AAVE could trade sideways until early next week- Should you continue HODLing?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AAVE’s uptrend was slowed and forced into a range.

- Price/Open Interest divergence could undermine further short-term uptrend momentum.

Aave [AAVE] has been in price consolidation since mid-January. Similarly, Bitcoin [BTC] has been trading sideways within the $22.4K – $23.3K range.

The king coin’s price action has forced most altcoins into a similar trading range. AAVE’s price range has curved out critical supply and demand zones, offering swing traders profit levels. But everything could change by early next week due to the FOMC announcement.

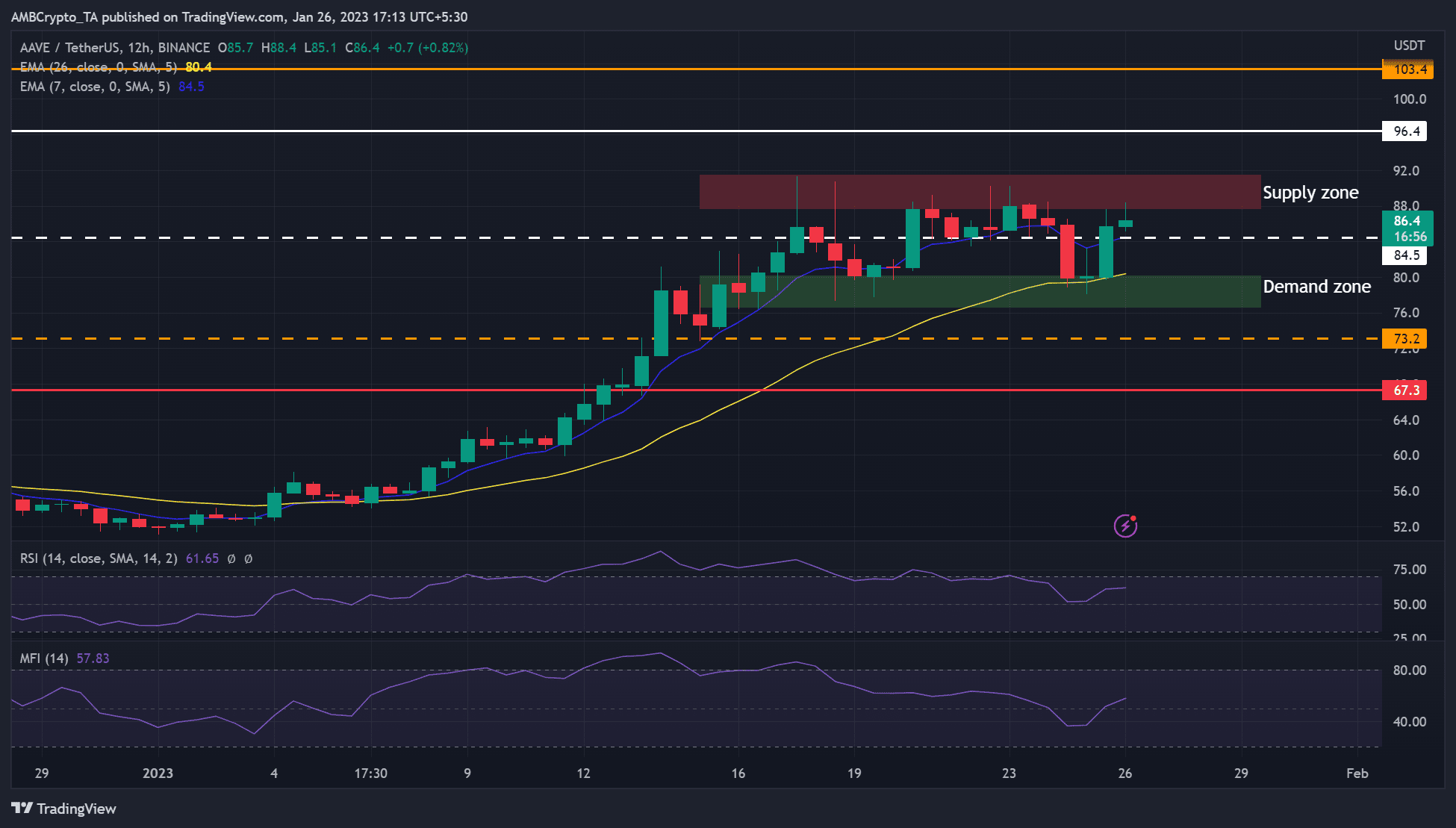

At press time, AAVE’s price was $86.4, as bulls seemed psyched to deal with this key supply zone.

Read AAVE Price Prediction 2023-24

The supply zone at $90 – Can bulls bypass it?

AAVE has been oscillating between $80 and $90 since mid-January, forming critical supply and demand zones on either end.

On the 12- hour chart, the RSI was 61, indicating that AAVE was still bullish and could attempt further upward movements. Similarly, the Money Flow Index (MFI) rose sharply, indicating that accumulation was ongoing.

But AAVE was approaching the supply zone at press time. Therefore, short traders could offload their holdings at the zone to lock in short-term gains. This could make AAVE drop lower to $84.5 or the demand zone below $80.

AAVE’s sideways structure may last until BTC’s strong price action after next week’s FOMC meeting. A bullish BTC will push AAVE to break above the range and target the pre-FTX level of $96.4 and the $100 zone.

However, a break below the demand zone ($76 – $80) would invalidate the above bias. Such a downtrend could settle at $73.2.

How much are 1,10,100 AAVEs worth today?

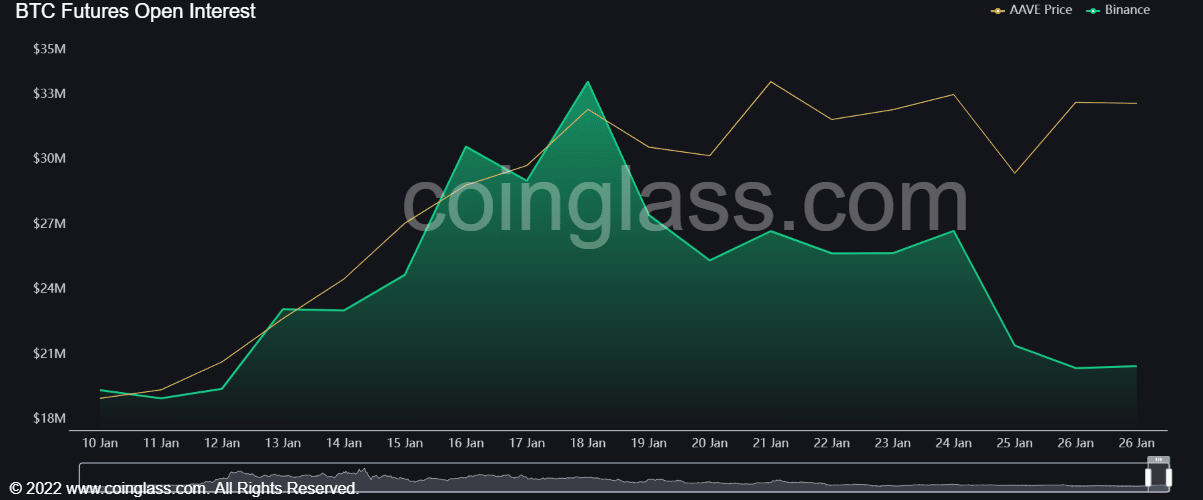

AAVE recorded price/OI divergence, but sentiment remained positive

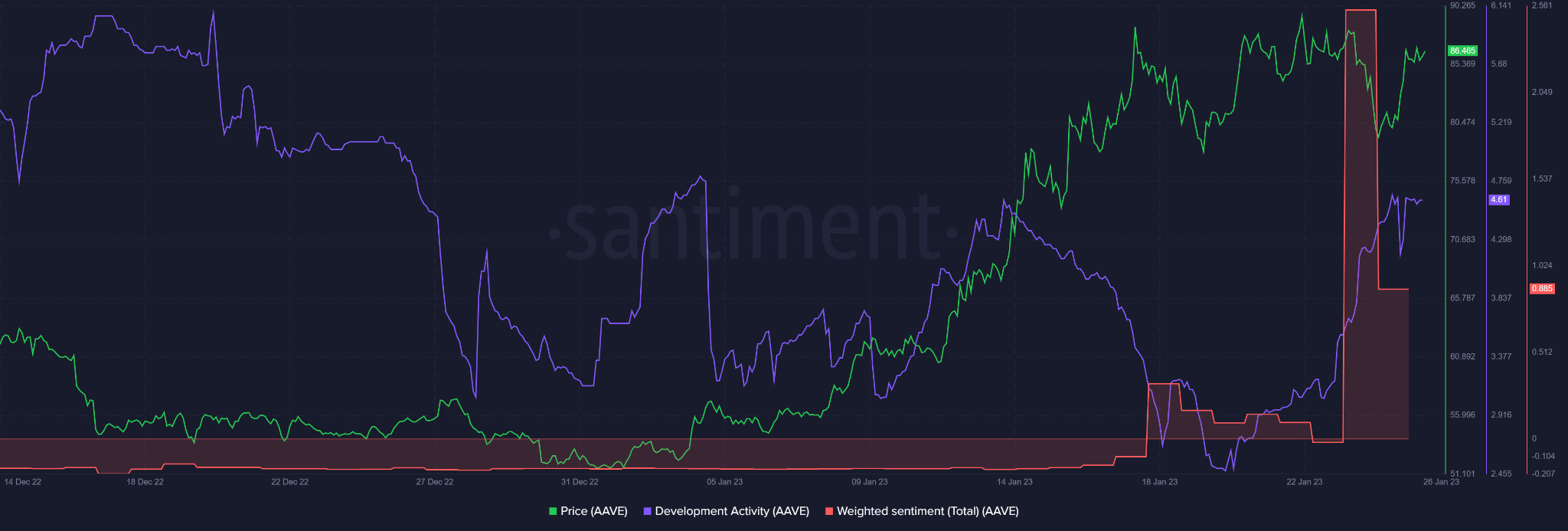

According to Santiment, AAVE’s weighted sentiment dropped with declining prices but remained positive. Besides, AAVE’s recorded an impressive development activity that has risen incredibly since 20 January. The growth could boost investors’ confidence in the asset and increase its value in the long term.

However, as prices fluctuated, AAVE’s open interest (OI) rates declined from January 18. The trend indicates a price/OI divergence that could weigh down AAVE’s uptrend momentum.

Therefore, the conflicting growth metrics could point to a continuance of the sideways structure before a definitive price action next week.