HBAR posted an 18% hike, but here’s why a reversal could be likely

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- HBAR posted a double-digit rally in the past week and the last 24 hours.

- However, it hit an overbought zone which could weaken the uptrend.

Hedera’s [HBAR] impressive performance could slow down. The asset has been posting double-digit rallies for the last 30 days. In the last 24 hours alone, HBAR hiked by 18%, climbing above its August 2022 high of $0.0832.

Read Hedera’s [HBAR] Price Prediction 2023-24

However, it could face difficulty moving beyond the June lows, which could pose significant resistance.

The June lows of $0.0872: Can bulls overcome it?

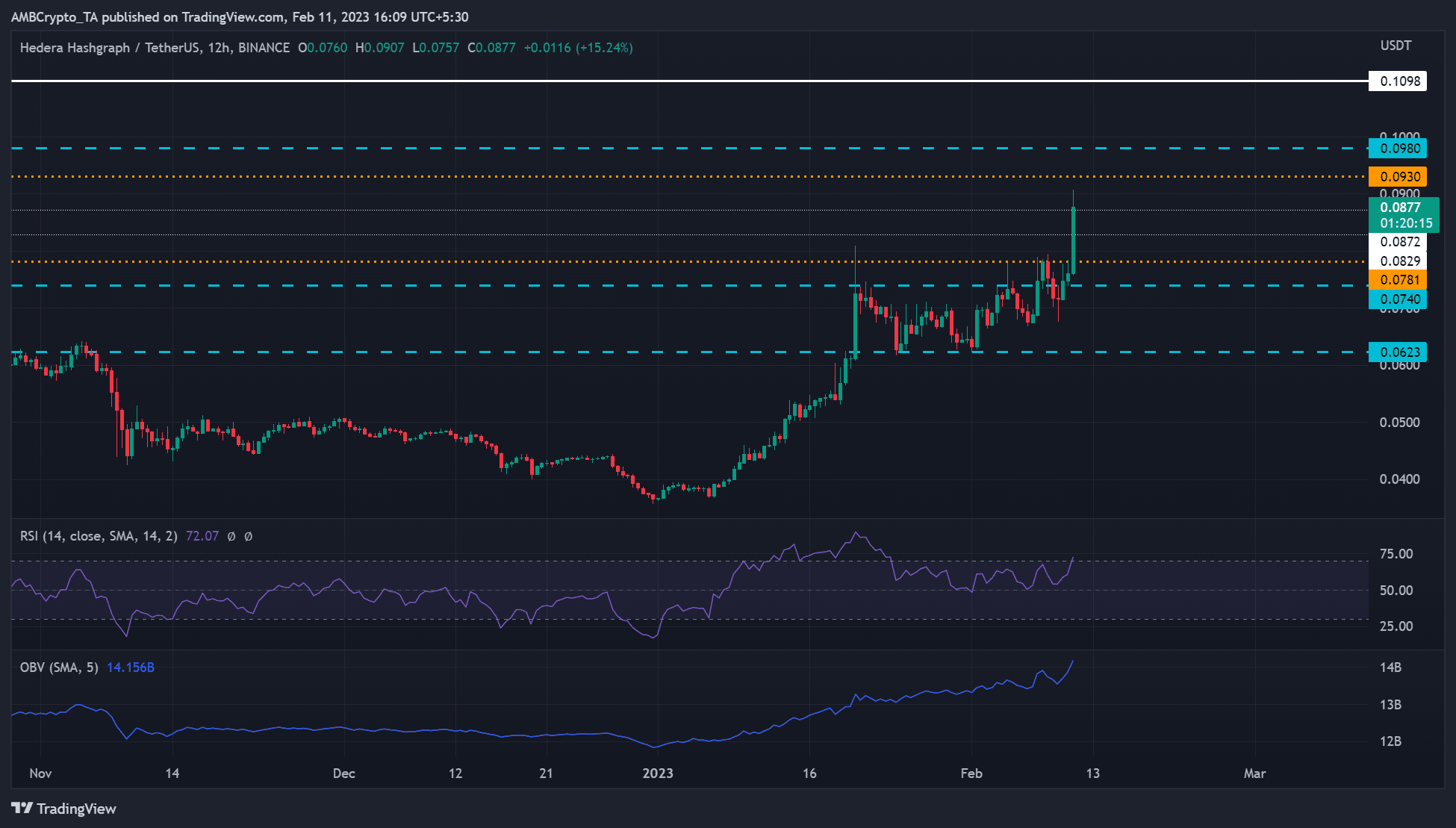

On the 120-hour timeframe chart, HBAR was bullish, with an RSI reading of 72. In addition, the OBV (On Balance Volume) showed a sharp uptick, denoting increased trading volumes and buying pressure at the time of writing.

The strong bullish momentum has pushed HBAR to enter the overbought zone – a ripe condition for a potential reversal. As such, the token could face price rejection around the $0.0872 zone if short traders offload their holdings to lock in profits.

A drop could follow the selling pressure, pushing HBAR to $0.0829 or $0.0781. These levels can be used as short-selling targets.

However, a break above $0.0930 would invalidate the above bearish bias. Such an extra upswing could set HBAR to target the June highs of $0.0980.

HBAR saw a negative sentiment despite the sharp rally

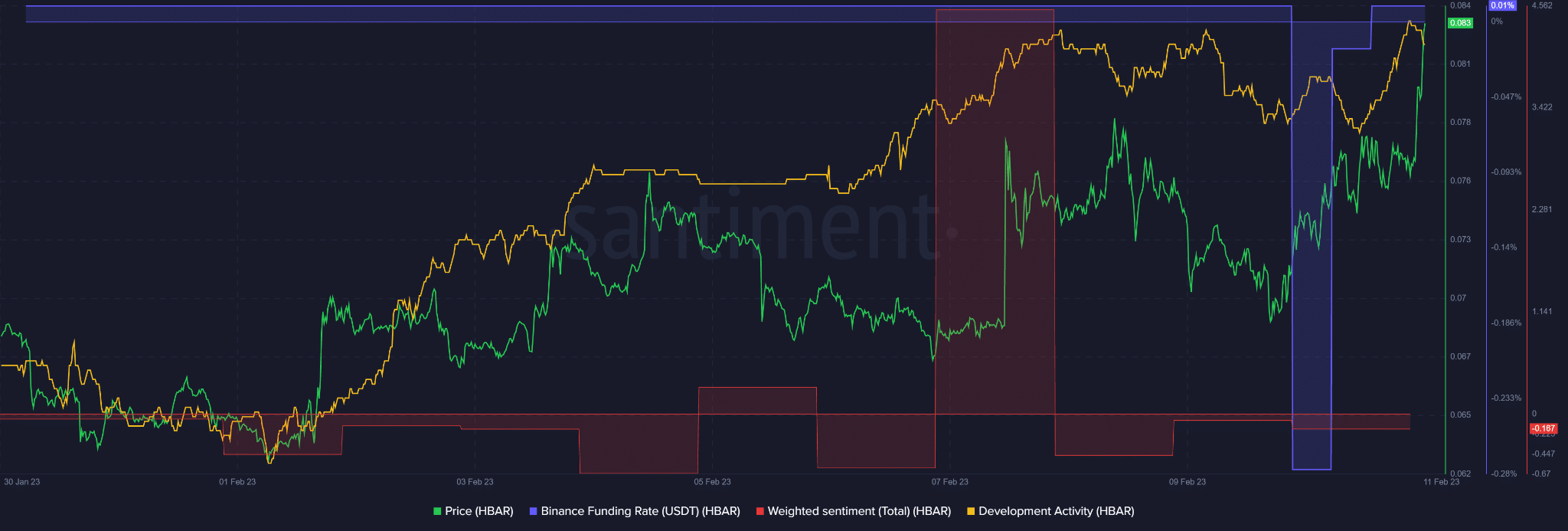

According to Santiment, HBAR has seen massive development activity, indicating that the network recorded massive building activity in the past few weeks. The development activity has increased in tandem with the price.

Is your portfolio green? Check out the HBAR Profit Calculator

In addition, the demand remained steady by the time of writing. However, the token’s weighted sentiment was negative despite the improved development activity and price surge. The bearish sentiment could set the market for short-sellers and inflict a price reversal.

Nevertheless, HBAR’s uptrend could continue if BTC reclaims the $22k zone. Thus, bears should track the king coin’s price actions.