CAKE’s latest burn stats bookend countdown to V3 deployment

- More than 750 million CAKE tokens have been burned till date

- Weekly trading volume on PancakeSwap recorded a 10% drop

As part of its latest burning round, popular decentralized exchange (DEX) PancakeSwap removed about 7.15 million CAKE tokens out of circulation. The burned tokens were worth $27 million in value.

🔥 7,153,999 $CAKE just burned – that’s $27M!

💰 Trading fees (Swap and Perpetual): 255k CAKE ($958k) +80%

🔮 Prediction: 84k CAKE ($315k) +31%

🎟️ Lottery&Pottery: 35k CAKE ($132k) +44%

🔒 NFT Market, Profile & Factory: 560 CAKE ($2k) +4% pic.twitter.com/PFeMFxIN9c— PancakeSwap 🥞 #Multichain (@PancakeSwap) March 6, 2023

More than 750 million tokens have been burned till date. In fact, CAKE’s circulating supply had dropped to 180.65, million at the time of writing.

Despite the development, the altcoin’s price failed to react positively, however, and fell down by 1.68%. It could be due to the fact that the recently burned tokens formed just about 2% of the total supply of CAKE. From a macro perspective, this was a not a very significant number.

However, since they add deflationary pressure, coin burning is one of the most sought after events in the crypto-space.

Read PancakeSwap’s [CAKE] Price Prediction 2023-2024

Trading volume, TVL declines

PancakeSwap managed to generate immense hype of late because of the upcoming launch of its third iteration V3 on the BNB chain in April. This development comes after Uniswap V3’s proposed deployment on the BNB got a go-ahead from its community members.

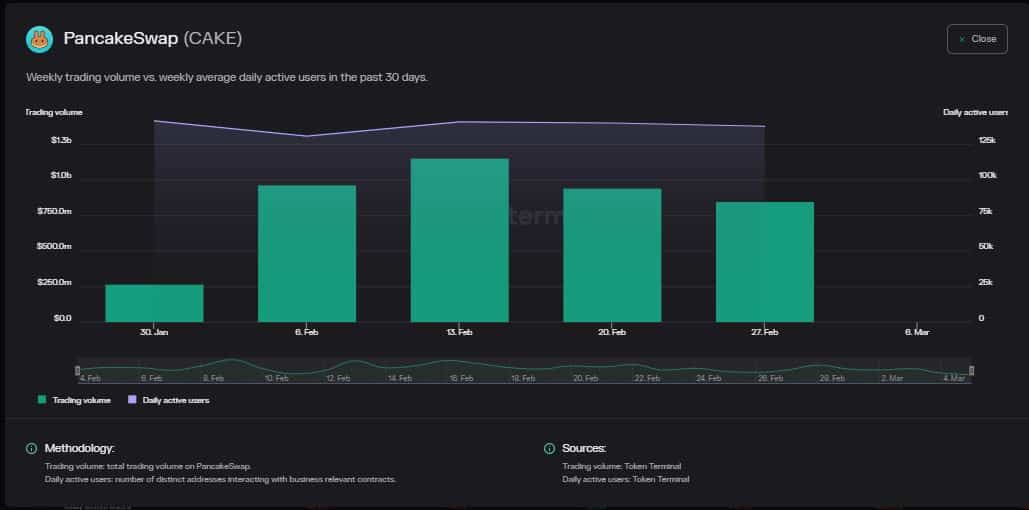

Alas, the hype failed to boost on-chain trading activity for PancakeSwap. The weekly trading volume recorded a 10% drop while the weekly average of daily users also fell marginally, data from Token Terminal revealed.

On top of this, its vital DeFi indicator disappointed too. The total value locked (TVL) on the network declined by almost 15% since it hit the $4 billion-mark on 9 February.

How much are 1,10,100 CAKEs worth today?

On-chain activity slows down

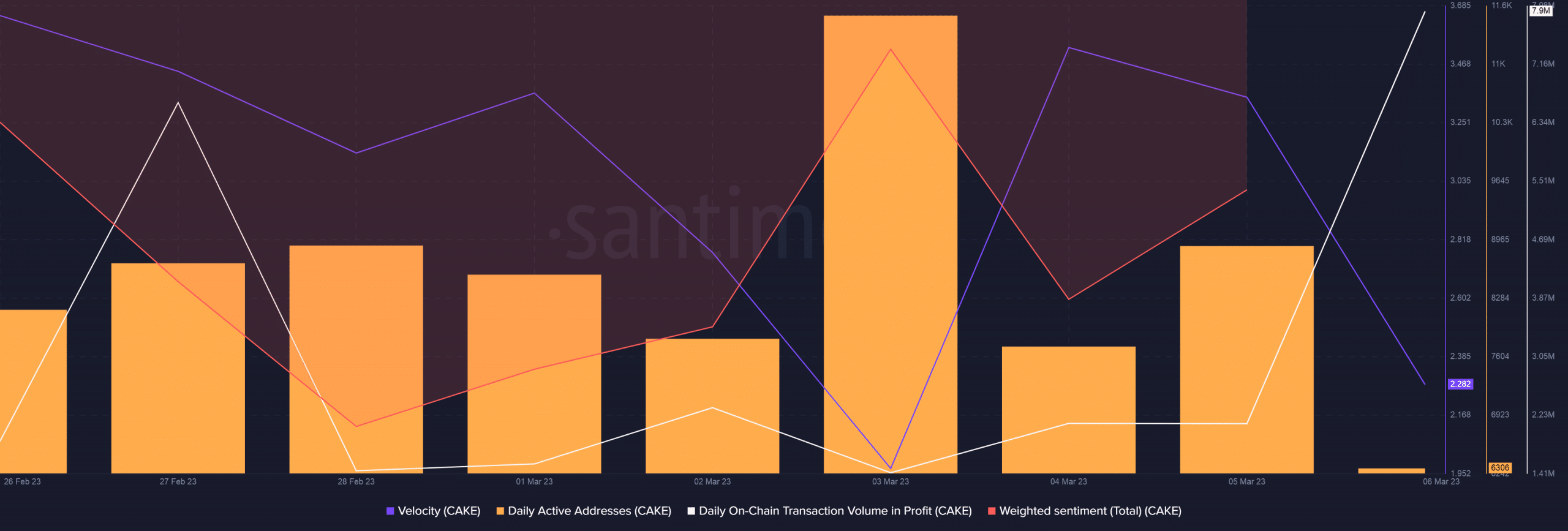

According to data from Santiment, daily active addresses have plunged by 23% since hitting the weekly peak on 3 March. The fall in number of active addresses lowered the frequency at which CAKE tokens moved across the network.

However, this could change if the sharp upswing in the daily transaction volume in profit is to be believed. The prospect of realizing higher profits may prompt holders to transact more. However, it could lead to greater selling-pressure in the short term.

The weighted sentiment has been in negative territory too, indicating that investors are not very keen on putting their bets on CAKE.