MakerDAO [MKR]: Will DAI adoption improve with new protocol?

- MakerDAO’s new protocol could help improve DAI adoption.

- Selling pressure on MKR increased as MVRV ratio rose.

Messari, in a 22 February tweet, announced the launch of MakerDAO’s new vertically integrated market, called Sparks Lend. The market will primarily be aimed at improving DAI adoption.

1/ The success of @MakerDAO‘s stablecoin $DAI has largely been dependent on its acceptance across markets.

In an effort to incentivize and control $DAI‘s success and usage, the protocol is launching Spark Lend, the first vertically integrated market for $DAI.🧵 pic.twitter.com/TaucLnof5R

— Messari (@MessariCrypto) February 22, 2023

Read Maker’s [MKR] Price Prediction 2023-2024

Spark Lend’s association with Maker would enable users to borrow DAI at the DSR variable rate of 1%. Spark Lend taps into Maker’s DAI Direct Deposit Module (D3M) and PSM to directly regulate the supply of DAI in its market.

The next step for this protocol would be integrating its services with L2 solutions, which would help make DAI more mainstream.

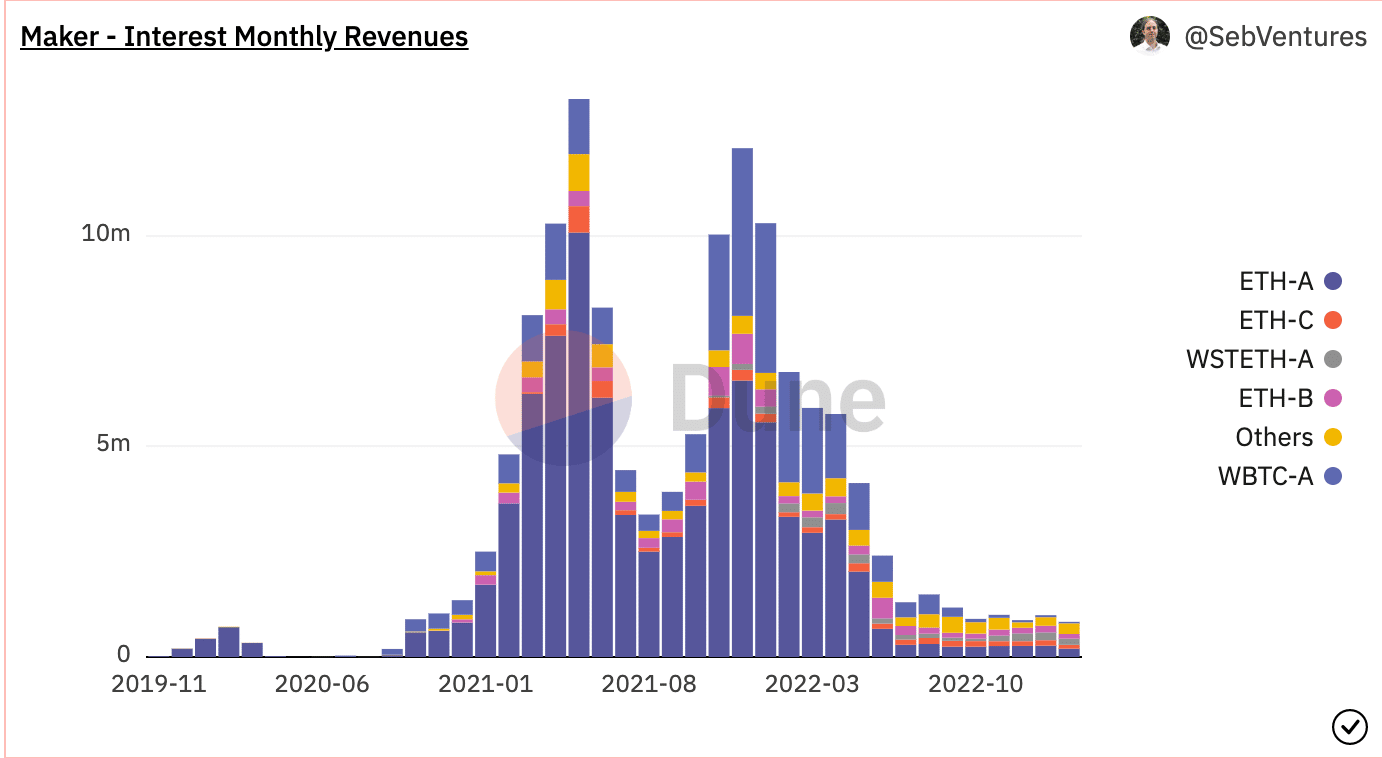

If DAI adoption increases, it could improve the revenue generated by MakerDAO. At the time of writing, the revenue generated by MakerDAO, especially through interest generated from stablecoins, was decreasing. Most of the revenue generated by the protocol depended on its investments in real-world assets (RWA).

Whales meet their MKR

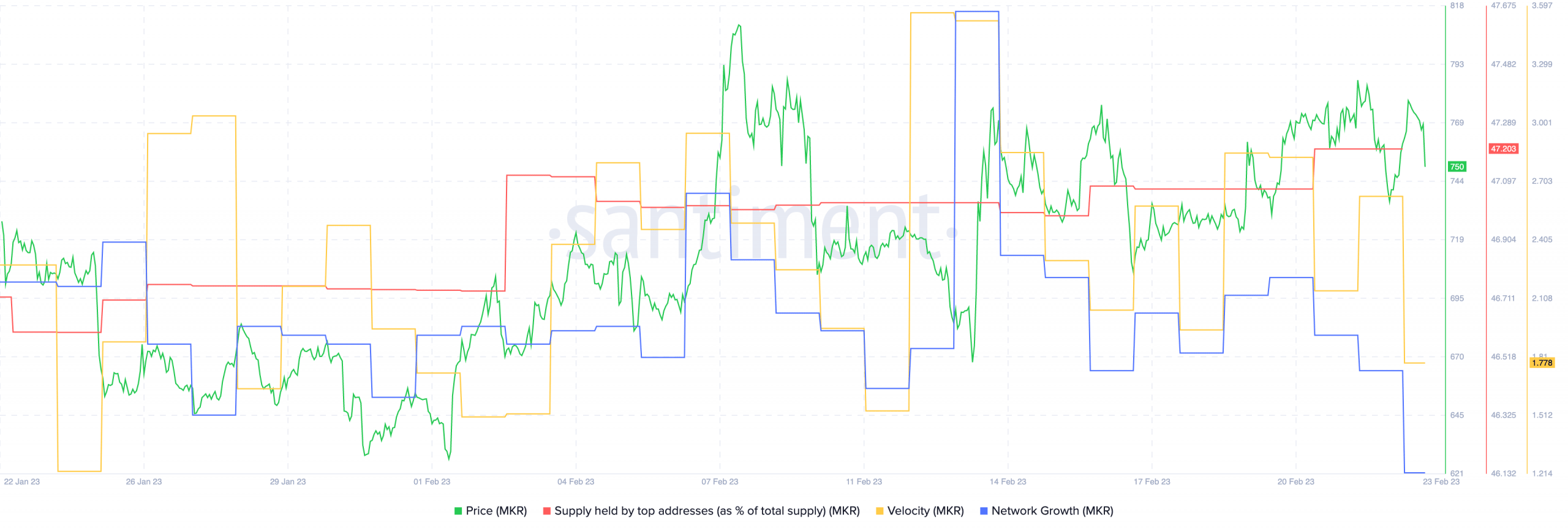

This new update could also be one reason why whale interest in MKR increased, as the percentage of large addresses holding MKR grew over the last month, according to Santiment.

However, its velocity continued to decline, implying that the frequency with which MKR was being traded fell. Coupled with that, the overall network growth of MKR also declined. This suggested that new addresses were not particularly interested in buying MKR.

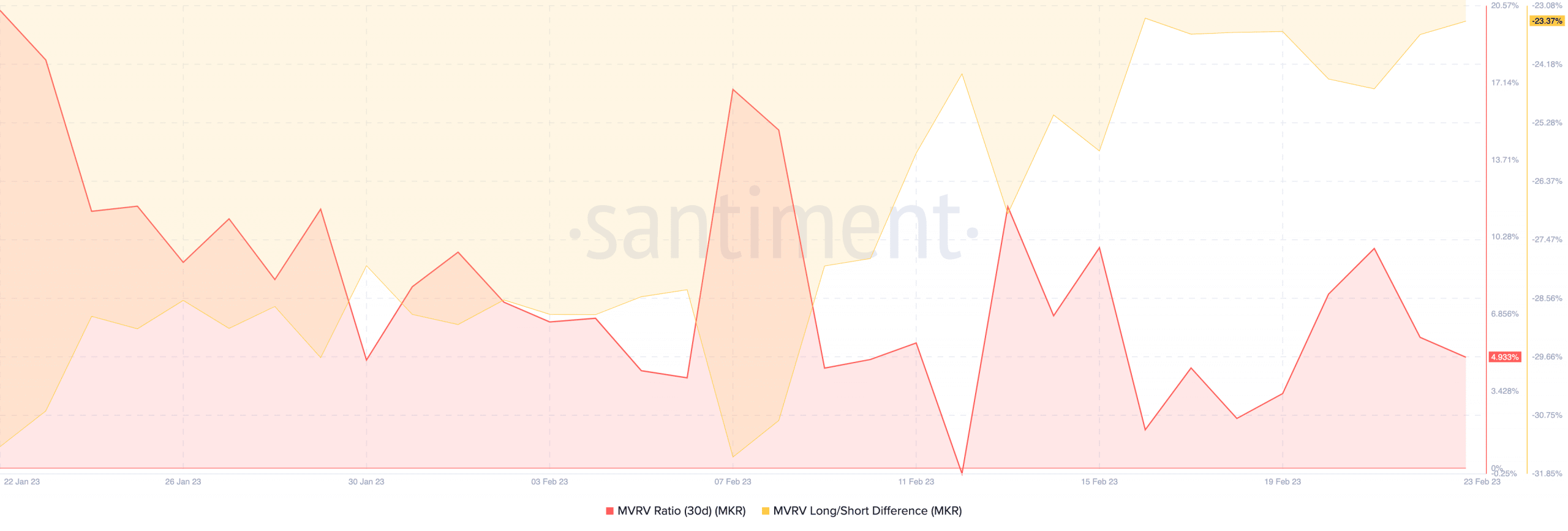

One reason for the same could be MKR’s high MVRV ratio, which implied that holders would turn profits if they sold at the time of writing. As the long/short ratio was negative at press time, it implied that most MKR holders were short-term.

Realistic or not, here’s MKR market cap in BTC’s terms

However, if these short-term addresses ended up selling MKR at press time, it would drive MKR’s price down considerably.

Over the last few years, Tether [USDT] and USD Coin [USDC] have been the go-to stablecoins for users dealing with DeFi. These stablecoins captured a large majority of the market and have left behind other stablecoins, such as DAI, behind.