Crypto’s ‘killer use case’? It’s real-world asset tokenisation, believes Citi and other analysts

Bitcoin maximalisation considerations aside, the wider crypto world has long speculated on what will be the true catalyst for mainstream adoption of cryptocurrencies. The concept of tokenising real-world assets appears to have joined the conversation with a little more vigour just lately.

Gaming, DeFi, and, yes, Bitcoin’s strong narrative as a Gold 2.0 store of value (and even a future world reserve currency) have all been touted as gateways for floods of fresh capital to enter the space.

But what are real-world assets in a crypto sense? As the popular Twitter account @thedefiedge explains it, “RWA”s are physical assets that can be tokenised and represented digitally, and immutably, on blockchains.

“An example is fiat-backed stablecoins: $1 is held in a bank and then tokenized on a blockchain. It has DeFi superpowers once it’s on the chain,” he explains further.

One crypto sector is estimated to reach $16 Trillion by 2030:

Real World Assets.

This will be the CATALYST for mainstream Crypto adoption.

Here’s your 2023 guide to RWAs (and the top protocols): pic.twitter.com/bGudNQX0zq

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) March 30, 2023

The DeFi Edge pointed to recent research by the Boston Consulting Group (BCG), which suggests that the tokenisation of global illiquid assets could become a US$16 trillion industry by 2030.

And to put that into some sort of context, that’s about 15% of the global GDP (gross domestic product) figure that 2023 is projected to reach.

According to the research’s classifications, real-world assets include equities, bonds, investment funds, and other financial instruments and can also include commodities such as gold, silver and real estate.

Crypto is reaching an ‘inflection point’: Citi

Last month American multinational investment bank Citi Group released its “Money, Tokens and Games” report, in which it identified RWA tokenisation as a potential “killer use case”.

In fact, for this adoption narrative, Citi forecasts that the crypto market itself can reach between US$4 trillion to US$5 trillion by 2030.

Yes, that’s a fair bit smaller than the Boston Consulting Group estimation, but it’s still a bullish thesis given the crypto market’s total capitalisation is about US$1.2 trillion at the time of writing.

Nevertheless, drilling into the sub-sector specifically, Citi says it would represent an 80x increase from the current value of real-world assets digitally enabled by blockchains.

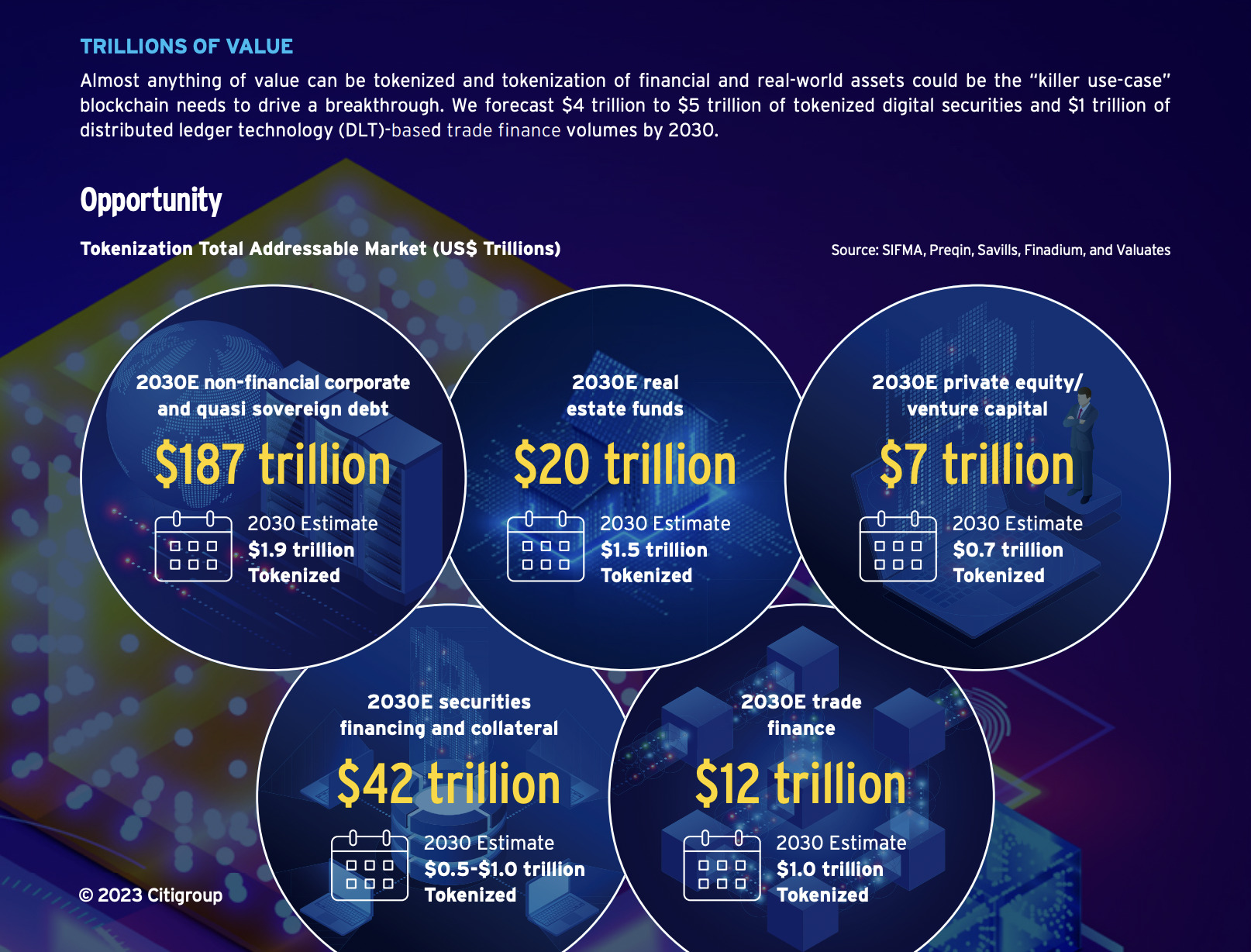

“We forecast $4 trillion to $5 trillion of tokenized digital securities and $1 trillion of distributed ledger technology (DLT)-based trade finance volumes by 2030,” the firm’s analysts said.

The firm added that there would be up to US$5 trillion of central bank digital currencies (CBDCs) circulating around the globe.

Managing editor of the Citi Global Perspectives and Solutions report, Kathleen Boyle, noted in her introduction to the report that blockchain and crypto adoption will also be driven by CBDCs, tokenised assets in gaming, and blockchain-based payments on social media, adding:

“Successful adoption will be when blockchain has a billion-plus users who do not even realize they are using the technology.

“Although we think mass adoption could still be six to eight years away, momentum on adoption has positively shifted as governments, large institutions, and corporations have moved from investigating the benefits of tokenization to trials and proofs of concept.”

Love this. So obvious that tokenized property and contracts will be the norm in the next 5-10 years. https://t.co/FpwQwUFVB9

— Jeremy Allaire (@jerallaire) March 29, 2023

One final thing to note here, as DeFi Edge points out (see below), there are already some pretty prominent crypto protocols focusing on real-world asset tokenisation. Some of these include: GoldFinch, Centrifuge, TrueFi, Maple Finance, and MakerDAO.

The Top RWA Protocols

RWAs are ALREADY here.

So which protocols are the market leaders?

I’ll focus on popular ones. They tend to involve undercollateralized lending in various sectors.

Then, I’ll mention some others that caught my eye. pic.twitter.com/TLbOaVXhul

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) March 30, 2023