Cardano [ADA] slides down descending channel: Can bulls defend $0.3790?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ADA cleared half of the gains made on the mid-February rally.

- Weekly price volatility and open interest flashed weak signs of a pivot.

Over the past few days, bears have remained in control of the market, leading to an extended correction for Cardano [ADA]. Ethereum’s [ETH] blockchain rival has already cleared 10% of its 20% gains from the mid-February hike. As of press time, ADA was trading at $0.3792 and had hit a key support level.

Is your portfolio green? Check out the Cardano Profit Calculator

Can the $0.3790 support hold?

After the FOMC meeting in mid-February, ADA rose from $0.3452 to $0.4216, a 20% appreciation. However, it has since formed a descending channel and fallen to $0.3744, a 10% drop after facing price rejection at $0.4216.

If bulls defend the $0.3790 support, near-term targets could include the 50% Fib level of $0.3834 or the 61.8% Fib level of $0.3924. However, key resistance levels also lie at $0.3985 and $0.4052.

Alternatively, sellers may seek market entry if ADA closes below the $0.3790 support. This could offer shorting opportunities at the 38.2% Fib level of $0.3744 or $0.3712 (the descending channel’s lower boundary). The downtrend could be accelerated if BTC drops below $23.76k.

How much are 1,10,100 ADAs worth today?

Weekly volatility and open interest rates showed signs of a pivot

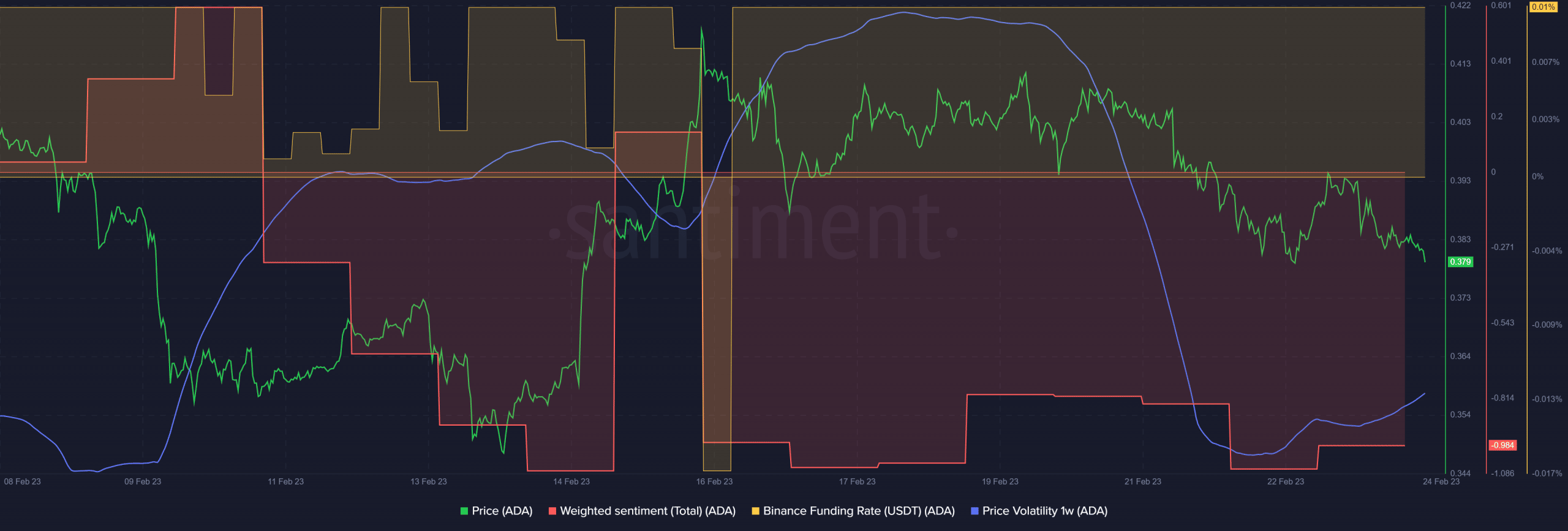

According to Santiment, ADA’s weekly price volatility hit bottom and rose gently at the time of writing. Furthermore, the Funding Rate remained positive, suggesting that demand for ADA has remained stable despite the recent price decline. This could indicate a potential price reversal and short-term recovery if the bulls defend the $0.3790 support.

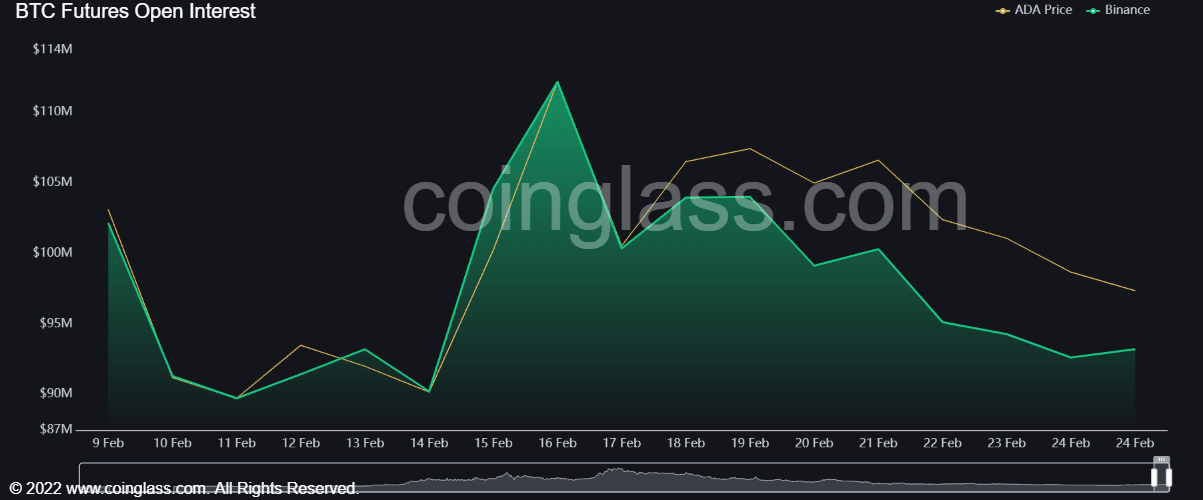

Moreover, ADA’s open interest rate showed an uptick at press time after a recent drop, further reinforcing the pivoting thesis. Nevertheless, the sentiment has improved but remains negative, indicating caution for both bulls and bears.