Grayscale Bitcoin Trust: Discount To NAV Closes (OTCMKTS:GBTC)

Vertigo3d

As we covered in our article on Grayscale Ethereum Trust (OTCQX:ETHE) the risk of the assets within the Grayscale Bitcoin Trust (OTC:GBTC) not being there is not a real risk in our opinion, and there are no real risks in the case of DCG going bankrupt.

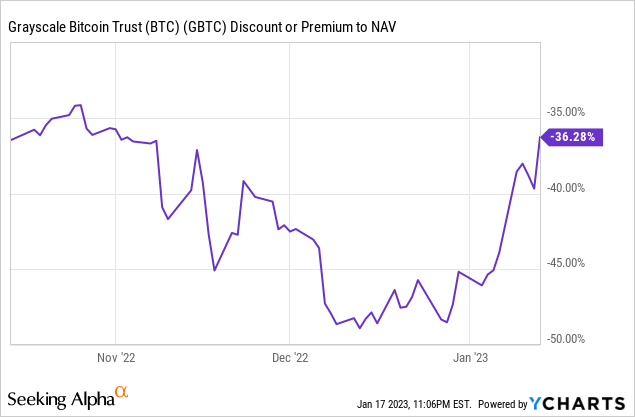

With that being said, as the market has realized the lack of risk in this regard the discount to NAV has closed drastically. The discount dropped from over 48% all the way down to 36% in the past month, to levels before any of these fears surfaced.

With this it begs the question of if the discount to NAV at this stage is justified, particularly now that there is elevated perceived risk and mistrust in GBTC, Grayscale, and their parent company DCG.

Revisiting the SEC suit

There has been some updates in this regard, which may explain the discount to NAV closing – namely:

The SEC has argued that GBTC shouldn’t be converted to an ETF and that Bitcoin Futures like ProShares Bitcoin Strategy ETF (BITO) holds are “fundamentally different products protected by different market-surveillance mechanisms and regulatory oversight to detect and deter fraud and manipulation.”

Grayscale has responded claiming the SEC’s central premise “that the Exchange’s surveillance-sharing agreement with the CME provides adequate protection against fraud and manipulation in the bitcoin futures market but not the spot bitcoin market-is illogical.”

Both of these arguments were expected from both sides – so effectively nothing has changed here beyond the court process moving along and a decision being a bit closer.

Grayscale is clearly on the right side of things here and the SEC is being unreasonable in my view, however I do not have faith the courts will be unbiased in this matter.

This could be one reason the discount to NAV has closed though, as institutions have been reminded how strong Grayscale’s case is here.

Revisiting the digital currency group FUD

The FUD has largely disappeared in the rearview mirror in the past few weeks, however in the past few days it has begun ramping up again – with the DCG’s CEO Barry Silbert being accused of stalling the inevitable – repaying creditors and likely bankruptcy – by many folks.

One of the Winklevoss twins has begun advocating for Barry Silbert to be disposed of as CEO of DCG, and generally the FUD is ramping up again.

This all points to the fears of bankruptcy, uncertainty regarding GBTC, and all the fears we had in late November and December will return in the coming weeks, likely causing the discount to NAV to increase once again.

As we pointed out before in our article on Grayscale Ethereum Trust DCG going bankrupt could be positive for investors if they decide to simply close the Grayscale Funds, however this situation remains unlikely.

The more likely scenario is DCG selling Grayscale and its funds to another asset manager and them continuing to be ran as they are rather than being closed.

Revisiting Bitcoin’s price action

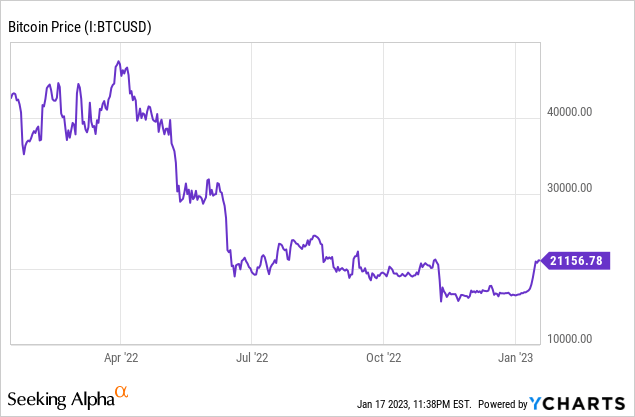

Finally one last thing to revisit is Bitcoin’s price itself, as due to the underlining asset being Bitcoin GBTC’s price action is predominantly determined by Bitcoin’s price action.

While sentiment has shifted and bitcoin has moved off its lows, sentiment has shifted positive, there doesn’t appear to be any real catalysts for a higher move up in my view.

Inflation is still quite high, interest rates continue going up and are likely to be sustained throughout 2023, there is still plenty of uncertainty regarding a potential recession and the consequences of it on the crypto market, the halvening is quite a bit away…

Worst of all institutions want nothing to do with bitcoin or crypto broadly – atleast until regulation comes, and arguably most people feel the same way after the collapse of FTX and other large crypto platforms.

Where does this leave us?

This actual risks related to DCG bankruptcy is now being priced relatively efficiently in my view, however the market risk is now being underpriced as fear can and likely will expand the risk-premium in time.

Any bad news, be it Cathie Woods selling out of GBTC, or DCG going bankrupt, will spark the same fears and doubt – of uncertainty – and likely cause an expansion of the discount once again.

With Bitcoin having no real catalyst in the short-term and plenty of potential downside catalysts there are plenty of risks here from the NAV side as well.

What are we doing?

We decided to shift from GBTC into BITO once again as the discount to NAV is relatively fair once again in our opinion, while we believe bitcoin is slightly expensive given the macro environment and general positioning of the crypto market.

This decision is done as we believe the upside risk in the discount to NAV of GBTC is equal to the downside risk – and thus there is no real arbitrage to be had there.

We can generate a little yield selling covered calls in BITO without being exposed to discount to NAV risk or selling out completely and that’s perfect for our current assumptions. It might not be right for you.

Rating & risks to consider

Before closing this out I want to be clear – there are many risks here still and engaging in trading these derivatives of bitcoin carries extra risk, as does selling options against them (covered-calls).

There are also potential tax consequences in swapping GBTC out for BITO that would make it a bad choice for you personally – please do not follow what we are doing, we have different circumstances, risk tolerance, and tax positioning than you do.

With that being said we’d rate GBTC at a hold to situational sell relative to Bitcoin or S&P 500 (SPY) and a modest short-term sell relative to dollars.

We’d change our rating of GBTC to a buy at a 40-42%+ discount to NAV and/or Bitcoin being <$16000-18000~.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.