Hopeful BTC investors banking on a bull run may want to read this because…

- Bitcoin lacked demand despite the impressive run of the first ten days in 2023

- A short term retreat could be likely depending on the CPI outcome as supply in profit spikes

Expecting a return of the Bitcoin [BTC] bull market might sound too hasty despite the king coin resurgence above $17,000. CryptoQuant analyst, Cauceconomy opined this after assessing the condition of the Bitcoin demand.

BTC, which had more green days than reds since 2023 began, had helped renew the enthusiasm of its investors. But for Cauceconomy, a significant breakout might be unlikely.

Are your holdings flashing green? Check the BTC Profit Calculator

Trading volume restraining demand

According to his publication on the crypto data insight platform, Bitcoin’s lack of demand could be traced to its network usage. This is because each block confirmation translates to increased daily transactions.

However, that has not been the situation lately as miners have not necessarily been profitable to increase productivity by confirming more blocks. Hence, the trading volume has been repressed.

According to CoinMarketCap, the BTC 24-hour trading volume was a 1.75% decrease at press time. This aligned with the analyst’s reference to a dip in transactions on the Bitcoin network.

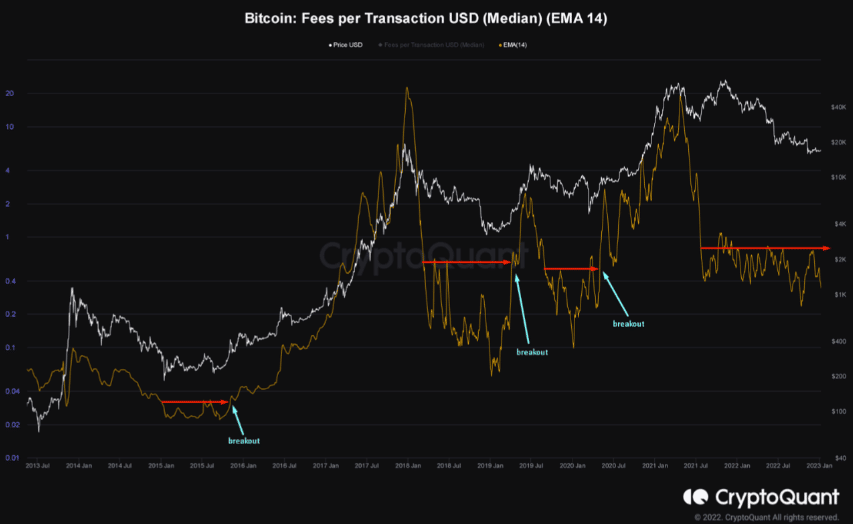

Besides, Cauceconomy backed up his opinion by citing the historical trend. He pointed out that there was usually a notable breakout during the bear market before the bull season in previous cycles as shown by the above image. Meanwhile the current momentum displayed by BTC has shown nothing of such. The analyst said,

“For us to have growth in the fundamentals of the network, we will need to see greater demand for trading and, consequently, higher fees for daily transactions. At this time, we haven’t had that breakout yet and trading volume remains low, indicating low demand.”

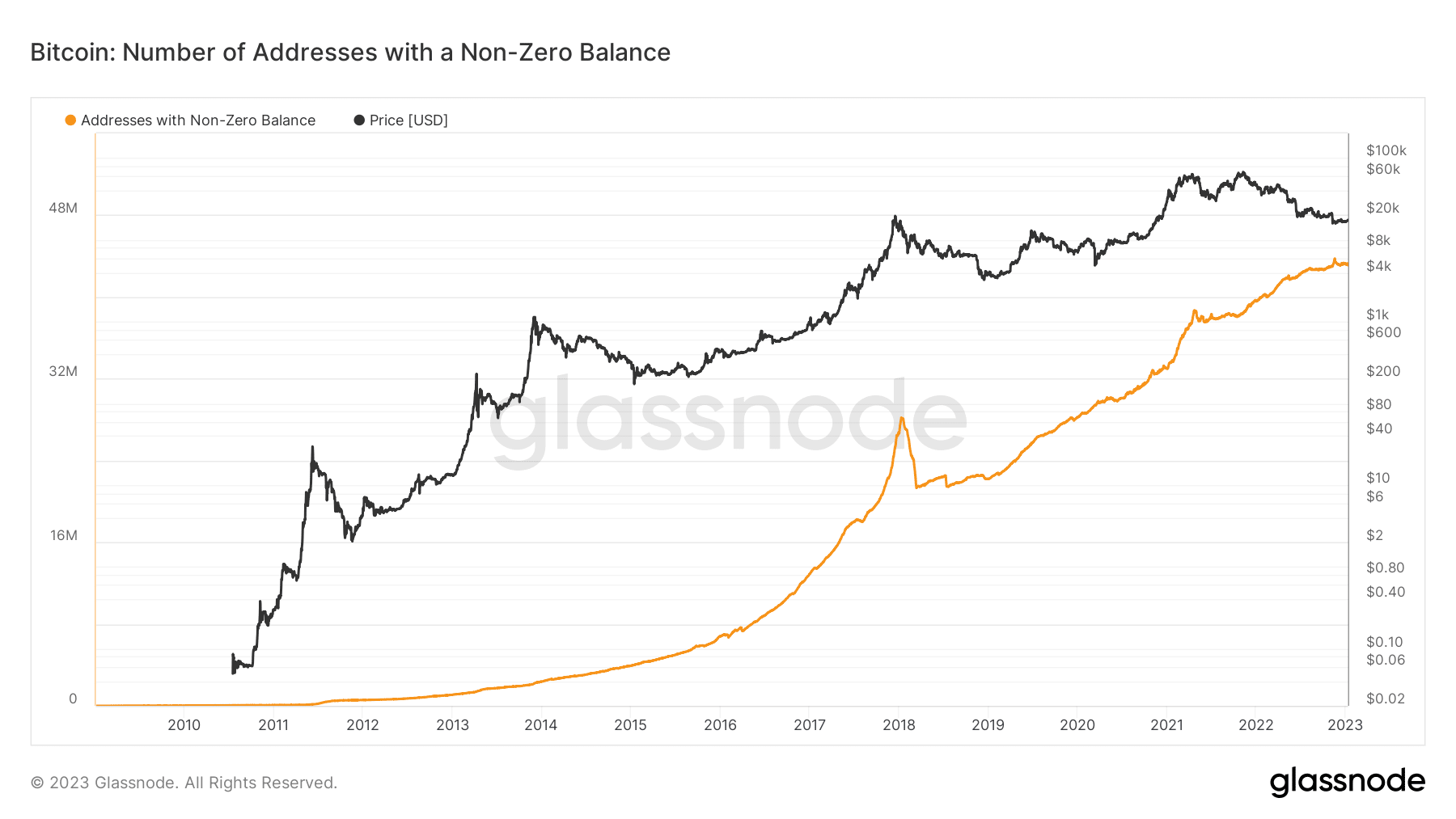

On evaluating the Bitcoin addresses with non-zero balance, Glassnode showed that there has been a slight decrease from the peak registered in November 2022.

The data at the time of writing, reported the number to be 43,170,375. Although this was a marginal difference, it suggested a lackluster perspective towards network utilization user base expansion.

How many BTCs can you get for $1?

The cause to take heed

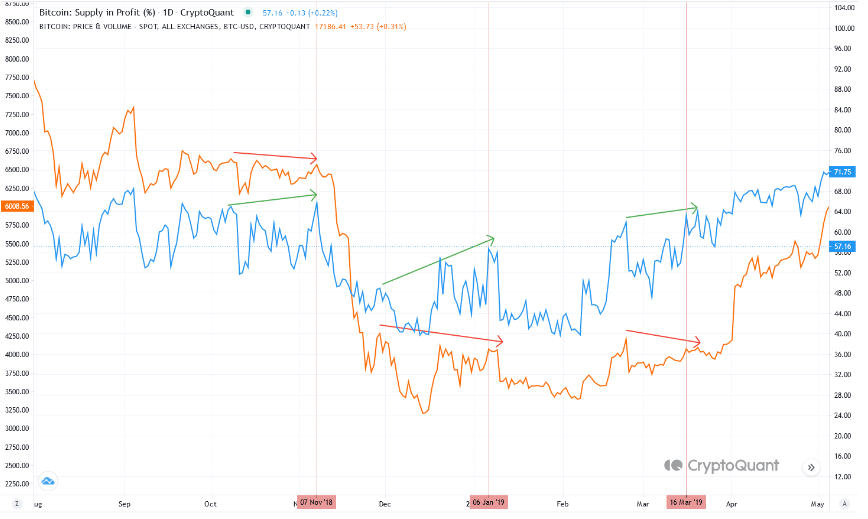

In addition, another post on CryptoQuant warned optimistic investors of an impending price drop. On-chain analyst Gigisulivan was the one who raised the alarm after his assessment of the supply in profit percentage. At press time, the Bitcoin supply in profit percentage headed towards peaks, and was forming a divergence.

Like Cauceconomy, he also referred to history as situations like that eventually led to a short term BTC pull back. For context, in 2018 and 2019, it only took a few days before the projected outcome happened. So, it might be the case as well considering the present circumstances.

However, the analyst mentioned that macroeconomic factors would also have a say in the potential BTC trend. Therefore, the result of the Consumer Price Index (CPI) report on 12 January could determine if the supply in profit percentage goes ahead with the forecast.