Silvergate shares tumble as crypto bank reveals $8.1bn fall in deposits

Clients pulled $8.1bn in deposits from Silvergate during a “crisis of confidence” late last year, forcing the crypto-focused US bank to sell assets and underscoring how the implosion of FTX reached the regulated financial sector.

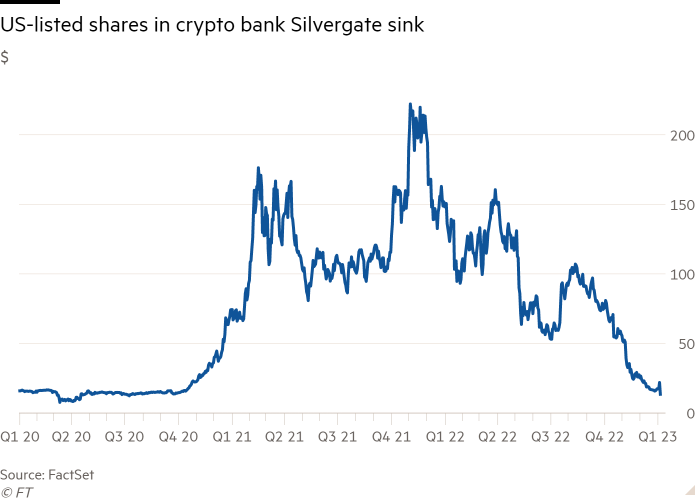

The California-based group’s disclosure on Thursday showing its deposits from digital asset customers shrank to $3.8bn on December 31 from $11.9bn at the end of September sent its shares plummeting almost 43 per cent in New York trading.

Silvergate, which is a Federal Reserve member bank and is listed on the New York Stock Exchange, has come under heavy pressure over the past year as crypto asset prices have tumbled and several big players have collapsed into bankruptcy. The bank’s share price had tumbled 88 per cent in 2022.

Silvergate has grown from a tiny community lender into a major crypto bank in recent years and was key in providing services to Sam Bankman-Fried’s now-collapsed crypto empire.

Alan Lane, chief executive of Silvergate, said the crypto industry faced a “crisis of confidence and in that kind of situation many of the institutional players have been pulling money off of these trading platforms”.

The group said in a provisional fourth-quarter earnings report on Thursday that in order to meet customer withdrawals and raise cash, Silvergate rushed to sell $5.2bn worth of debt securities at a loss of $718mn.

Lane added the sector experienced a “significant overleveraging that began to unwind” last year, citing the collapse of companies including Celsius, Voyager and Three Arrows Capital. “This was a much more widespread . . . deleveraging of the ecosystem that obviously culminated with the collapse of FTX.”

Silvergate said $150mn of its deposits were from customers that had filed for bankruptcy.

“We had clients that were proprietary traders, market makers that had been doing business with each other for sometimes six to eight years that just stopped doing business with each other and pulled all their deposits,” said Ben Reynolds, president of Silvergate. Some “crypto native” clients had “moved almost completely into US Treasuries”, he added.

The group is cutting 200 employees to “account for the economic realities” facing its business and the cryptocurrency industry, which account for 40 per cent of its staff, it said.

It added it held $4.6bn worth of cash and equivalents at the end of December, “which is in excess” of the $3.8bn remaining deposits, and $5.6bn of US government and agency-backed debt. Silvergate added it planned to sell “a portion” of the debt in early 2023.

The report did not include a full accounting of the group’s balance sheet or income statement; Silvergate said it would publish its full quarterly and annual earnings report on January 17.

Silvergate has also halted its plans to launch a digital currency and said it would take a $196mn impairment charge in the fourth quarter related to the blockchain payment assets that it bought from Diem, the crypto payment project originally backed by Meta. “There are significant headwinds to launching something in the near future,” Lane said.

The group is also facing scrutiny from US lawmakers. Last month, senators including Elizabeth Warren wrote to Lane urging clarity on Silvergate’s role in accepting customer deposits for Bankman-Fried’s crypto investment firm, Alameda Research, which the former billionaire has said were ultimately supposed to go to the FTX exchange.

“Silvergate appears to be at the centre of improper transfers of customer funds,” the senators wrote, adding that its involvement showed an “egregious failure”.

Silvergate in December defended its role in accepting deposits for Alameda, saying it conducted “extensive due diligence” and that

“when Silvergate received payments directed to Alameda Research and credited it to the account of the same name . . . this was consistent with the instructions from the sender of the wire and industry practice”.

Additional reporting by Alexandra White in New York