How the GBTC premium trade ruined Barry Silbert, his DCG empire and took crypto lending platforms with them

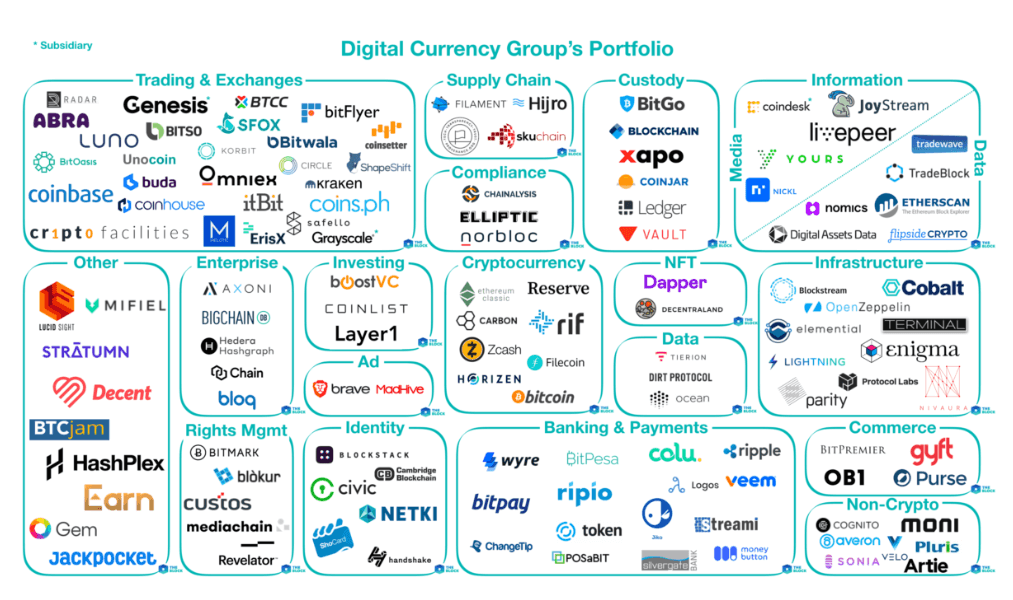

Introduction to Digital Currency Group

Digital Currency Group was founded by Barry Silbert in 2015, who subsequently created the DCG empire by investing in hundreds of projects and companies.

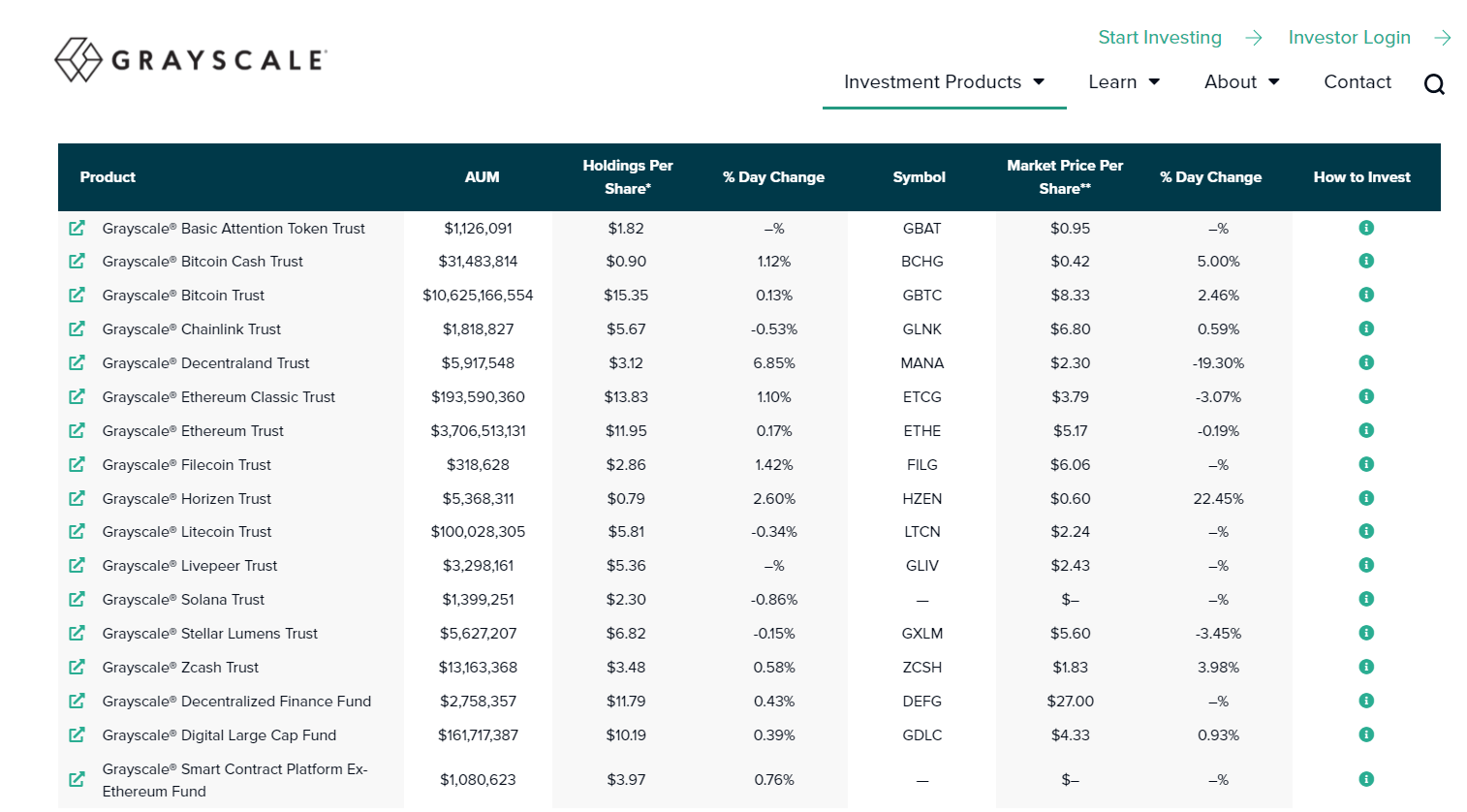

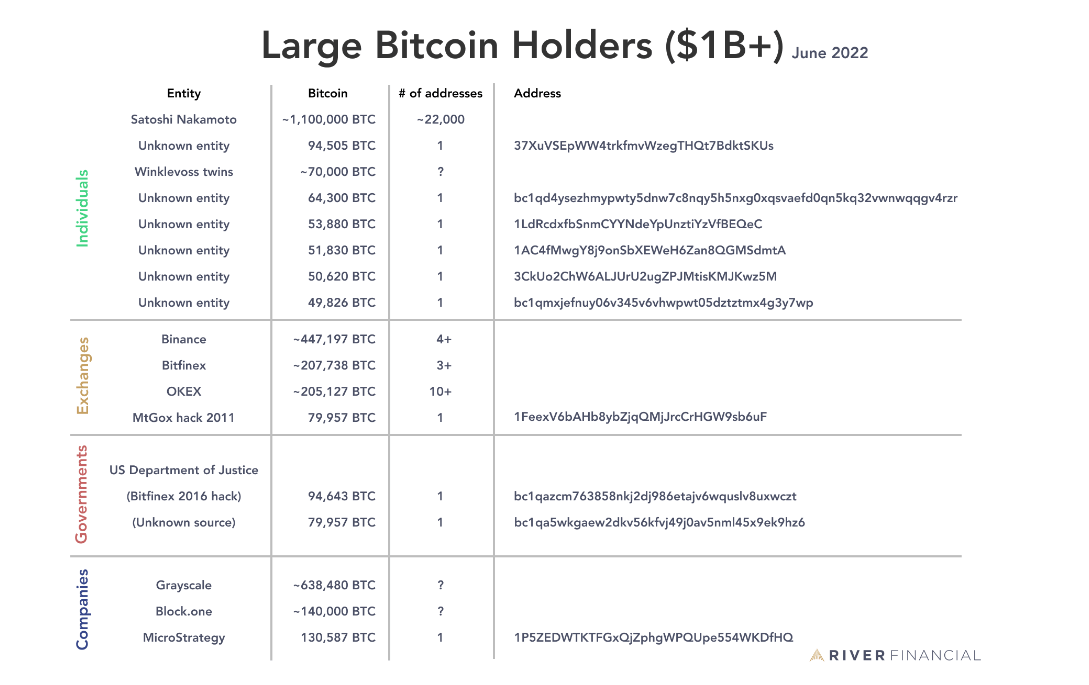

However, the most important company within DCG’s portfolio is Grayscale Investments, the largest holder of Bitcoin in the world, other than Satoshi Nakomoto.

GBTC holds the equivalent of 633K BTC, just over 3% of the Bitcoin circulating supply. The trust’s Net Asset Value (NAV) is roughly $10.5 billion at the time of writing.

The custody of the BTC is held with Coinbase Custody. However, Coinbase is yet to verify if they have control of the BTC. Yet, as Coinbase is traded as a public company in the U.S. and is therefore subject to audits, it like probable that the BTC is stored under standard practices.

How does DCG make money?

DCG charges a 2% management fee for the underlying Bitcoin held in the trust.

According to SEC filings in Q3 2022, DCG earned $68 million from this fee while bringing in around $230m in revenue annually. The income represents a large percentage of the $800 million it generates annually. Barry Silbert corroborated these numbers in a letter to shareholders on November 22nd.

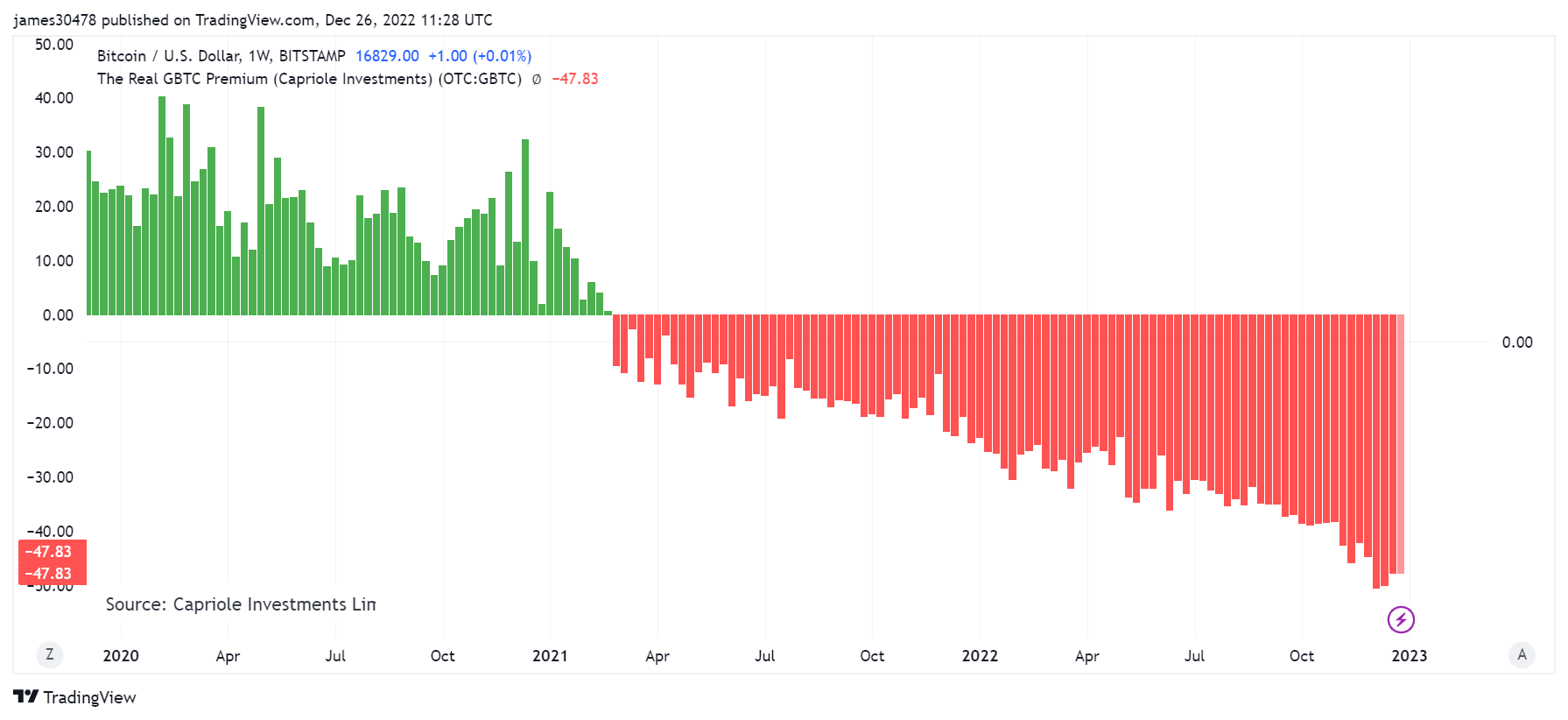

GBTC, for some time, was the only way U.S. investors could get exposure into their IRAs or 401k accounts, which is one of the reasons it traded at a premium for so many years, as high as 40%.

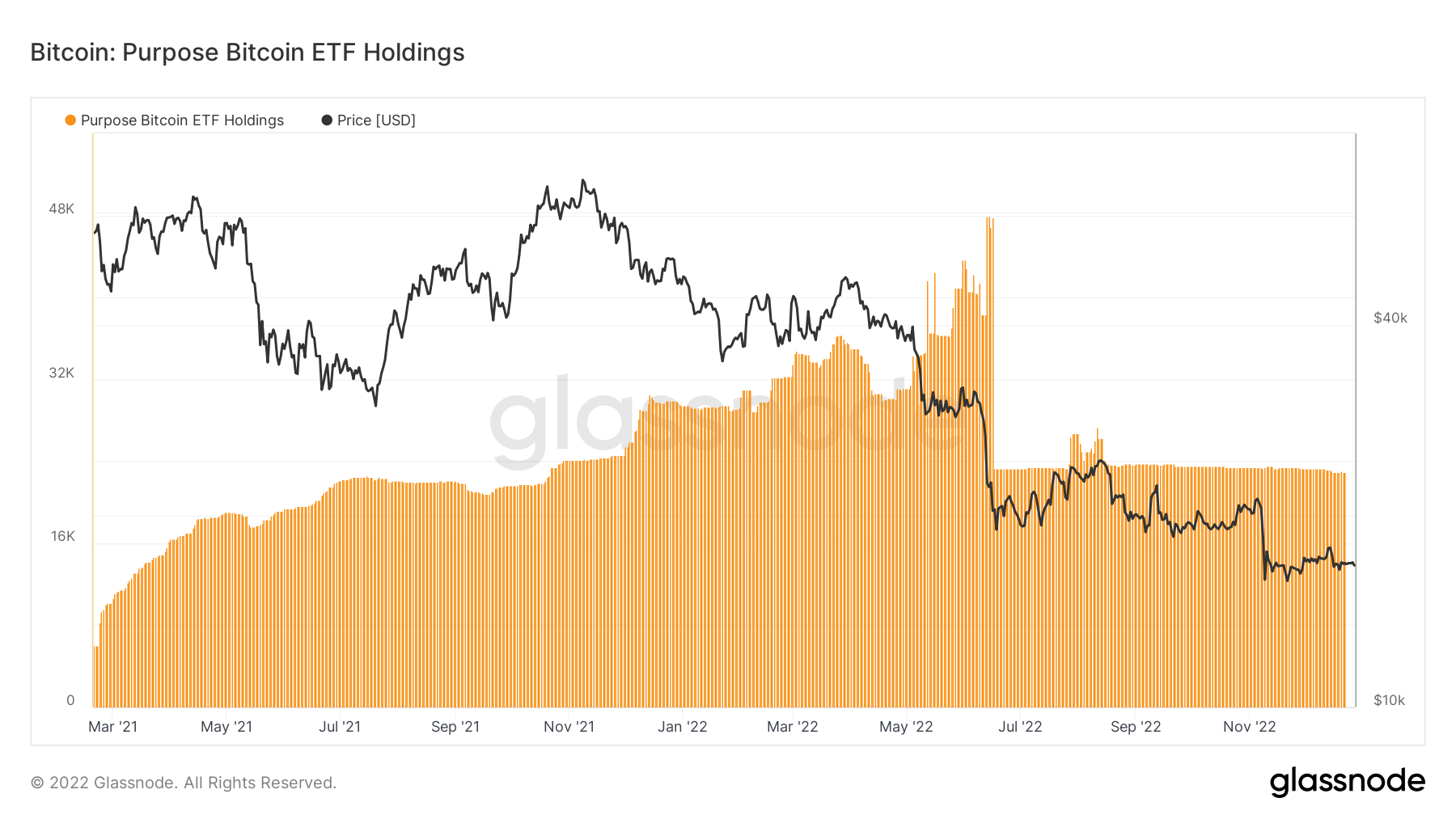

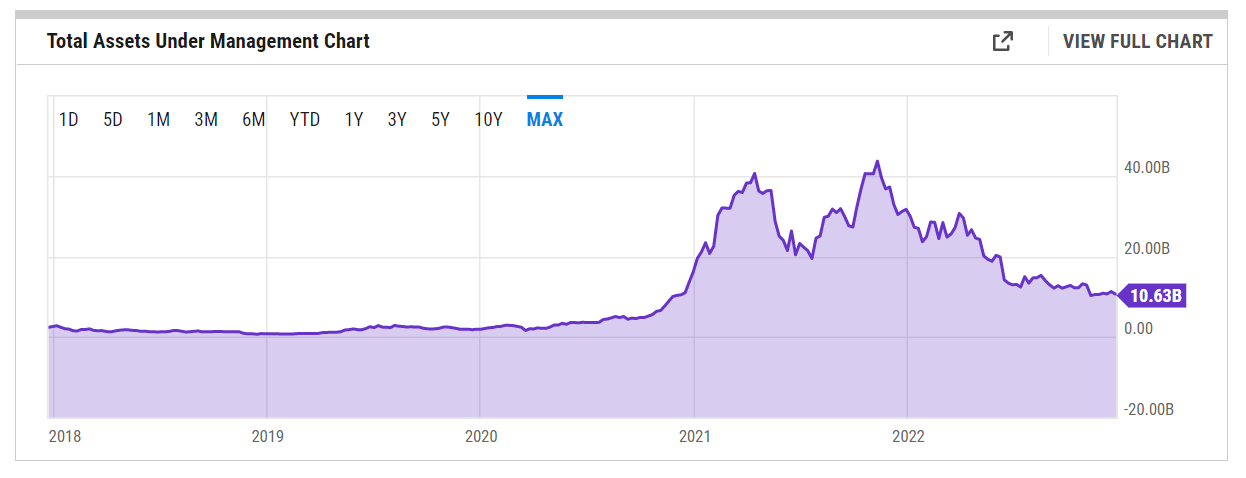

Even though GBTC was deemed a security, it doesn’t have the self-custody risks attributed to holding your keys for BTC. As demand grew, so did assets under management, which topped out at over $40bn during the 2021 bull run.

Genesis and lending platforms

Several failed crypto companies, like 3AC and BlockFi, had significant exposure to GBTC shares.

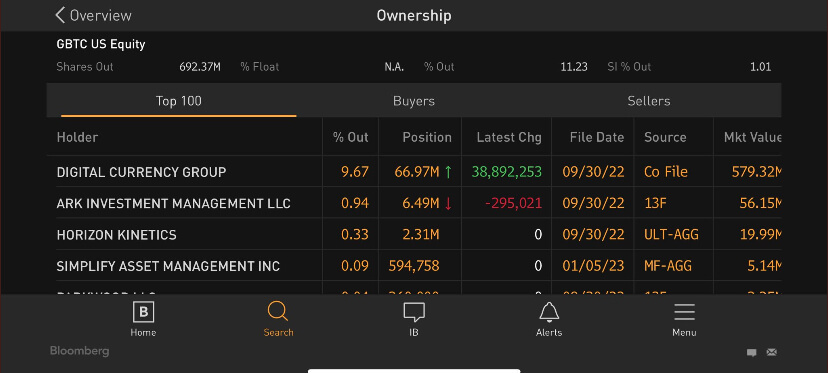

During 2021, 3AC had the most significant position of GBTC shares at almost 40 million, amounting to a value of $1.3bn. To put it into perspective, Ark Invest is now the largest shareholder outside of DCG, with just under 1% of the supply, equivalent to 6.5 million shares.

As the GBTC premium rose as high as 40%, companies like 3AC and BlockFi leveraged returns to speculate in the market. This is how BlockFi was allowed to offer such high yields to clients. As the lock-up expired every six months, it allowed these companies to keep continuing to roll on profits, while Genesis was happy to keep loaning money to companies like 3AC.

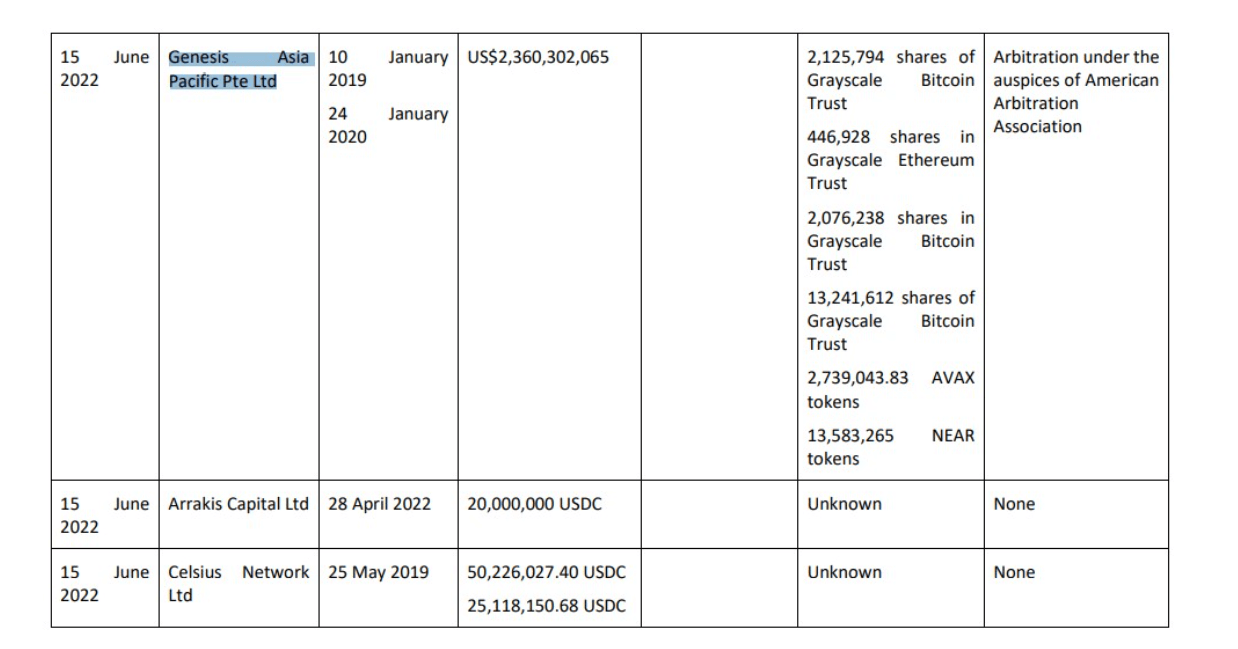

3AC took a $2.36 billion loan from Genesis, another DCG company, which made up almost 50% of the entire Genesis loan book. The loan was made up of illiquid cryptocurrencies and paper derivatives of Bitcoin and Ether.

In total, Genesis’ loan to 3AC was backed by 17 million shares from GBTC. Grayscale is a DCG subsidiary with 446,000 shares in the Grayscale Ethereum Trust, 2 million Avalanche (AVAX) native tokens, and 13 million NEAR tokens.

ETF

Barry Silbert and DCG have pleaded for many years with the SEC to convert GBTC into an ETF. An ETF would track the underlying product, and there would be no premiums or discounts as the shares would be redeemed to NAV, plus management fees would be considerably less.

The SEC has continued to decline a spot ETF, which would have protected investors. The conversion into a spot ETF would see any investor who bought at a discount make a profit as it would trade to NAV.

ETFs are safer than a closed-ended fund and are more transparent, with no premiums or discounts and lower fees. However, the SEC has approved futures ETFs and a short Bitcoin strategy ETF (BITI).

Grayscale is now suing the SEC, but the SEC has rejected Grayscale, NYDIG, Wisdom Tree, and other institutions. As a result, many countries worldwide have seen spot ETFs approved in Europe, Canada, and Africa.

Grayscale’s ongoing lawsuit with the SEC related to ETFs has a final brief deadline of Feb. 3 before a ruling will occur.

SEC have failed to help investors

As the premium for the GBTC ended, the crypto ecosystem saw blow up after blow up of crypto lending platforms as these funds and lenders had to go further out onto the risk curve to make a profit and make their consumers whole.

The SEC repeatedly failed to approve a spot ETF for GBTC, which would ultimately have prevented this from day one and might have avoided such leverage being wiped out. As a result, the GBTC premium would not have existed, and these firms would not have grown in size and taken on as much leverage as they did.

Grayscale had been doing everything they possibly could have done for a spot ETF to have been approved.

The SEC has rejected the spot ETF due to the possibility of spot bitcoin manipulation. However, approving a CME Bitcoin futures ETF that doesn’t track the underlying spot price can arguably be subject to manipulation and fraud just as quickly.

As outlined above, there are multiple spot ETFs worldwide in Europe and Africa, for example. This has undoubtedly seen capital flow out of America and into these jurisdictions.

Where are we now, heading into 2023?

If DCG were to enter bankruptcy, the company could be forced to liquidate its assets and see sizeable sales in GBTC and ETHC. This would put considerable sell pressure on Bitcoin and Ethereum.

However, according to Ryan Selkis, CEO of blockchain research firm Messari, Grayscale Bitcoin Trust’s (GBTC) controlling shareholders Genesis Global and Digital Currency Group cannot simply “dump” their holdings to raise more capital.

“restrictions are due to Rule 144A of the U.S. Securities Act of 1933, which forces issuers of over-the-counter, or OTC, traded entities to give advance notice of proposed sales, as well as a quarterly cap on sale of either 1% of outstanding shares or weekly traded volume”

One notable option DCG could take is to initiate a Reg M, which would allow investors to redeem shares at NAV, narrowing the current discount gap.

On Jan. 2, Cameron Winklevoss published an open letter to DCG’s CEO Barry Silbert, who questioned Barry on his delay tactics as Genesis owes Gemini Earn users $900m. In addition, Cameron accuses Barry of using NAV trade tactics, which Barry personally benefits from. The letter ended with Cameron Winklevoss telling Barry Silbert to find a solution by Jan. 8.

However, the letter did not reveal if DCG and Barry responded; a scenario that could prevail would be for DCG to file Chapter 11.

On Dec. 28, investment advisor Valkyrie presented a proposal to become the new sponsor and manager of the GBTC while also launching a fund to take advantage of the discounted crypto..

As rumors continue circulating, DCG/Genesis is under active investigation by the SEC. Sources confirmed that multiple whistle-blowers have come forward.

The current DCG situation

- Genesis is currently considering bankruptcy

- DCG shuts down wealth management subsidiary

- DCG Owes $2.025B

- Genesis can call their $1.675B loan

- Genesis owes $900M to Gemini

What can we learn from all of this?

Bitcoin is a non-bearing digital asset with no counterparty risk; if self custodied correctly, no leverage or yield occurs. However, investors have the personal responsibility of managing their finances.

The number one issue with human beings is often greed, which, as history tells us, usually leads to fraud, manipulation, and centralization. By correct custody of your Bitcoin, you hold Bitcoin, not an IOU or paper derivative.

As we saw in 2022, with the counterparty risk that occurs due to funds chasing high yields and using Bitcoin to chase yield, these companies will take the ‘any means’ approach.

Lessons will be learned from this, but it is crucial always to do your due diligence, which is why the phrase “Not your keys, not your coins” is paramount in the Bitcoin ecosystem.