New milestone for Tron [TRX], but will that really be enough

- TRX completed 5 billion transactions and also outperformed others in terms of stablecoin market cap

- However, TVL declined and market indicators remained bearish

TRON’s latest announcement is evidence of its efforts to increase TRX’s global adoption and usage. TRON has announced a partnership with the Commonwealth of Dominica to usher in a new era of Web 3.0. The official announcement mentioned that TRON will be developing the first Caribbean Digital Identity Initiative, which includes the establishment of the Dominica Metaverse, as well as the operation of the Dominica Digital Identity (DDID) and Dominica Coin (DMC) programs.

#TRON will be helping to develop the Digital Identification Program for Dominica Metaverse! 🇩🇲

“…this partnership recognizes the potential for Dominica to lead the way in this groundbreaking technology…” 🚀

More from @CryptoSlate below ⬇️https://t.co/J9l0C9gfgu

— TRON DAO (@trondao) March 7, 2023

Read TRON’s [TRX] Price Prediction 2023-24

Similar on-chain growth

A similar rate of growth and increased adoption was also noted as far as TRON’s network performance is concerned. In fact, TRON recently hit a new milestone by successfully completing 5 billion transactions, proving the network’s reliability and high usage.

#TRON just reached a huge milestone, with over 5 billion total transactions!🔥

Let’s keep #BUIDLing the future of #crypto together!🚀 #TRONStrong pic.twitter.com/l2oAE5e8VZ

— TRON DAO (@trondao) March 6, 2023

Not only that, but TRX was only second to Ethereum [ETH] in terms of total market capitalization of stablecoins. In fact, TRON’s stablecoin market cap hit $36.4 billion – Considerably higher than that of BNB Chain [BNB], Solana [SOL], and Polygon [MATIC].

#TRON ranks second after #Ethereum in total market cap of stablecoins ahead of #Binance, #Solana, and #Polygon 🔥 pic.twitter.com/UwwsCdYYb1

— TRON Community (@TronixTrx) March 6, 2023

Network value, however, registered a decline

However, despite greater adoption and usage, Tron’s network value did not seem to follow the same trend.

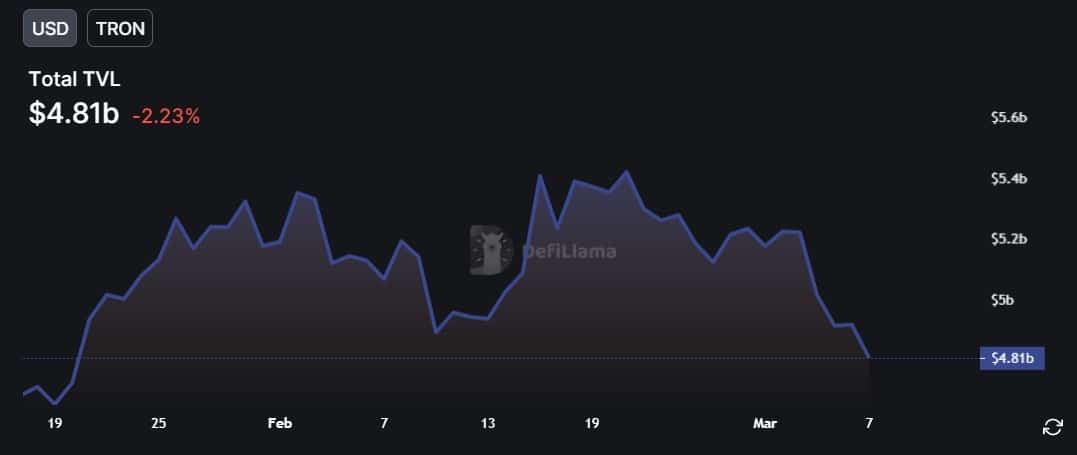

In fact, DeFiLlama’s data revealed that TRON’s total value locked (TVL) has been on a sustained decline for the past week.

At press time, TRON’s TVL had registered a decline of over 2% in the last 24 hours. Though a potential reason for the value decline can be TRX’s price action, which was in bears’ favor, a look at TRX’s on-chain metrics suggested that other factors were also at play.

TRON’s demand dwindling?

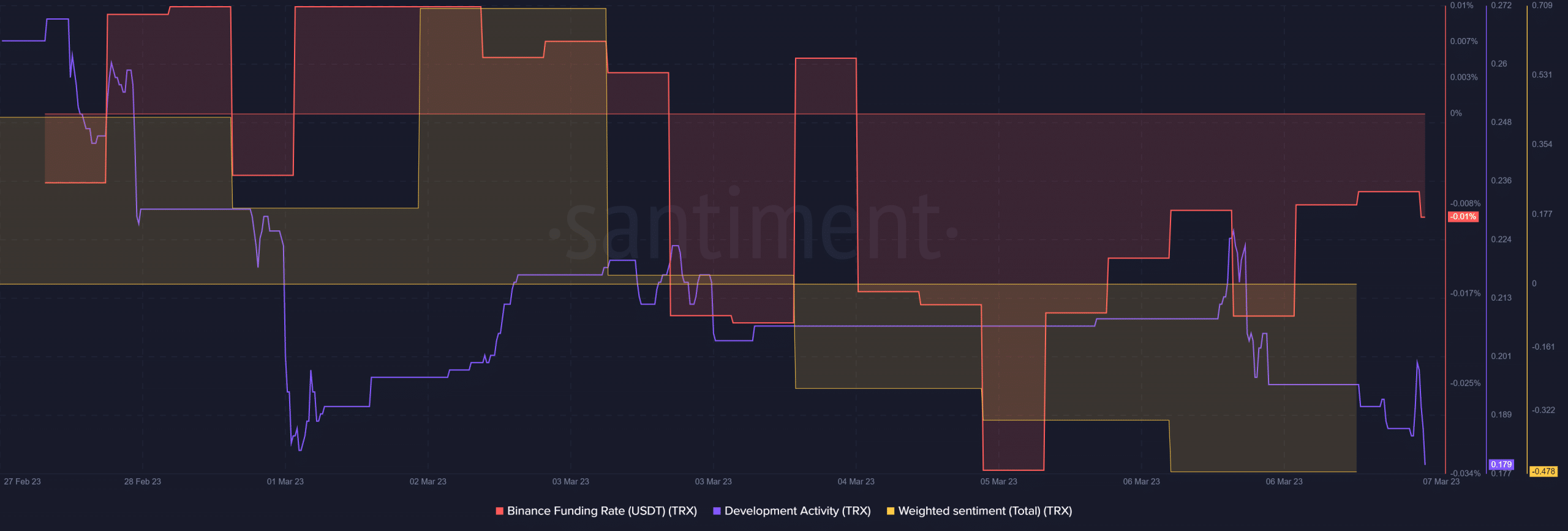

Santiment’s data also revealed that TRON’s Binance funding rate went down considerably over the last few days. This is a negative development as it reflected less demand for the token in the Futures market.

Additionally, the weighted sentiment remained on the negative side, suggesting less confidence among investors in TRON. The network’s development activity also declined last week, which by and large looked concerning for TRON.

Is your portfolio green? Check the TRON Profit Calculator

Investors can expect this from TRX

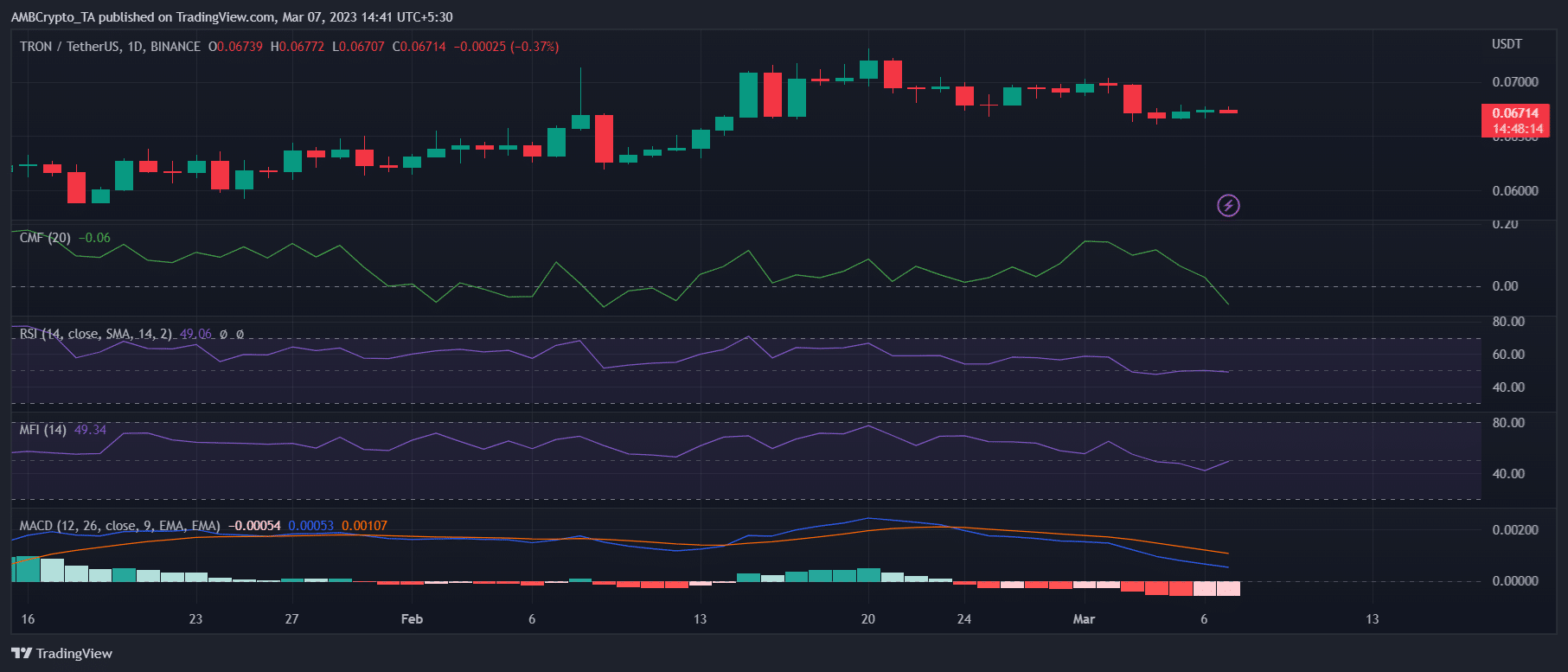

TRX’s performance on the price front was unsatisfactory, thanks to the dominant bearish sentiment in the market. According to CoinMarketCap, TRX was down by more than 3% in the last seven days. At the time of writing, it was trading at $0.06714.

TRX’s daily chart suggested a similar performance can be expected in the coming days as most of the market indicators were bearish. For instance, the MACD revealed sellers’ upper hand in the market. TRX’s Chaikin Money Flow (CMF) registered a sharp decline, increasing the possibility of a price decline.

The Relative Strength Index (RSI) was resting in the neutral zone. Nonetheless, TRX’s Money Flow Index (MFI) gained upward momentum – A bullish signal.