Could BNB’s diminishing enthusiasm have investors rethink their 2023 investments

- BNB released its weekly stats and December stars list

- Metrics showed signs of recovery but indicators were against a price surge

Binance Coin [BNB] recently released its weekly stats, pointing out how the network performed over the last seven days. BNB revealed that its weekly transactions exceeded 16 million, and its daily average transactions were more than 2.7 million.

Check out the key metrics from BNB Chain over the past week ⤵️ pic.twitter.com/T76g4UoGwu

— BNB Chain (@BNBCHAIN) December 24, 2022

BNB also announced its December stars, which hit new metrics targets and conducted new launches on the BNB Chain. The list mentioned Lifeform, which minted over 200,000 avatars with more than 131,000 holders. BNB also included Hooked on the list as it had more than 3 million active users.

It’s been another busy week for our December Stars as we close out the year. @tapfantasy2021, @Lifeformcc, @HookedProtocol and @sendwyre have been hitting new metric targets and conducting new launches on BNB Chain.

Get the details ⤵️ pic.twitter.com/xXFXwtEbqg

— BNB Chain (@BNBCHAIN) December 24, 2022

Read Binance Coin’s [BNB] Price Prediction 2023-24

But BNB remained sluggish

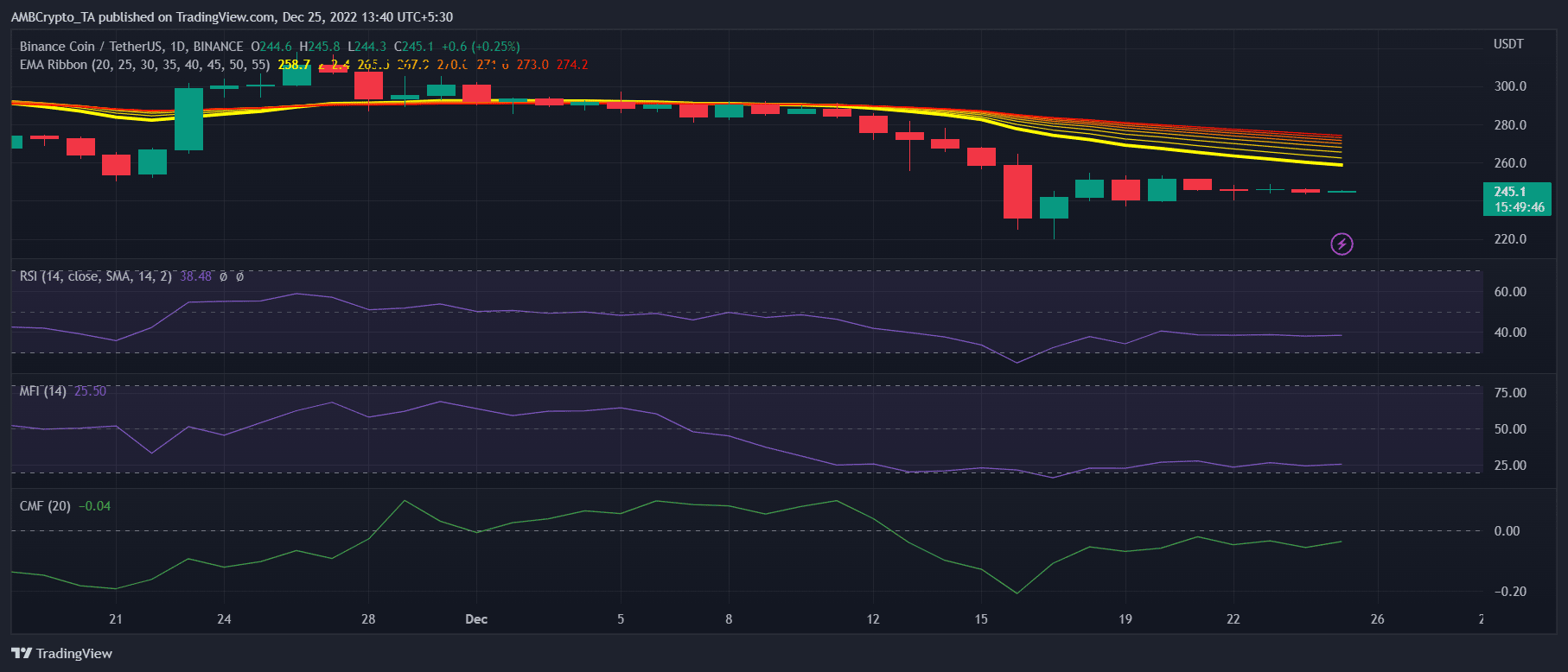

Surprisingly, BNB did not respond to these updates and registered a poor performance over the week as its price declined by 1.17% in the last seven days. As per CoinMarketCap, at the time of writing, BNB was trading at $245.09 with a market capitalization of more than $39.2 billion.

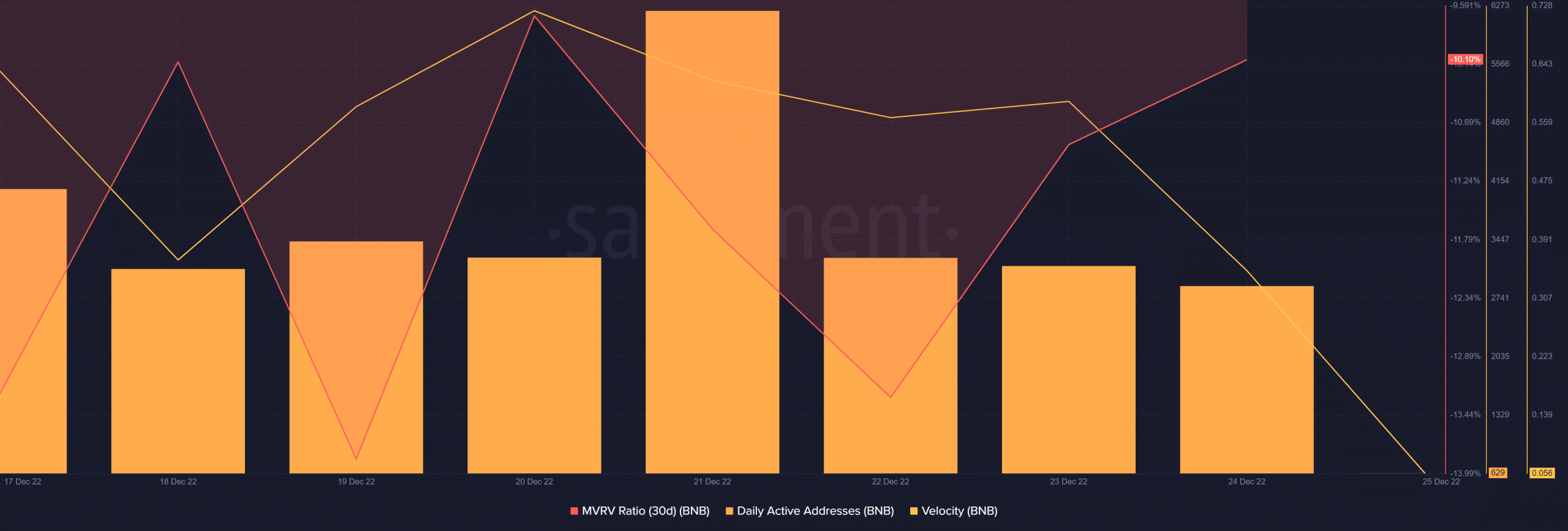

However, BNB showed signs of recovery on its metrics front, which set up the opportunity for a trend reversal in the coming days. For instance, BNB’s Market Value to Realized Value (MVRV) Ratio registered an uptick during the last week, which looked bullish.

BNB’s daily active addresses also spiked on 21 December, reflecting the high number of users in the network. Nonetheless, BNB’s velocity chose to follow the opposite route, which can restrict BNB’s price from pumping.

How many BNBs can you get for $1?