MakerDAO configured to implement parameter changes; a look at the lending markets

- MakerDAO has a new proposal to implement some parameter changes.

- The protocol has displaced Lido to regain its position as the leading DeFi protocol.

in a new proposalThe Open Market Committee of the MakerDAO governance team is seeking community approval to implement some parameter changes to the operation of the decentralized finance (DeFi) protocol in light of recent events in the lending vertical of the DeFi ecosystem .

Read MakerDAO [MKR] Price prediction 2023-2024

According to the proposal, due to the general decrease in liquidity for smaller assets and market manipulations by Avi Eisenberg that led to the diversion of $114 million from Mango Markets, the decentralized cryptocurrency exchange (DEX), now accepted fewer long tail assets as collateral in the world of crypto lending.

Long-tail assets are cryptocurrencies that have been in circulation for several months or years but have little or no trading volume. Instead of discarding these crypto assets, DeFi protocols float pools using them, thus generating liquidity in this asset category.

Under the new proposal, MakerDAO’s Aave-DAI (Aave D3M) direct deposit module is proposed to be reactivated with a limited debt ceiling, and the Compound v2 D3M debt ceiling would be increased.

The stability fees for the WSTETH-B vault type of the protocol would also be normalized. In addition, the fees on the USDP PSM would be increased to avoid an increase in exposure.

According to the Open Market Committee, if implemented, these changes are expected to result in an increase in annual revenue of approximately 525,000 DAI and an increase in COMP rewards for the D3M Compound Maker treasury.

MakerDAO Reclaims Its Position as King of DeFi

Lido Finance, a leading liquid ETH staking platform, briefly overtook MakerDAO as the DeFi protocol with the highest total value locked (TVL) earlier in the year. In the last week, this caused a significant increase in the value of Lido’s LDO governance token.

Are your MKR holdings flashing green? Consult the benefit calculator

However, as of this writing, according to data from DeFillama, Maker has regained its position as the leading DeFi protocol with a TVL of $6.27 billion. So far this year, MakerDAO’s TVL has grown by 4%.

Source: DeFiLlama

The MKR protocol governance token has also seen some growth in its price. Changing hands at $558.98 at press time, its value is up 10% since the beginning of the year, according to data from CoinMarketCap revealed.

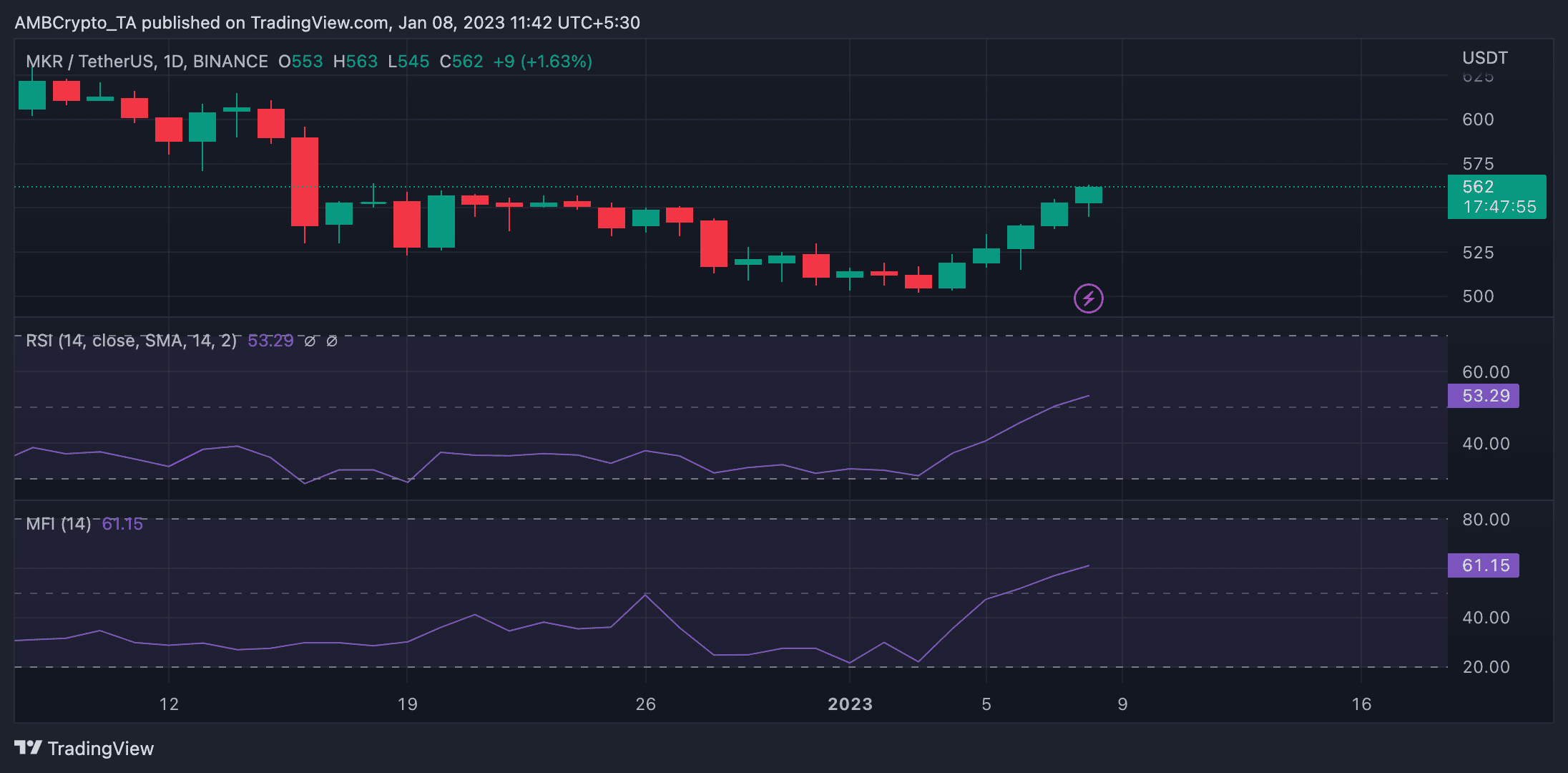

The price growth is attributed to a steady increase in MKR accumulation since the start of the year. An assessment of MKR’s price movements on a daily chart revealed that the alt’s relative strength index (RSI) and money flow index (MFI) have been trending higher since January 3.

At press time, they were seen above their neutral lines at 53.29 and 61.15 respectively.

Source: TradingView

source: ambcrypto.com