‘ETH is deflationary’ – Why this is important under recent circumstances

- ETH sees surge in demand which may remain in the long term courtesy of deflationary milestone

- ETH shorts traders suffer as price pivots while demand for leverage recovers

Ethereum’s EIP 1559 in August last year marked an important milestone for the network and ETH. The impact of that milestone is particularly evident in the fact that ETH is now deflationary.

The latest Ethereum data reveals that the network has so far burned over 3 million ETH. The total amount of ETH burned is worth over $9.09 billion, trimming the post Merge total supply by slightly over 62,000 ETH. These findings underscore the progress that the Ethereum network has achieved so far as part of its PoS transition.

ETH’s race for sound money

ETH’s current 0.42% deflationary rate puts it well within the list of sound money. Why is this important? Well, traditional fiat money is currently feeling the weight of inflation which has been gradually causing the loss of value. As such, investors are eying asset classes that may allow them to protect their wealth from inflation.

A deflationary asset such as ETH is currently more preferable both in the short and long-term. This is likely one of the reasons why the demand or ETH recently surged, resulting in significant recovery from the bearish performance we saw earlier this month.

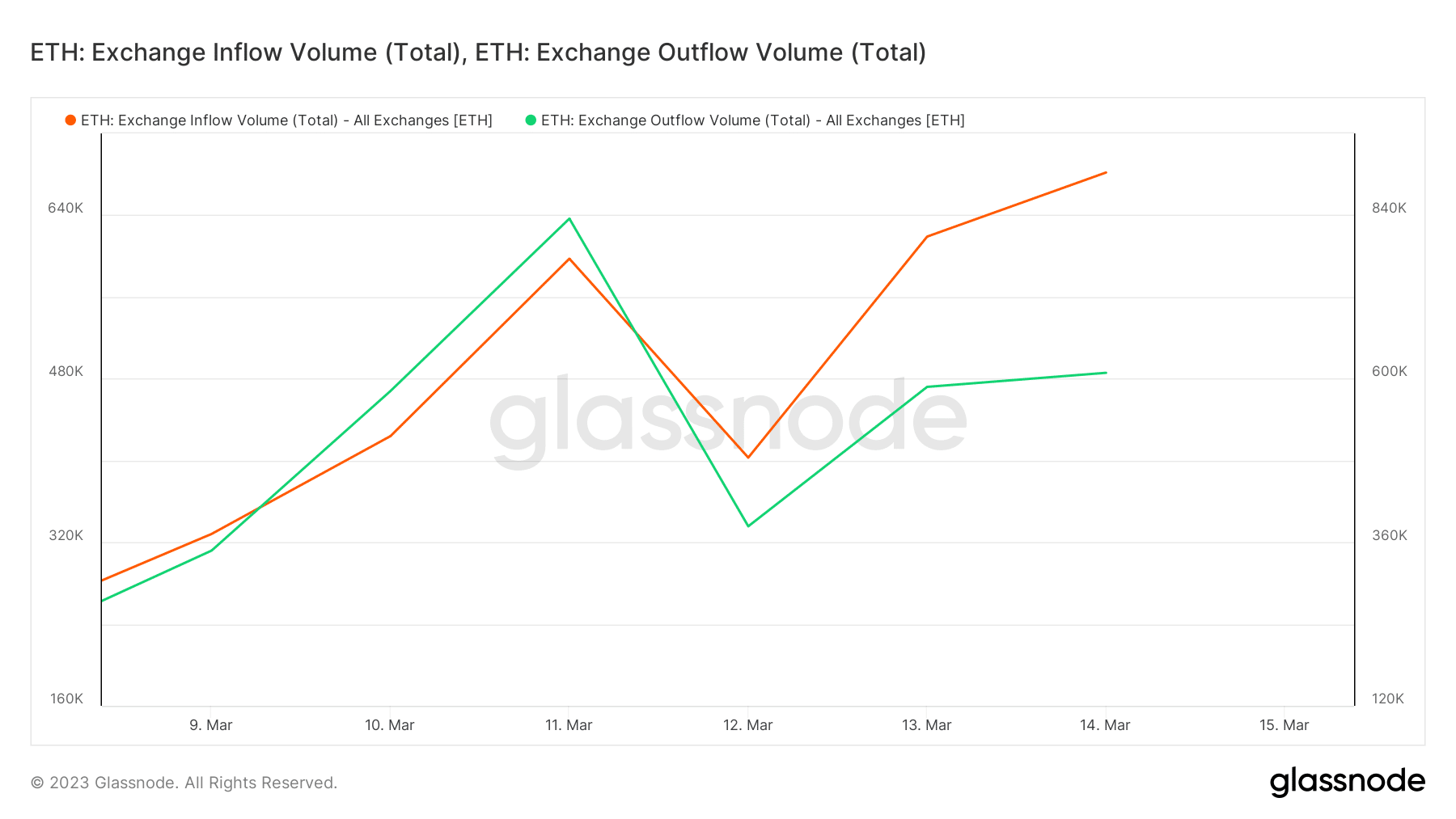

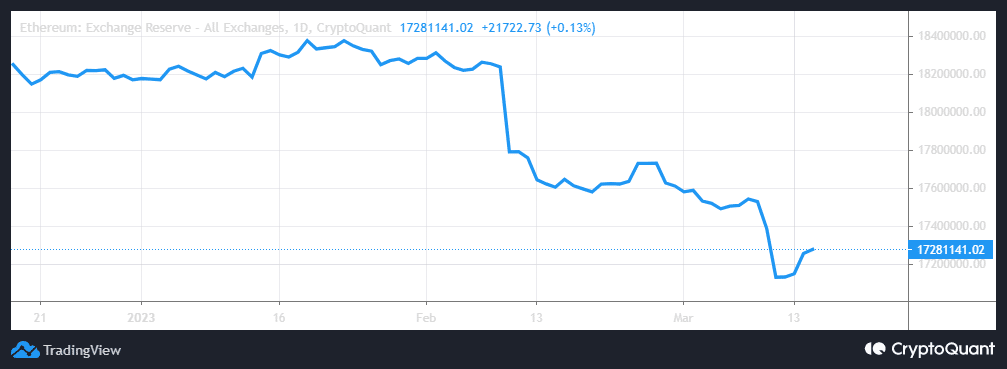

In fact, Glassnode’s data confirmed a surge in demand for the cryptocurrency. For instance – ETH’s exchange outflows volume just hit a new 3-month high. This is a sign that ETH traders have been aggressively buying the recent dip.

📈 #Ethereum $ETH Exchange Outflow Volume (7d MA) just reached a 3-month high of $32,742,895.81

Previous 3-month high of $32,737,155.33 was observed on 14 March 2023

View metric:https://t.co/L4RHmV9kZG pic.twitter.com/6CjaL5QgG0

— glassnode alerts (@glassnodealerts) March 15, 2023

The latest ETH exchange flow data confirmed that exchange outflows are back on the rise. A consequence of the robust buying pressure observed over the last few days, a period during which its price action bounced back strongly.

The aforementioned surge was strong enough to push ETH back to a new YTD high. As a consequence, the retest of its previous resistance level yielded some sell pressure. Hence, the higher exchange inflows than outflows.

The state of ETH shorts, liquidations, and leverage

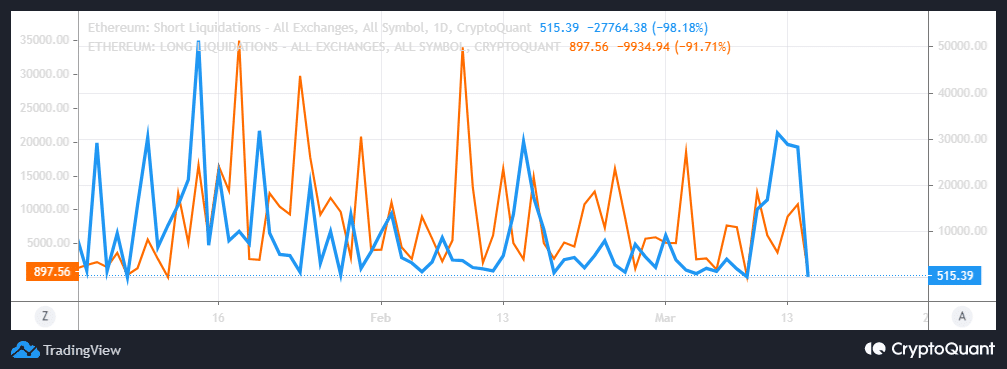

Shorts traders once anticipated further downside after the events of last month. However, the pivot on 9 March triggered a surge in liquidations and a shift to long positions.

How many are 1,10,100 ETHs worth today

Demand for leverage has been declining since the end of February, likely due to concerns over market outcome in March. This has been an unsurprising outcome, one factoring the recent market events which made it more difficult to predict the next outcome.

However, we have seen an uptick in demand for leverage over the last few days, with the same corresponding with the price surge.

The market will likely feature more volatility if the level of leverage continues to rise. A higher likelihood of liquidations may lead to more wild swings.