Mooners and Shakers: Bitcoin rejects at $25k but Filecoin and other ‘Chinese crypto coins’ surge

Bitcoin took its second recent trip just above US$25k, but was swiftly sent packing again, keeping bulls and bears guessing. Meanwhile, move over AI and scaling – are Chinese coins the next crypto “narrative“?

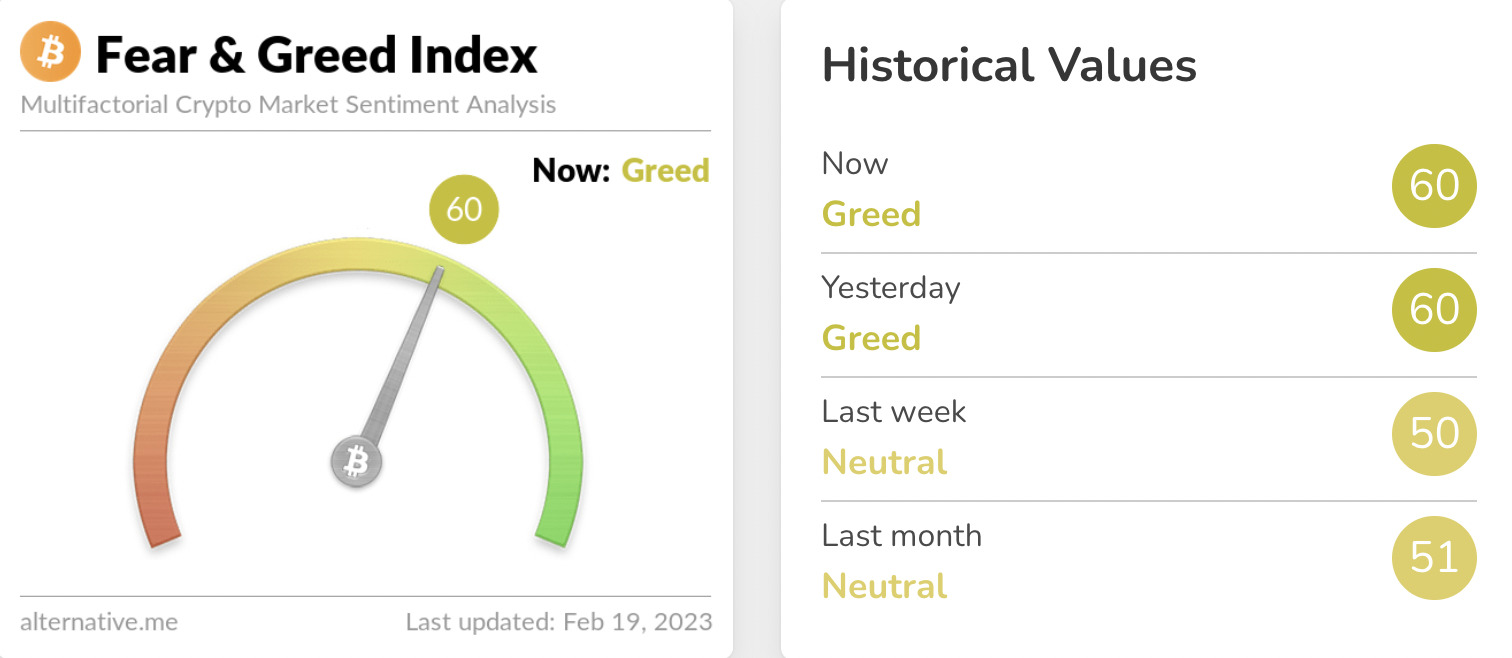

We’ll take a look at what’s trending on that front, shortly. First some market-sentiment tracking, courtesy of alternative.me’s Crypto Fear & Greed Index, then some crypto majors price action.

Sentiment is still high in the Cryptoverse, in spite of A) fairly tepid recent CPI data that would likely indicate the Fed’s rate hiking isn’t due to pivot any time soon, and B) stern talk and crackdowns from US regulatory body the SEC last week.

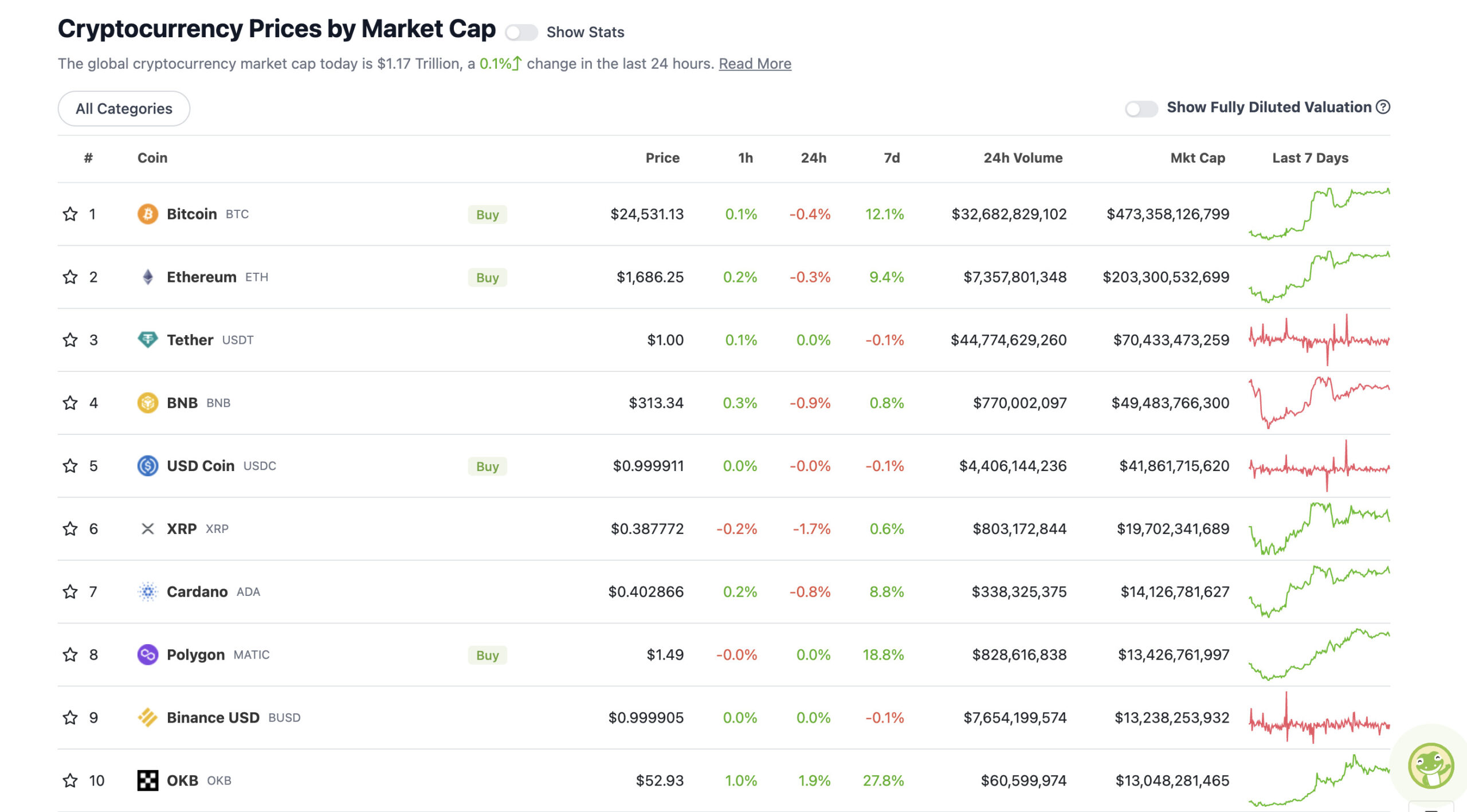

Top 10 overview

With the overall crypto market cap at US$1.17 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So yep, Bitcoin is down a tad from where it was half promising to bust, overnight, at US$25k. That said, it’s hanging in there for now, still giving traders and analysts some hope of continuation higher. If that one door keeps slamming in its face, though, confidence will surely wane, mirroring pretty obvs human psychology, really.

There are no shortage of optimistic chart watchers floating about, though. For instance, here’s the Twitter-popular Stockmoney Lizards with some highly speculative projecting, comparing BTC’s current structural formation to a similar looking stage back in 2019.

Bear-rally, followed by chop, followed by bull run. Guess it could happen again, keeping in mind past performance is no guarantee of photocopying, naturally.

Ready to move pic.twitter.com/5Ur4HeaSg8

— Stockmoney Lizards (@StockmoneyL) February 19, 2023

And here’s @thescalpingpro, aka Mags, also referring to historical BTC action to validate possible bullish bias.

#Bitcoin 4 year Cycle still on Track 🚀#crypto #btc pic.twitter.com/oLjy14Bt09

— Mags (@thescalpingpro) February 19, 2023

US trader/analyst Justin Bennett, though, emphasises that comparisons with past bullish action should be taken with salt, though not in those exact words.

So many tweets comparing the bear market rally in 2019 and expecting $50k $BTC this summer.

If the last bull market taught us anything, it’s that things are never that easy.

The 2020/2021 bull market was nothing like 2017, so why assume the 2018/2019 bear market will repeat?

— Justin Bennett (@JustinBennettFX) February 19, 2023

“I think we see higher prices from Bitcoin in the coming weeks,” he adds, “but to tweet about $50k this summer simply because that’s what 2019 did is beyond lazy.”

Chinese coin narrative… really?

You might’ve noticed that OKB has surged back into that crypto market-cap top 10 list above. It’s just one of a group of tokens being labelled “Chinese coins” that have been seeing some significant upwards action over the past few days.

OKB is the native token of the Seychelles-based crypto exchange OKX, but has Chinese origins and founders.

Some of the most notable performers with strong ties to China, however, have been Filecoin (FIL) +70% over seven days; VeChain (VET), NEO (NEO) and ConFlux (CFX), although there are others that loosely fit the bill, if this tweet from Mechanism Capital VC founder Andrew Kang is any indication…

China Coin Narrative is here. Some of my favorites

– $FIL (恭喜FIL財)

– $DOT

– $VET

– $EOS

– $ICP

– $KLAY (actually Korean, but it might get confused)

– $BNB (People always mistake CZ for Chinese Citizen)

– $ETH (Vitalik has had multiple Chinese GFs)— Andrew Kang (@Rewkang) February 17, 2023

Not quite sure how he’s wedging Polkadot (DOT) into this narrative, and ETH, based on Vitalik Buterin’s dating history seems a bit of a stretch, too.

Nevertheless, what’s behind these pumps? It’s apparently all to do with some impending regulatory clarity in Hong Kong regarding Virtual Asset Service Providers (VASPs), some positivity there surrounding crypto adoption, as well as potential for “quantitative easing” in China as it reopens its economy after particularly long and brutal pandemic policies.

The China easing narrative is not some imaginary garbage

Look at the liquidity injections China is ramping up in Feb – most recent 835B CNY via reverse repurchase

Monie printer goes brrrr from the EAST

oh, sorry US inflation, China exporting moar pic.twitter.com/LMmNLP1xHQ

— Crypto熊猫 (@NoodleofBinance) February 18, 2023

Wait, isn’t crypto banned in China? Well, yes, it still is, largely. Crypto mining is certainly still banned there, and it’s also illegal to use and buy crypto in China. That said, it’s not illegal to hold digital assets, for those who already had some in their crypto wallets.

Will China pivot on this? We’re seeing some hopium on this here and there. Wouldn’t bet the farm on it.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11 billion to about US$475 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Stacks (STX), (market cap: US$838 million) +72%

• OKC (OKT), (mc: US$536 million) +18%

• Filecoin (FIL), (mc: US$3.4 billion) +17%

• NEO (NEO), (mc: US$744 million) +9%

• VeChain (VET), (mc: US$2.1 billion) +8%

DAILY SLUMPERS

• Lido DAO (LDO), (market cap: US$2.5 billion) -10%

• Render (RNDR), (mc: US$515 million) -7%

• Frax Share (FXS), (mc: US$794 million) -6%

• Optimism (OP), (mc: US$565 million) -5%

• SingularityNET (AGIX), (mc: US$486 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

We are even celebrating #bitcoin today at the carnival in Lugano 🇨🇭🍫🎉https://t.co/ftPL9vtchV

— Lugano Plan ₿ (@LuganoPlanB) February 19, 2023

Can you believe that the future #BTC Bear Market bottom will likely form around the ~$60,000-$69,000 region?$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) February 19, 2023

I have a theory:

Regulators let the bad guys get big and blow up because it serves their agenda.1. destroy capital/resources in crypto ecosystem

2. burn people, deter adoption

3. give air cover to attack good actorsThe bad guys are actually on-side. Good guys are the enemy. https://t.co/DZI2O8gVyO

— Jesse Powell (@jespow) February 19, 2023

The agencies are causing real damage to some parts of the crypto space, primarily to US firms that want a path to compliance and US investors who want access to crypto products and services.

But nothing they’ve done so far is a real threat to the decentralized core of crypto.

— Jake Chervinsky (@jchervinsky) February 19, 2023