Meme season blamed for jump in Ethereum (ETH) gas fees

Ethereum (ETH) gas fees jumped to a 10-month high — prompted by a surge in meme coin mania.

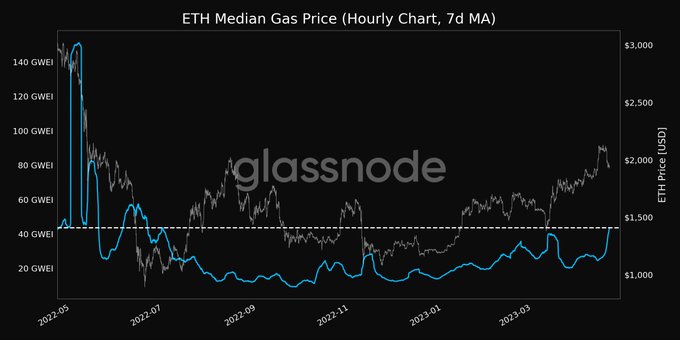

Per Glassnode, the median Ethereum gas price over a seven-day moving average (7DMA) reached 43.641 gwei — a price last seen on June 30, 2022.

Gwei is a denomination of ETH — with 1,000,000,000 gwei equaling 1 ETH, or 1 gwei equaling 0.000000001 ETH.

Over the past year, the median gas price over a 7DMA peaked at 150 gwei in May 2022 but dropped sharply by July 2022. It then gradually stabilized around the 20 gwei mark going into September 2022, when the Merge rolled out.

Ethereum gas fees

The cost of using Ethereum has been a point of contention since the “DeFi Summer” of 2020 — when the average gas price reached as high as 700 gwei.

This period saw network activity surge as yield protocols, such as Curve, Compound, and Yearn, began taking off — triggering mania from the demand to farm unreal gains.

Ethereum’s architecture is such that high gas fees come about when network traffic and the demand for transaction verification is high.

While some assumed the Merge and the switch to Proof-of-Stake (PoS) consensus would tackle this problem, it was confirmed that gas fees remain primarily driven by the demand for blocks and the network’s capacity to meet that demand — not the consensus mechanism used.

Recently, Ethereum network activity has skyrocketed with a wave of newly released meme coins — some of which netted early investors gains in the thousands of percent.

Meme coins are back

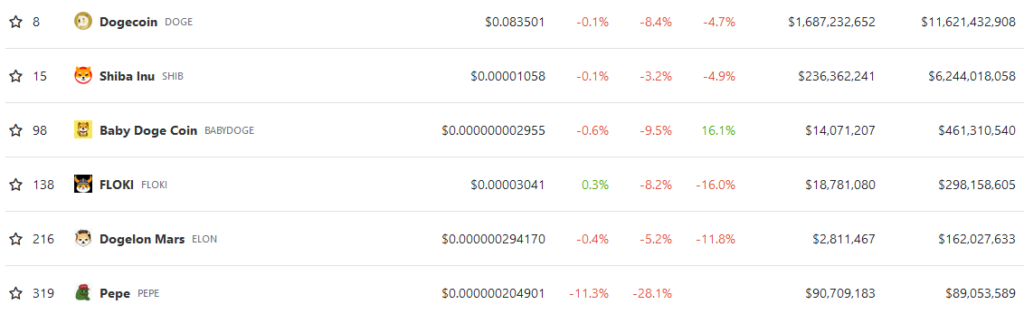

PEPE is one such meme coin, which has risen to become the sixth largest by market cap at $89.1 million in a few days.

PEPE reached a local top of $0.000000391704 on April 20 and has been trending downwards since.

The success of PEPE has spurred social media chatter on which meme coin is next to spike. For example, a tweet from @liquiditygoblin said meme season is back — tagging “$PEPE, $WOJAK, $COPE.”

The post Meme season blamed for jump in Ethereum (ETH) gas fees appeared first on CryptoSlate.