Bitcoin Monthly Futures on CME Expire Today, Will BTC React?

A raft of Bitcoin futures contracts at the Chicago Mercantile Exchange (CME) is set to expire today. Meanwhile, analysts ponder on the potential impact on the BTC price.

On March 31, an estimated 8,171 Bitcoin futures contracts will be closed and settled on the Chicago Mercantile Exchange.

The last open price taken on March 30 was $28,355, marginally higher than Bitcoin’s current price of $28,182.

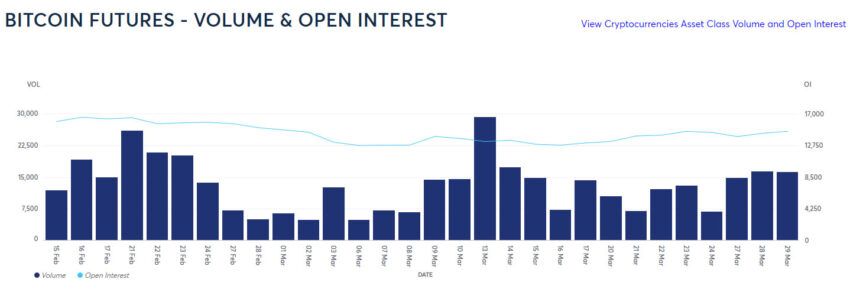

The CME reported a volume of 16,139 contracts as of March 29 and an open interest (OI) of 13,971. OI is a measure of the total number of outstanding futures contracts that have not been settled.

According to Deribit, the total open interest (OI) for all BTC futures contracts is almost $300 million. This is much lower than previous peaks of over $1 billion, suggesting that there will be minimal impact on BTC spot prices.

Bitcoin Futures Remain Bullish

Furthermore, TradingView is displaying a buy signal for CME Bitcoin futures, suggesting that derivatives markets are still bullish.

Analysts have observed that there was a close on the five-day CME Futures chart above the medium band on the Gaussian channel. This is bullish and could lead to a next level of around $33,000, according to one analyst.

Another noted that the CME Bitcoin futures gap had been closed, and a new one was forming. The gap refers to the difference in BTC and CME contract prices that forms over the weekend when the exchange closes. Furthermore, these CME gaps have a tendency to get “filled” as the market corrects back into the gap.

Earlier this month, the CME Group announced the trading of Event Contracts on Bitcoin futures. The cash-settled, daily expiring contracts will further complement the existing suite of ten event contracts, said Tim McCourt, Global Head of Equity at CME Group.

BTC Price Outlook

Bitcoin is currently in a short-term bullish pattern. Therefore, the futures contract’s expiry is unlikely to have a major impact on markets.

On the daily time frame, BTC has dropped 1.4% in a fall to $28,185. However, it remains up 12% over the past fortnight.

The asset has recovered all losses from the FUD regarding the CFTC Binance lawsuit earlier this week. On March 28, it fell to $26,770 but quickly rebounded.

Major resistance still lies around $30,000, so this is the target for further upsides.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.