Solana’s ‘bull trap’ risks pushing SOL down by about 20%

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL’s price has tripled since January.

- It could face a correction because of a key metric divergence and a bearish pattern.

Solana [SOL] bulls should be ready for a potential impact due to an increasing RSI divergence and a bearish rising wedge pattern on the daily timeframe.

Read Solana [SOL] Price Prediction 2023-24

SOL chalked a bearish rising wedge pattern and RSI divergence

SOL’s value has tripled since January, rising from $9 to over $21. At press time, it traded at $24.35, but a devaluation could be likely in the next few days.

Is your portfolio green? Check out the SOL Profit Calculator

SOL formed a rising wedge channel pattern – a typical bearish formation. In addition, the daily timeframe showed an increasing RSI (Relative Strength Index) divergence, which could suggest the current rally is a “bull trap.”

Therefore, SOL could drop to $19.06, a 20% potential plunge. But the downtrend could be slowed by the support levels at $24.15 and $22.68.

However, a daily candlestick close above the resistance level of $27.81 would invalidate the bullish forecast. Such a surge could tip bulls to target the pre-FTX level of $36.89. Nevertheless, bulls must clear the hurdle at $30.80.

Notably, the On Balance Volume (OBV) recently made the same lows, indicating a limited trading volume to push SOL’s uptrend momentum. Therefore, bears could be tipped to devalue the asset.

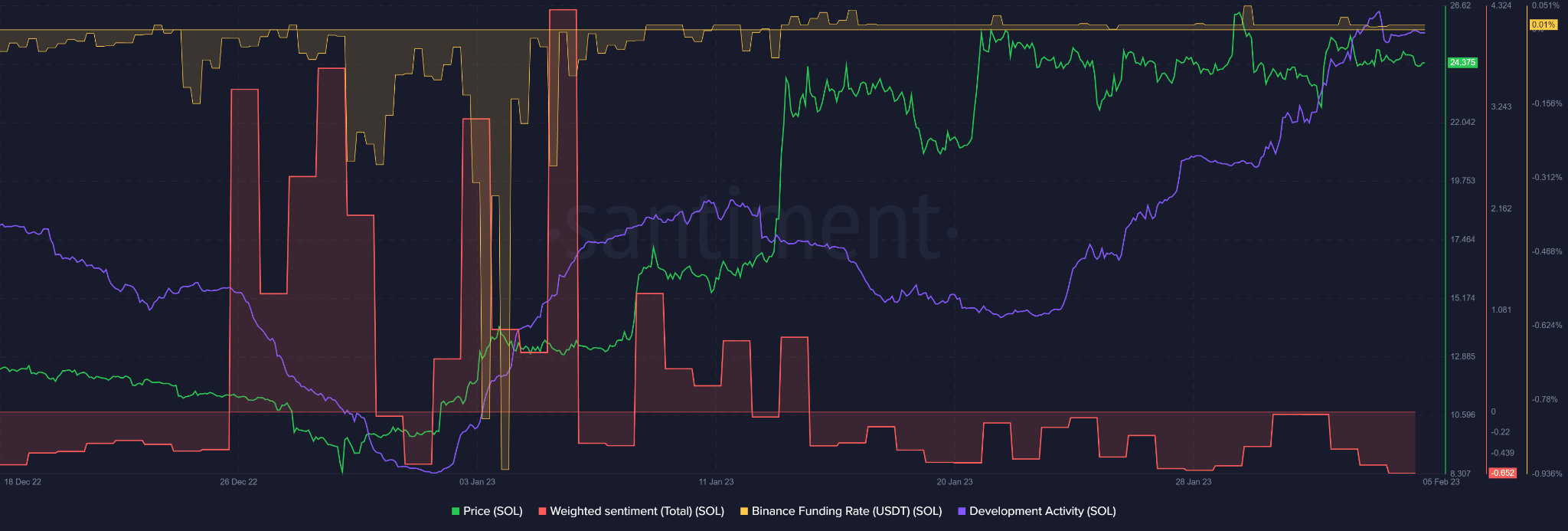

SOL’s development activity was on the rise, but the sentiment was bearish

As per Santiment data, the Solana network continues to build, as indicated by the rising development activity. The trend could assure investors of its stability and improve its value in the long run as investors’ confidence improves.

However, investors’ confidence was worryingly wanting at press time, as shown by the negative weighted sentiment. In addition, the Funding Rate was positive but negligible, indicating a limited demand for SOL in the derivatives market.

Therefore, the overall bearish sentiment could weigh down bulls’ efforts and undermine extra bullish momentum in the next few days. This could lead to likely price correction.

However, a bullish BTC could tip SOL bulls to target its November highs, invalidating the above bearish bias.