1INCH has a flying start to 2023 with major partnership… Details inside

- 1INCH is looking for organic growth avenues through new strategic collaborations.

- 1INCH attempted to exit its bottom range at press time as bulls regained dominance.

Now that the cryptocurrency market is recovering, there is a resurgence of growth-centric partnership announcements. 1INCH Network’s [1INCH] latest announcement suggested that it had gone down the same route. A tweet on 12 January revealed the DEX’s partnership with Beefy Finance, a yield optimizer designed to operate across multiple blockchain networks.

1/ Moo! 🐄 Beef lovers are gonna like this announcement.

🦄 #1inch is excited to partner with 🐮 @beefyfinance, a multichain yield optimizer, with the 1inch API powering ZAP V2!

👉 More info: https://t.co/Ydwhpdwb1Z#DeFi #crypto

— 1inch Network (@1inch) January 12, 2023

Is your portfolio green? Check out the 1INCH Profit Calculator

This partnership is important for both parties to tap into the demand for better yield farming solutions. As the market enters the bullish phase, many people will be looking for the best place to park their crypto to maximize potential yields.

The partnership also contributes to positive growth for the Network, as the DEX’s utility may expand in 2023. Speaking of utility, in a 13 January tweet, WhaleStats ranked 1INCH as the most used smart contract by Ethereum [ETH] whales.

JUST IN: #1INCH @1inch once again a MOST USED smart contract among top 500 #ETH whales in 24hrs 🐳

We’ve also got $NMR, $MANA, $SHIB, $FORT & $BAT on the list 👀

Whale leaderboard: https://t.co/tgYTpOm5ws#1INCH #whalestats #babywhale #BBW pic.twitter.com/uE3uUEVLq7

— WhaleStats (tracking crypto whales) (@WhaleStats) January 13, 2023

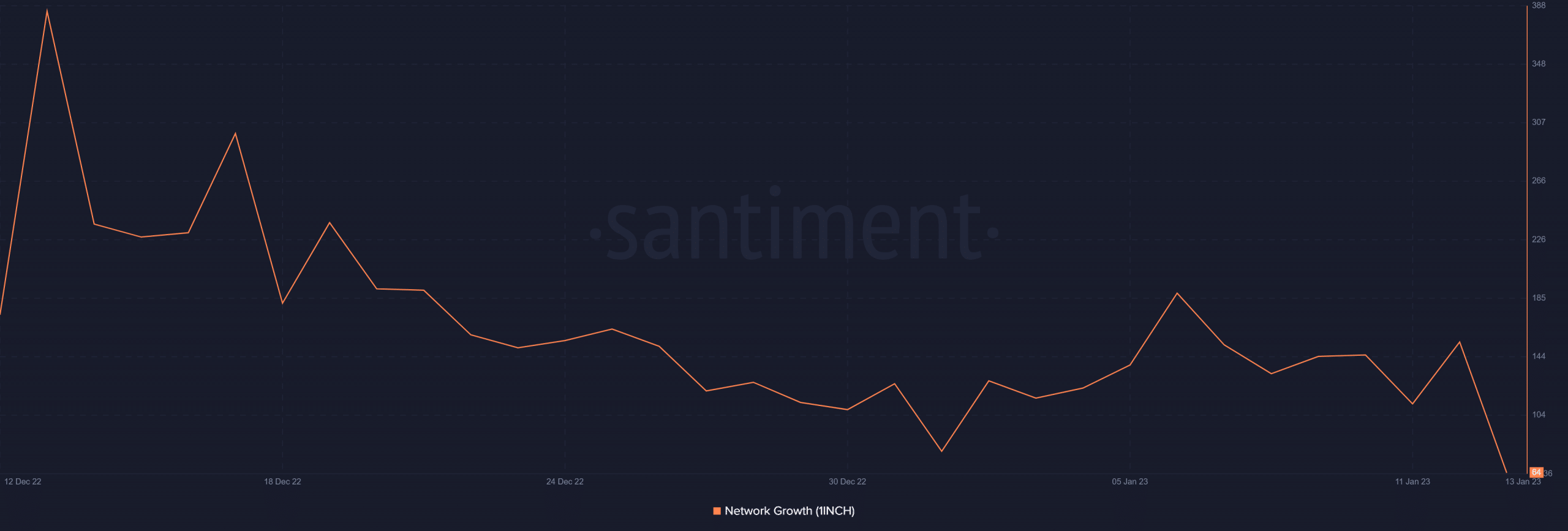

Low network growth in 1INCH, but strong price action

Unfortunately, contrary to expectations, 1INCH has been experiencing a slowdown in network growth for the last four weeks, and at press time, it was down to its monthly low.

Perhaps the aforementioned partnership and other organic developments happening this year might help trigger positive network growth. Nonetheless, the network has achieved growth in other areas in the last two weeks.

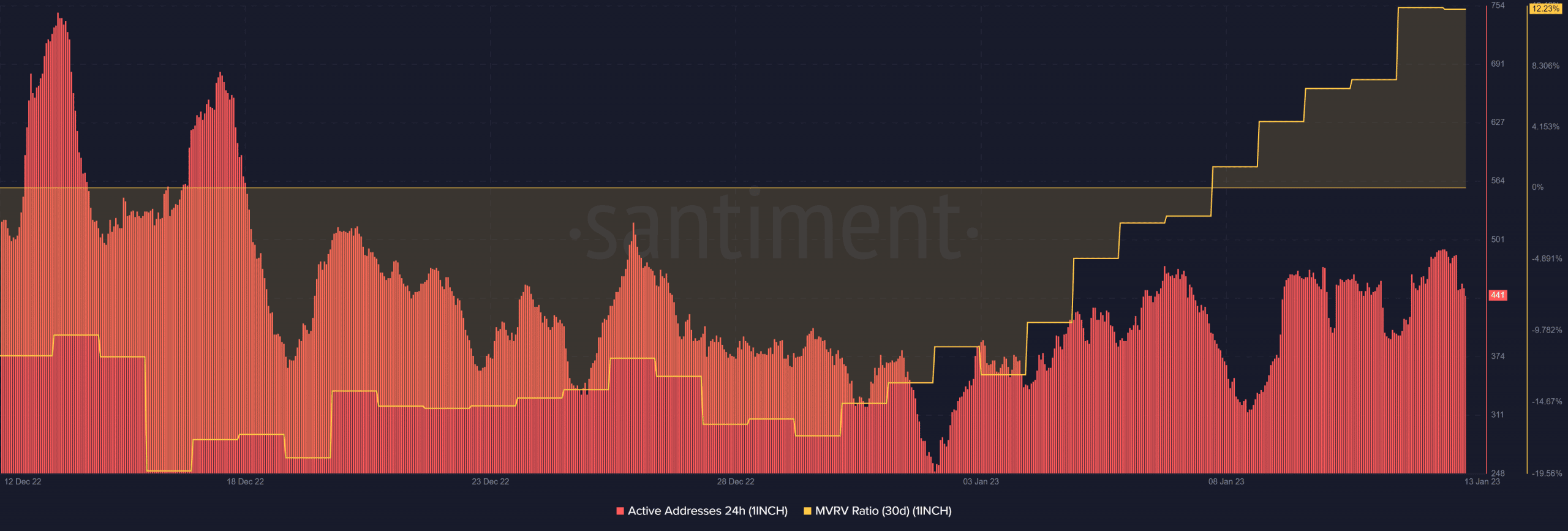

For example, there was stimulation in daily active addresses since the start of 2023. This was a noteworthy shift, considering that active addresses dropped towards the end of December 2022.

1INCH’s MVRV ratio (30 days) further revealed interesting insights about token holders. More investors have been holding on to their 1INCH tokens since mid-December 2022 rather than selling. This trend really kicked into high gear in the last days of 2022, resulting in a massive MVRV rally.

This above action denoted poignant accumulation.

How much are 1,10,100 1INCHs worth today?

Fortunately for 1INCH holders, the hodling aligned with the return of bullish momentum. 1INCH traded at $0.44 at the time of writing, which represented a 32% recovery from its 2022 low in December.

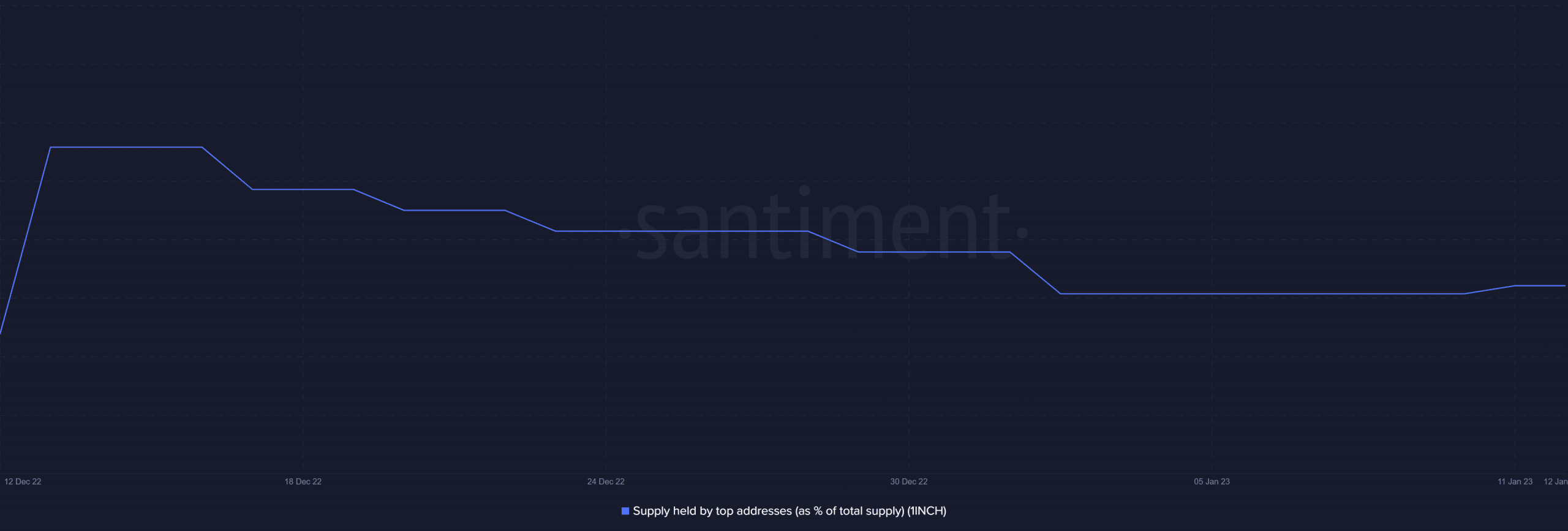

1INCH still has more upside potential before it gets into overbought territory. There was a slight increase in the supply held by top addresses between 10 – 11 January, suggesting that whales had added to their balances.

If whales continue to buy, then there could either be an upside surge, or a stronger resilience against the bears.