relatively detailed look at Bitcoin’s global power consumption and the utility that can already be extracted from it: anyone who has taken profits can attest to its utility; anyone who sold anything to someone and got paid in Bitcoin can attest to its utility; so can anyone who crossed an embattled border while invisibly carrying their wealth, or the citizens of El Salvador, where Bitcoin is legal tender. I’d be interested to know which process the White House used to quantitatively analyze cryptocurrency applications’ social benefits before concluding that they “are yet to materialize.”

There’s also the question of what amount of Bitcoin’s energy consumption actually hails from carbon-intensive sources; according to the Bitcoin Mining Council (BMC), a global forum of mining companies that represents 48.4% of the worldwide Bitcoin mining network, it’s estimated that in Q4 2022, renewable energy sources accounted for 58.9% of the electricity used to mine bitcoin – against an estimated 36.8% as of Q1 2021.

It’ll be interesting to see what results from this legislative push. For one, a 30% tax for cryptocurrency mining firms would drive most of them out of business, resulting in a concentration of hashing power in the hands of the few firms with strong enough financials to stand above the waterline. That would be terrible for Bitcoin, whose network security assumes that processing power is distributed, not concentrated. We wouldn’t go so far as saying that Bitcoin Core devs would be open to changing Bitcoin’s security model from Proof of Work (the cause for the monumental energy consumption) to Proof of Stake (Ethereum did this transition through its Merge, basically cutting its energy consumption on transaction validation by over 99%). But Ethereum isn’t Bitcoin, and Bitcoin isn’t the only Proof of Work cryptocurrency out there.