5 Myths About Crypto Regulations Debunked

Crypto assets have existed for over a decade but are still considered novel technology. Despite several attempts to regulate the industry, there is still no clear framework for crypto operations. This has led to numerous misconceptions about how crypto assets are regulated.

However, it is essential to be clear on the facts surrounding crypto regulations and how they can affect your crypto investments, especially as the industry grows. So, here are five common misconceptions, along with the truth.

1. Crypto Regulations Stifle Innovation and Growth

Several people claim that crypto regulations stifle innovation and growth, especially as the basic tenet of cryptocurrency is a lack of centralized oversight. While this might have been true in the early days of digital assets, it is not true now that crypto has advanced and achieved massive adoption. Hardly any invention can succeed without a clear and consistent operational framework.

Regulations can ensure that businesses are held accountable. This can lead to a more stable investment environment, reduce risks and uncertainties, guarantee consumer protection, foster trust and confidence in the industry, and lead to further adoption. While new technologies offer great benefits, they often pose great risks. Appropriate crypto guidelines can make investing in and developing crypto assets easier for mainstream businesses and individuals, leading to more innovation and growth in the industry.

Surely, there’s the potential for stifling and overtly burdensome guidelines, especially with the continuous linking of crypto assets to illicit financial activities. After all, we’ve heard several reports of criminals using Bitcoin to launder money. However, this is not the goal of crypto regulation. With appropriate crypto policies, especially against money laundering, digital assets can become more viable for widespread adoption.

Crypto regulations should protect the end consumers while enabling new products and processes to grow and evolve. Regulators can take advantage of the attributes of cryptocurrencies, employing blockchain-based tools to create and enforce guidelines. Policies that ignore the uniqueness of cryptocurrencies are plainly just short-sighted and stifling.

2. Crypto Regulations Are Similar to That of Traditional Financial Systems

A common misconception is that the laws guiding traditional financial systems work fine for cryptocurrencies. Coindesk even reported that SEC Chair Gary Gensler has attested to this. However, this is not true. Crypto and blockchain technology are far apart from traditional assets and financial systems, so it is inappropriate to regulate them the same way.

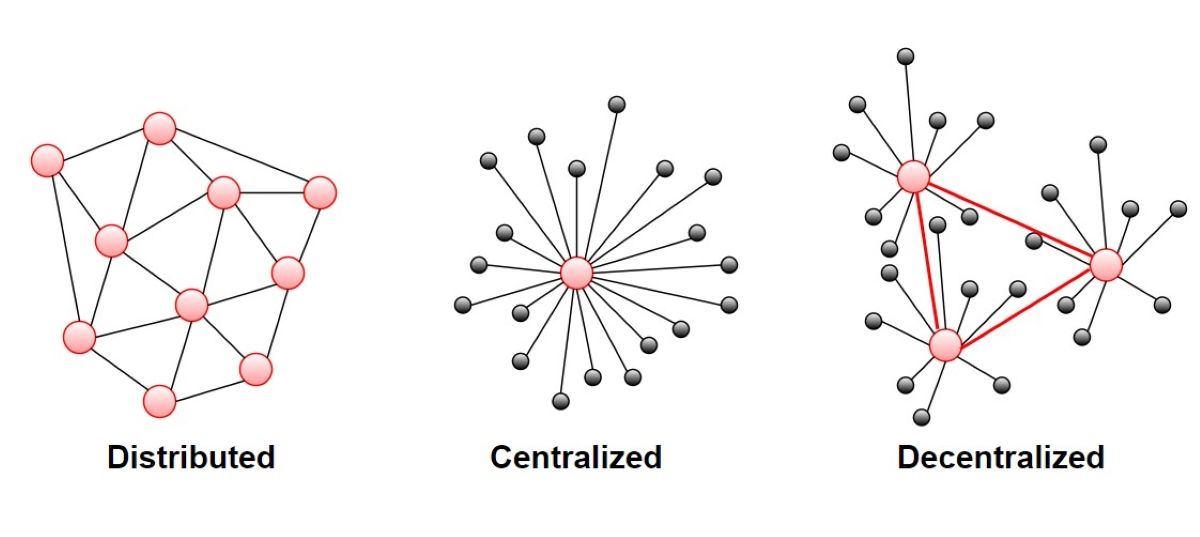

For instance, blockchains are typically decentralized, while traditional financial systems are centralized.

In the conventional banking sector, a central governing body—the government or a private government-affiliated institution—creates and enforces requirements, restrictions, and guidelines. In contrast, cryptocurrencies were created to eliminate centralization. So copying regulations from the traditional financial space and pasting them into the crypto space is bound to be a failed process.

Although crypto and conventional financial regulations seek to protect people from fraudulent financial activities, their requirements, restrictions, processes, and guidelines should differ. Traditional financial guidelines were never created with the peculiarities of blockchain technology in mind. While the conventional financial industry is largely static, the crypto industry evolves swiftly, with numerous rapidly changing activities, products, and services.

So, new regulations that consider and address the unique attributes of crypto assets are to be created.

3. Crypto Regulations Are Impossible to Enforce

Because blockchain technology is decentralized and crypto transactions can be completed privately, many believe crypto regulations are impossible to enforce. But this is not true.

You can trace crypto transactions even though they are the most secure forms of payment, as they still leave audit trails linked to public keys. These public keys are typically linked to real-world data, especially when you want to convert crypto to fiat. This has enabled many law enforcement agencies to trace and prosecute cybercriminals who use cryptocurrencies for criminal activities with blockchain analytics and other relevant tools.

Furthermore, several crypto organizations are mandated to comply with anti-money laundering, know-your-customer guidelines, and the crypto regulators of the land.

Nevertheless, the enforcement of crypto regulations has been riddled with various challenges. Because countries are developing and enforcing different crypto regulations, there is no global crypto framework, and each country’s different laws and regulations do not sufficiently cover all elements of cryptocurrencies. Also, regulations must be updated constantly because of the many emerging trends and technologies.

4. Crypto Regulations Are Unnecessary Because Blockchain Technology Is Self-Regulatory

Another common misconception is that crypto regulations are redundant because blockchain technology and smart contracts are transparent, decentralized, secure, and tamper-proof. However, blockchain technology does not protect against criminal financial activities and other risks. And because cryptocurrencies are still new, several uncertainties and unknowns exist.

Blockchains can and have been hacked, and these hacks are somewhat permanent because of the immutable nature of blockchains. In addition, some blockchains are not so secure, transparent, or immutable, meaning that vulnerabilities might abound, identities may be hidden, and transactions may be reversed.

As a result, crypto regulations are vital to protect consumers and businesses from criminal financial activities and malicious actors. For instance, if crypto service providers are licensed and authorized, the risks related to crypto storage, investment, transfer, and others would be well-addressed.

In addition, regulated crypto firms would have clear requirements concerning their engagements with cryptocurrencies, leading to a more stable and safe environment for investors to engage with digital assets.

5. Cryptos Are Not Currently Regulated

Although there is no globally-accepted crypto regulatory framework, it is not true that cryptos are not currently regulated. Governments and regulatory agencies initiated cryptocurrency compliance because of the increase in crypto cybercrime and fraudulent digital asset transactions—with elements like know your customer (KYC), customer due diligence (CDD), and anti-money laundering (AML).

Several countries have implemented crypto regulations (positive and negative), and many others are still studying the crypto terrain to develop regulations. Even in countries without clear crypto regulations, crypto assets are typically subjected to general financial laws.

For instance, countries like China, Nepal, and Nigeria have banned cryptocurrencies, while Switzerland and Japan have implemented legislation for cryptocurrencies and crypto service providers. Meanwhile, the United States, United Arab Emirates, and European Union, despite having crypto regulatory bodies and myriads of guidance documents, are still drafting legislation for cryptos. Similarly, the Australian government released a paper on token mapping—its strategy for classifying digital assets to identify the best regulatory framework.

Countries have taken different approaches to regulating crypto assets, leading to a disorganized global response to crypto regulations. However, the Financial Action Task Force (FATF) issued directions for countries to regulate digital assets and crypto service providers. FATF is an international agency that creates regulations for combating criminal financial activities, so they know the importance of having effective crypto regulation.

Likewise, the International Organization of Securities Commissions (IOSCO) released guidelines (PDF) for countries to regulate crypto exchanges. The International Monetary Fund (IMF) has also called for a coordinated, consistent, comprehensive global crypto regulatory framework to stabilize markets and foster consumer confidence.

Knowing your country’s stance on crypto before trading or investing would be best, as its regulations can significantly impact your investment decisions.

Crypto Regulation Is Not Always What It’s Made Out to Be

Because the crypto climate is still emerging with no globally accepted framework guiding their operations, it can be easy to have the wrong ideas about crypto regulations. However, you must have the right information concerning crypto regulations to ensure compliance and avoid making a wrong investment decision.

Keep up with regulatory changes, remembering that building a secure, innovative, and thriving crypto ecosystem with crypto regulation is possible.