Balancer Warns of Potential Exploit, Asks LPs to Withdraw Assets

DeFi protocol Balancer asked liquidity providers to remove their liquidity immediately from some pools because of a security issue.

In a Jan. 6 Twitter thread, the DeFi protocol revealed that the affected liquidity pools included the DOLA/bb-a-USD on Ethereum, It’s MAI Life and Smells Like Spartan Spirit on Optimism, bb-am-USD/miMATIC on Polygon, and Tenacious Dollar on Fantom. Cumulatively, these pools contain $6.3 million worth of digital assets.

Balancer did not reveal the issue but promised to make it public later. The DeFi platform said its protocol fees had been set to zero by the emergency multisig as a way to mitigate the problem.

With Balancer not specifying the problem, the crypto community has been speculating about what could be wrong. Given Balancer’s status as the fourth largest decentralized exchange, any exploit could significantly impact the space.

Meanwhile, this is not the first time that Balancer would face the threat of an exploit. In 2020, Balancer lost $500,000 to a hacker who exploited two liquidity pools.

Balancer’s BAL Price Performance Unaffected

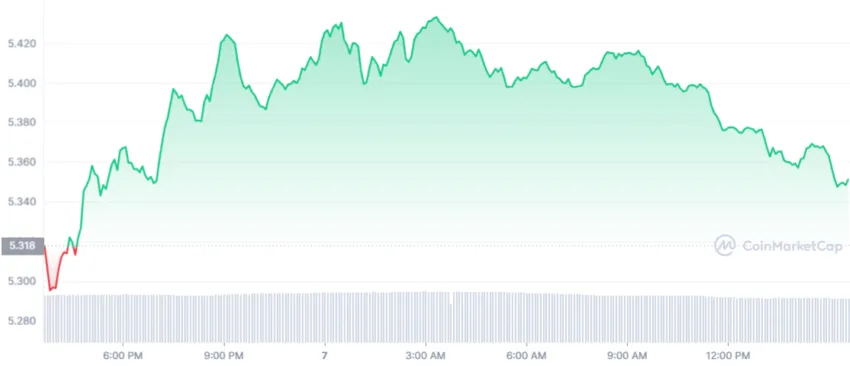

Balancer’s native token BAL appears to be unaffected by the threat of an exploit on the protocol. According to CoinMarketCap data, BAL rose by 0.62% to $5.35 as of press time. However, its trading volume declined by roughly 7% during the timeframe.

Defillama data shows that the Balancer DEX had a trading volume of $92.21 million in the last 24 hours and almost $350 million so far in January. The protocol’s TVL stands at $1.5 billion.

DeFi Protocols Exploit

Malicious players severally attacked DeFi protocols in 2022. In July, reports revealed that hackers had exploited over $2 billion from the crypto industry. BeInCrypto reported that the number had grown to $3.9 billion, citing data from the bug bounty platform Immunefi.

Meanwhile, blockchain security firm Certik said December 2022 recorded the lowest monthly figure of stolen crypto. According to the firm, only $62 million was stolen in the month. The firm reportedly predicted that the industry would see more hacks and exploits in this new year.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.