Should LDO holders be worried? Institutional investors’ selling spree means…

- Lido’s initial investors have started selling their holdings en masse

- The protocol continues to record positive performance

Lido has been dominating the LSD (Liquid Staking Derivative) space since the beginning of the year. However, despite its rising TVL and the protocol’s positive performance, many investors and validators have lately started to liquidate the assets that were assigned to them.

Read LDO’s Price Prediction 2023-2024

Whales make an exit

The same was evidenced by data shared by popular analyst – tumileth. According to the same, early investors in Lido such as ParaFi Capital and Wormhole Finance sold 100% of the LDO that was allocated to them. Additionally, other institutions such as 3AC and Alameda Research were also observed to be selling a significant majority of their holdings.

However, one of the biggest sell-offs of the LDO token was done by Terraform Labs. Terraform Labs had initially invested $2 million in LDO and were allocated 20 million LDO tokens in return.

At press time, they managed to gain roughly $40 million by selling all their holdings.

Terraform Labs (tagged by Nansen) sold all 20M $LDO today at an average sell price of $2.07.

15.3M $LDO ($32M at that time) sold on DEX at an average price of $2.1

4.7M $LDO ($9.4M at that time) was transferred to #Binance on May 9, when the price was $2. pic.twitter.com/EYkCxnF4VU

— Lookonchain (@lookonchain) March 12, 2023

Large addresses decreasing their LDO holdings caused the percentage of LDO held by them to drop. Despite the negative impact of these sell-offs on LDO’s price in the short-term, it would end up making the LDO network more decentralized.

One possible explanation for the high sell-offs is that institutions like Alameda and 3AC went through challenging periods. Ergo, they needed to sell assets to maintain liquidity.

Other factors such as declining network growth and volume could have also impacted the institution’s decision-making process.

However, not all institutions were selling their positions. In fact, funds such as Paradigm and DCG remained undeterred and have continued to hold on to their LDO.

Business as usual for the protocol

Even though a significant majority of the holders sold their holdings, the Lido protocol has continued to see some improvement in multiple sectors.

Realistic or not, here’s LDO’s market cap in BTC’s terms

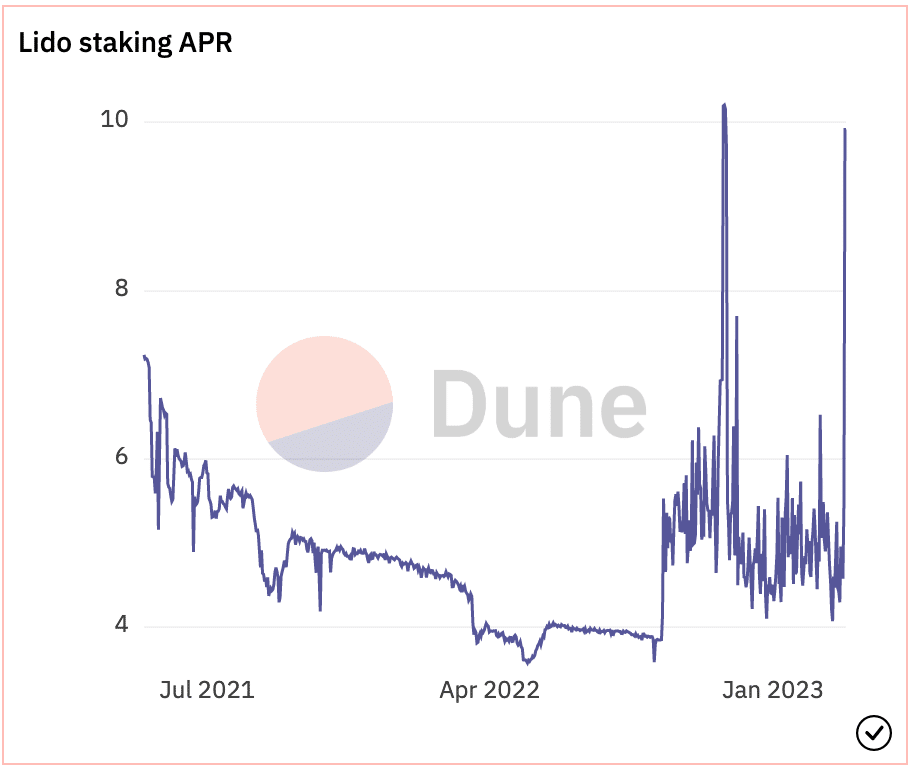

For instance, the overall APR provided by Lido skyrocketed over the past few days. The high APR also attracted a new set of unique users to the protocol.

In fact, according to Messari’s data, the number of unique users on the Lido protocol hiked by 0.28% over the last 24 hours.

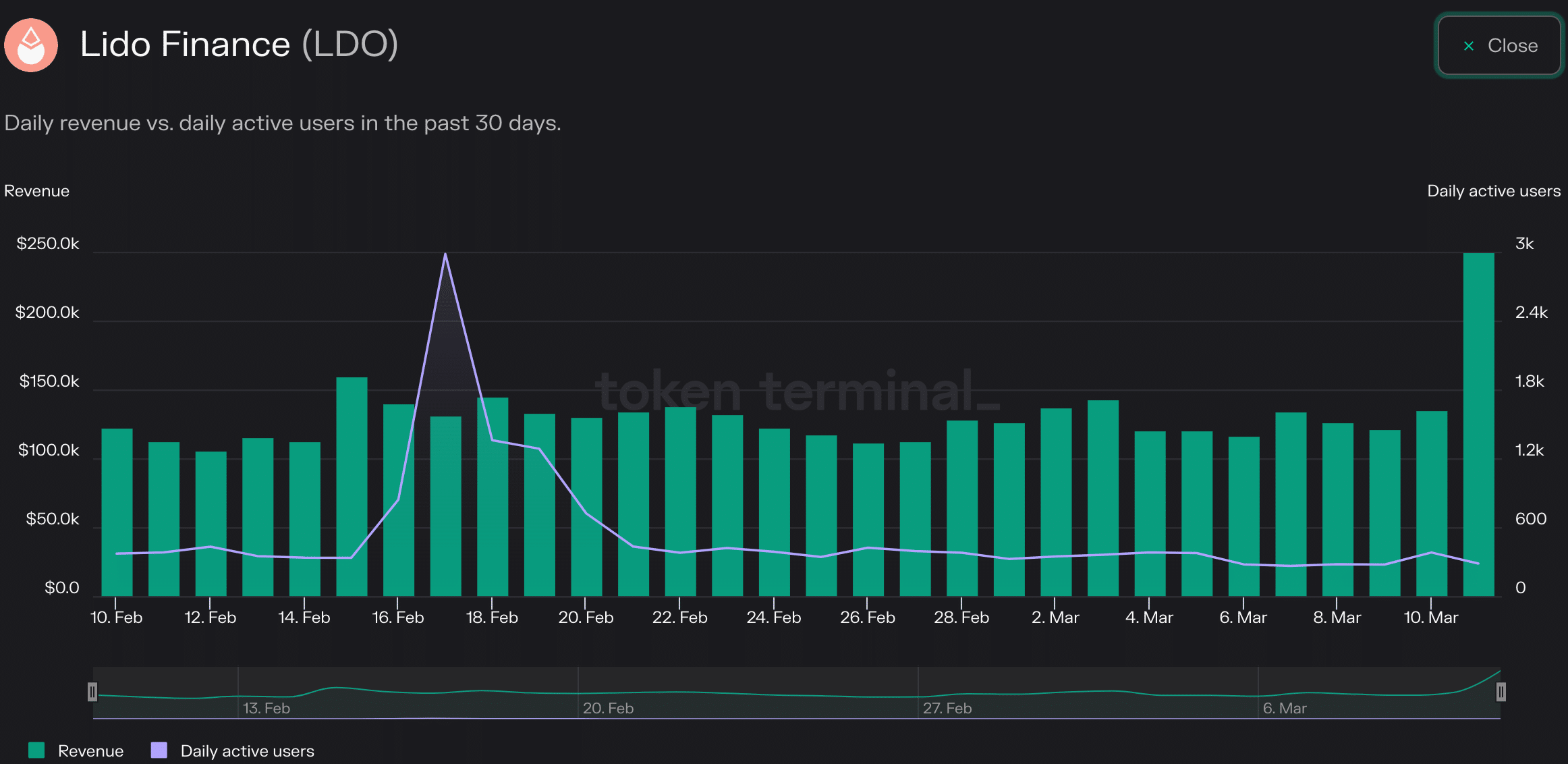

The aforementioned observation can be coupled with the fact that the revenue generated by the protocol appreciated by 85% in the last 24 hours.

In fact, the protocol managed to generate this kind of revenue despite a decline in daily active users on the protocol. This implied that the spike in revenue was due to the transactions of a few key addresses.