Bitcoin, Cardano, Shiba Inu post gains, but there’s more than meets the eye

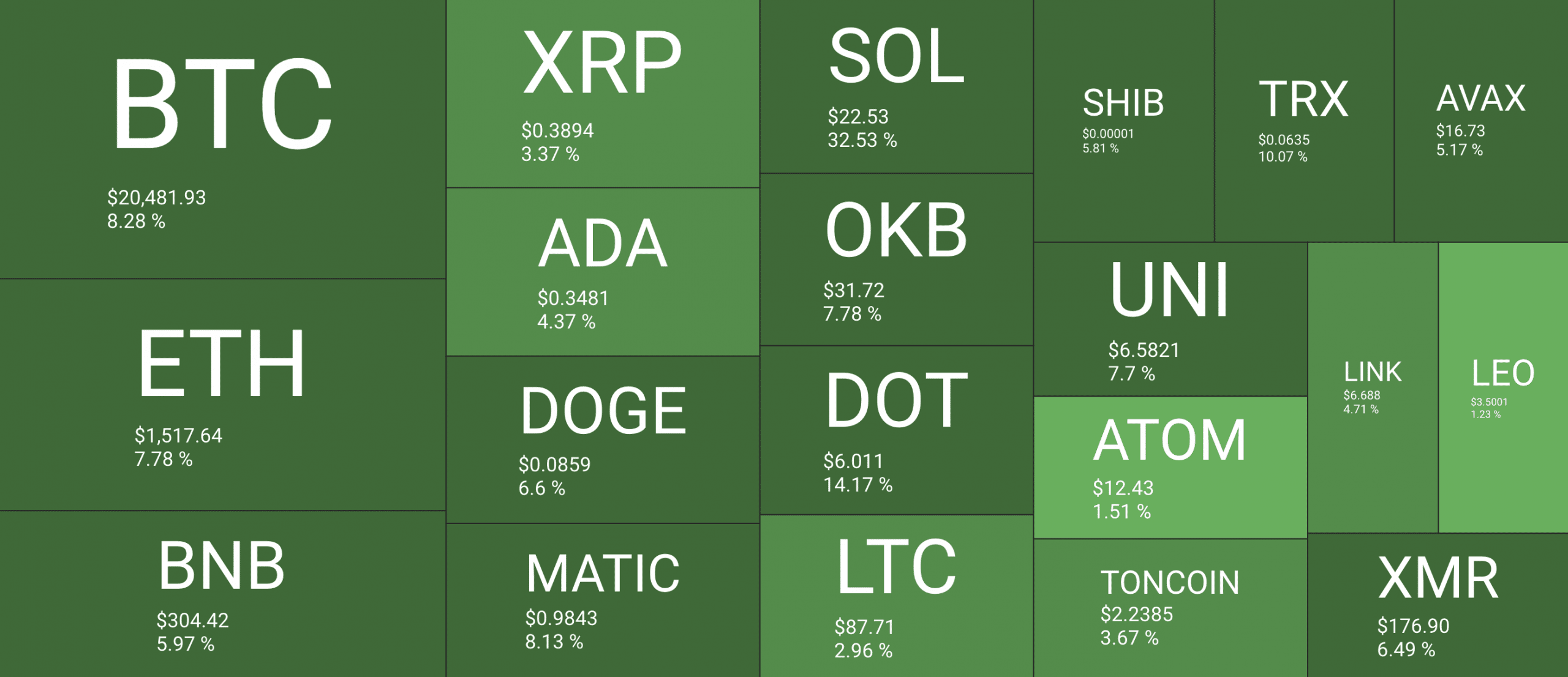

- The crypto market rallied significantly in the last 24 hours.

- Short traders have seen the most liquidation.

In the last 24 hours, the global cryptocurrency market capitalization grew by over 5%, per data from CoinGecko.

For the first time post-FTX collapse, Bitcoin [BTC] traded above the $21,000 price mark, while leading altcoin Ethereum [ETH] changed hands at $1,600, according to data from CoinMarketCap.

Also, sharing a statistically significant positive correlation with BTC, layer one coin Cardano [ADA] and leading meme coin Shiba Inu [SHIB] also logged price jumps of 4% and 6%, respectively, within the same time frame.

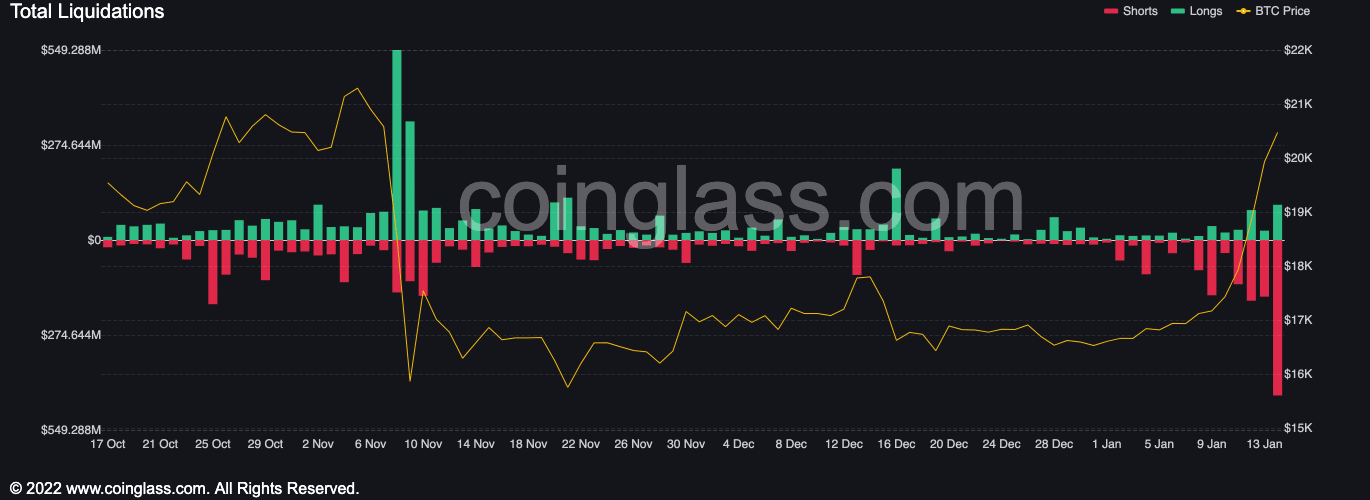

According to data from the crypto analytics platform Coinglass, liquidations across the cryptocurrency market in the last 24 hours totaled $719.05 million, with 131,575 traders liquidated.

However, the recent rally has had a particularly negative impact on short traders. In the last 24 hours, liquidated short positions represented 62% of total market liquidations, data from Coinglass showed.

Why the greens?

There’s no denying that the crypto and traditional finance markets share a close correlation. The recent rally in the crypto market could be attributable to the fact that all major indexes closed the just-concluded trading week on a positive note for the first time since November.

On 13 January, after starting the day by booking significant losses, all major indexes managed to recover and close in the green. The Dow Jones Industrial Average increased by 0.33%. The S&P 500 also rose by 0.40% to 3,999.09, and the Nasdaq Composite gained 0.71% to reach 11,079.16.

According to CNBC, the recent rally resulted in the S&P and Nasdaq both having their second consecutive positive week and best weekly performance since November. The Nasdaq had the highest weekly increase at 4.82%. The S&P and Dow also saw gains of 2.67% and 2%, respectively.

A bull trap or nay?

A pseudonymous crypto analyst on Twitter CryptoCapo opined that while the market might have logged unprecedented gains in the last 24 hours, the possibility of registering new lows was not completely invalidated.

Good morning.

Market is bouncing more than expected, that is a certainty. Now… is the bearish scenario invalidated?

I’m going to explain why I think new lows are still likely.

— il Capo Of Crypto (@CryptoCapo_) January 14, 2023

According to CryptoCapo, an assessment of BTC, ETH, and other altcoins on a high time revealed that the jump in price in the last 24 hours caused these crypto assets to test major resistance levels. However, “there’s no bullish confirmation yet,” CryptoCapo said.

He assessed BTC on a lower time frame and said:

“$BTC is in a ltf (lower time frame) parabolic move. But there’s a problem for bulls. This move is already overextended. The base of the parabola was weak, and when this ltf trend breaks it often results in sharp declines and full reversals.”

2) Lower timeframe.$BTC is in a ltf parabolic move. But there’s a problem for bulls. This move is already overextended. The base of the parabola was weak, and when this ltf trend breaks it often results in sharp declines and full reversals. pic.twitter.com/edq7tM25PI

— il Capo Of Crypto (@CryptoCapo_) January 14, 2023

On market sentiment, the analyst believed that:

“Bulls are not only euphoric, they are being very arrogant again. The need to constantly celebrate a victory by mocking others shows a weakness in their arguments. And it’s because the best bullish argument is that market has dumped a lot already”