Can Crackdowns on Crypto Mixers Harm Our Privacy?

Crypto mixers have recently come under fire from international law enforcement. They are designed to provide privacy and anonymity for people’s funds. But they present a question: what should the boundary of privacy be?

Crypto mixers have hit the headlines multiple times this year. Sinbad.io, apparently the preferred mixer of choice for North Korean hackers, even had its own WIRED profile. So what are they?

A crypto mixer, or crypto tumbler, is an online service that increases the privacy and anonymity of cryptocurrency transactions. It works by mixing a user’s crypto assets with those of other users. Creating a pool of mixed funds before returning them to their original owners. This makes it difficult to trace the funds back to their original source. This can involve splitting the funds into smaller amounts and sending them through multiple addresses to obscure the transaction history.

The primary reason people use crypto mixers is to increase the privacy of their cryptocurrency transactions. However, some individuals may use them for illegal activities such as money laundering or purchasing illicit goods on the dark web. By using a crypto mixer, they can make it harder for law enforcement to track their activities.

Authorities Seize $46 million in BTC

Due to their association with illegal activities, crypto mixers are often in trouble with law enforcement agencies. Last week’s crackdown on ChipMixer is the most recent example.

According to Europol, authorities in the US and Germany seized four servers, around 1,909 bitcoins (worth $46 million), and 7 TB of data connected to the platform, which has been operational since 2017. Ransomware actors like Zeppelin, SunCrypt, Mamba, Dharma, and Lockbit had apparently used the service to launder funds.

ChipMixer is believed to have enabled the laundering of around 152,000 BTC ($3.8 billion) in crypto assets. The funds were linked to darkweb markets, ransomware, illicit goods trafficking, child exploitation material, and stolen crypto. All serious crimes that are worthy of our attention.

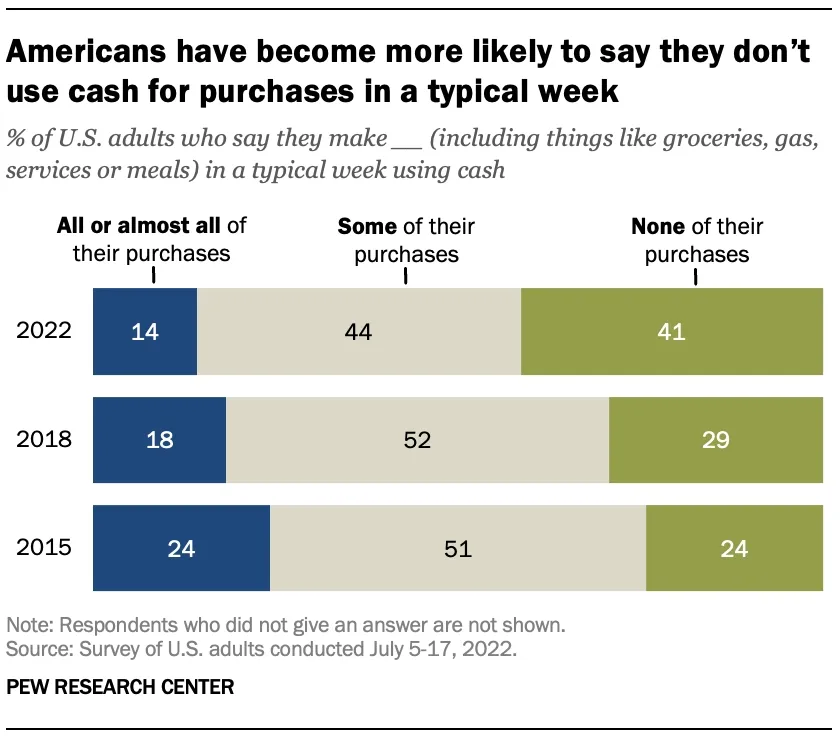

But it raises an ethical question: what is the limit of crypto-based privacy? Many defenders of crypto mixers will claim that users of crypto are only seeking the same privacy-by-default that cash offers. So, in a sense, they are simply reclaiming a level of privacy only recently taken from them. (In the UK, physical cash makes up less than 3% of the overall economy. A Pew Research survey recently found 41% of Americans didn’t use cash for a typical week’s transactions. )

There are legitimate reasons to use them too. For example, trying to hide your identity and funds from an oppressive government. You also shouldn’t need a reason to want privacy.

Crypto Mixers Present An Ethical Dilemma

“There are a number of legitimate users who are forced to use crypto mixers right now because there is no other alternative solution for them to use to protect their financial privacy,” Elena Nadolinski, founder and CEO of Iron Fish, a privacy-focused layer-1, told BeInCrypto.

“In the non-crypto financial world, you have a much larger degree of financial privacy. You can pay your friend, buy a coffee, accept a salary—all without the world knowing all your other financial details like what you buy, how much you earn, when you travel, etc. Right now, most of crypto is fully transparent by design leaking all your financial and data privacy. It is not just moral but essential for a healthy financial ecosystem to give protection to its users through privacy.”

Sakhib Waseem, Chief Technology Officer at Astra Protocol, a decentralized KYC platform for Web3, believes targeting crypto mixers is a good idea. “Mixer concerns are nothing new. If we look back at the tornado cash issues, it has unilaterally been agreed that in the eyes of law enforcement and regulators, these types of applications are actively being sought out to obscure criminal or illicit activity,” Waseem told BeInCrypto.

“There is agreement from regulators around the world that they should be banned, and also understanding within the industry that it is counter-productive to the growth of crypto as a whole. Analytical platforms already highlight which wallets are tied into this, which allows us to build more traceability of suspicious transactions and is one of the many virtues of blockchain.”

A Middle Ground?

Waseem believes cases like Sinbad.io highlight the need for a major overhaul in compliance infrastructure. “By applying modernized regulatory infrastructure to crypto platforms, we can drive more institutional and deeper retail trust in this industry and minimize the risk of illicit finance working its way through honest platforms’ economies,” he continued. “It will allow us to insulate nascent users from the risk of illicit finance, turning liquidity into a toxic finance pool.”

Perhaps the most famous mixer of all time is Tornado Cash. The US Treasury charges that bad actors used it to launder $7 billion in digital currency. That sum includes half a billion tied to Lazarus, a hacking group sponsored by North Korea. Other crypto mixers, like Privacy Pools, are trying to avoid the same pitfalls—claiming to offer privacy and regulatory compliance. Privacy Pools’ users will be able to indicate which depositors they do not want any association with. According to its creators, this will limit criminals’ ability to use the mixer.

“In the non-crypto world, would you be okay with a system that reveals all your financial activity (including credit cards, bank accounts, and fintech payments) for the sake of helping law enforcement catch bad actors?” asked Nadolinski.

“By giving up all our privacy in order to help law enforcement stop criminals, we as the people are taking on the burden of catching criminals instead of law enforcement.”

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.