NEST Protocol Aims to Provide Accurate Price Prediction for DeFi

Nest Protocol (NEST), a blockchain based oracle network, aims to eliminate one of the biggest problems faced by decentralized applications (dApp) developers that is access to reliable and timely pricing data. It provides a more balanced distribution of the network promoting a trustless system which is the very core concept of DeFi. Here is everything you need to know about Nest protocol.

Understanding Decentralization

The decentralized finance (DeFI) space is growing leaps and bounds. It rose to prominence in the summer of 2020 with yield farming, the rise of tokens such as Compound and Sushiswap promising attractive yields to crypto traders. The total value locked in DeFi has witnessed an exponential surge in just over two years.

With the burgeoning DeFi adoption, the technology surrounding it is also evolving at a rapid pace. DeFi is a disruptive innovation that takes the component of centralized finance and replaces human trust with math-based trust, paperwork with smart contracts, legal enforcement with cryptographic enforcement, and third-party audit with open-source code and public ledger.

The underlying technology of this ecosystem is based on blockchain technology. One of the most important aspects of blockchain technology is smart contracts. It is a set of contracts defined in digital form, helping the contract participants to execute the agreement to complete the task. In this process, off-chain information is important to interact with the on-chain world. In order to bridge this, oracles are used to upload data from the off-chain world to the blockchain.

DeFi relies on accurate and timely pricing data to provide a service to the market. But the DeFi protocol oracles in this space are plagued with various problems such as providing uncertain data to several DEXs (decentralized exchanges), DeFi networks, and P2P lending protocols. Moreover, networks like DEX need pricing information imported from outside sources to remain credible.

Nest Protocol Seeks to Eliminate the Problem of Accurate Data

Nest protocol is trying to solve this problem of accessing reliable data. It is a distributed price fact oracle network which provides third parties with access to valuable pricing information and operates more than 60 oracles. Nest is a distributed pricing oracle network based on the Ethereum blockchain which uses a special “quote mining” mechanism to ensure that off-chain data is synced to on-chain prices. A distributed pricing oracle network provides price information outside of the blockchain in a decentralized way, without a single point of entry or a governing body.

One of the biggest issues that early oracles suffered from was centralization. Since centralized oracles are controlled by a single source, a significant amount of trust has to be placed on that entity. Furthermore, if the oracle gets compromised, the smart contract and correspondingly, the entire blockchain is impacted.

In the wake of such discrepancies, the NEST Oracle aims to solve the issue by being a truly decentralized oracle. It eliminates the middlemen from the oracle equation autonomously gathering all the data by sensors. This means that companies don’t need to hire third parties and save on overhead costs. Furthermore, the protocol’s low costs make it an ideal option for startups and many Dapp developers.

Nest also simplifies the price problem in the string through the price verification. Along with the price verification mechanism, the NEST protocol also restricts attacks by attackers through the price string by raising the attacker’s costs. That is, the attacker must offer a replacement price and an equal asset after the price attack. Because following an assault, the attacker has to define the precise price or give up the arbitrage option.

NEST- The Native Token

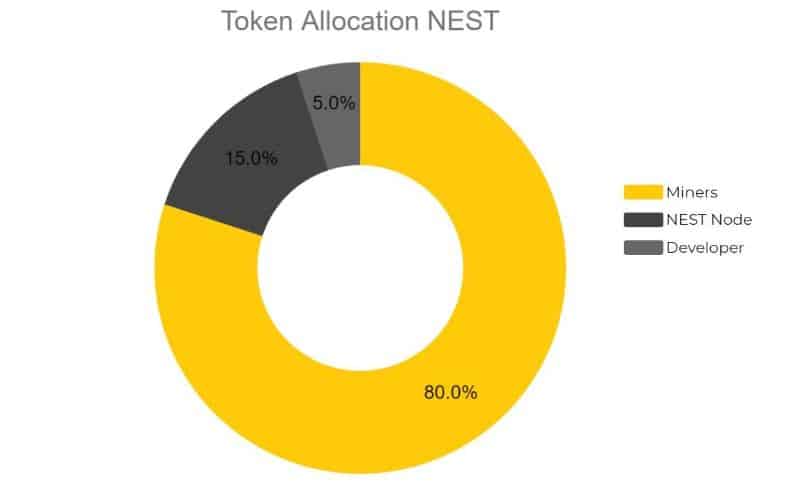

The native token of the protocol is NEST that is used to meet liquidity needs for the platform. The tokens are issued on the Ethereum blockchain, following the ERC20 standard with the maximum number of NEST tokens set at 10 billion. As per an official blogpost, in order to use the price quotations calculated by the NEST system, users need to pay a fee in ETH. A percentage of this fee will be returned to NEST token holders as ETH, which means that the more users the protocol has, the more fees will be returned.

Is Nest the Next Big Thing?

🌞McKinsey’s report: metaverse could create $5 trillion in value by 2030.

🔥NEST, the infrastructure for web3 and the metaverse, will expand use cases in more areas and welcomes collaboration on metaverse projects!

🔗https://t.co/Jb9id1DLk3 pic.twitter.com/XYnWlVhAat

— NEST Protocol (@NEST_Protocol) January 9, 2023

Recently, McKinsey reported tthe crypto subecosystems including NFTs and metaverse could potentially generate up to $5 trillion in value by 2030. The report highlighted that in the next seven years, 50% of live events could be held in the metaverse noting,

“The metaverse is simply too big to be ignored.”

Since Nest is a Web3 and metaverse infrastructure, the number of uses case for the protocol has a possibility of expanding multifold. On December 28, crypto exchange, OKX partnered with Nest integrating the OKX Wallet Web Extension allowing users to store and manage assets of NEST Protocol.

📢 Attn: Buidlers 📢

OKX has partnered with @NEST_Protocol 🤝

You can now use #NESTProtocol’s Futures, Options, Swap, and NFT functions directly in #OKXWallet.

Get started! ⤵️

— OKX (@okx) December 30, 2022

As per CoinGecko, in 2022, the NEST token experienced an impressive price performance of nearly 232%, making it one of the best performing cryptos. On December 9, Nest took to twitter to reveal it has collaborated with over 70 projects in product & marketing.

Several experts believe that as the first oracle to provide actual on-chain price prediction, NEST Protocol provides many potential advantages to the DeFi space. It could be used to balance tokens, automatic settlement mortgage loans and futures. Last but not the least, the NEST Protocol integrates blockchain data with decentralized real-world data which will increase the likelihood for mass adoption of blockchain technology in the real world, bridging networks together while building a reliable and secure system for all.